Commodities & Metals

Commodities & Metals Articles

With the overhang and larger media frenzy around bitcoin and cryptocurrencies having witnessed a death of a thousand cuts, the interest in gold has been coming back with a rising price.

Published:

CMC shares were giving some back on Friday morning, but the analyst community sees stronger performance in the coming year.

Published:

New coverage from Credit Suisse noted that thermal coal is near its bottom and that the market is valuing Peabody like a peak met-coal play.

Published:

The federal funds rate remaining steady, along with additional outside interest rate pressures, could be a further supportive action for the price of gold for the remainder of 2019.

Published:

The brokerage firm Raymond James sees a mixed view of Newmont and Barrick after the deal in a report from March 12, 2019.

Published:

DowDuPont revealed details for its spin-off of the company's material sciences division into a new, standalone company to be named Dow. The separation date is set for April 1.

Published:

With the first quarter almost over, it makes sense to look for stocks that have the ability to push higher, that may have lagged during the first part of 2019.

Published:

Last Updated:

As expected, Newmont Mining this morning rejected last week's offer of an $18 billion all-stock merger with rival Barrick.

Published:

What consumers pay for goods this year will be due to the prices a handful of things -- primarily just eight commodities.

Published:

Last Updated:

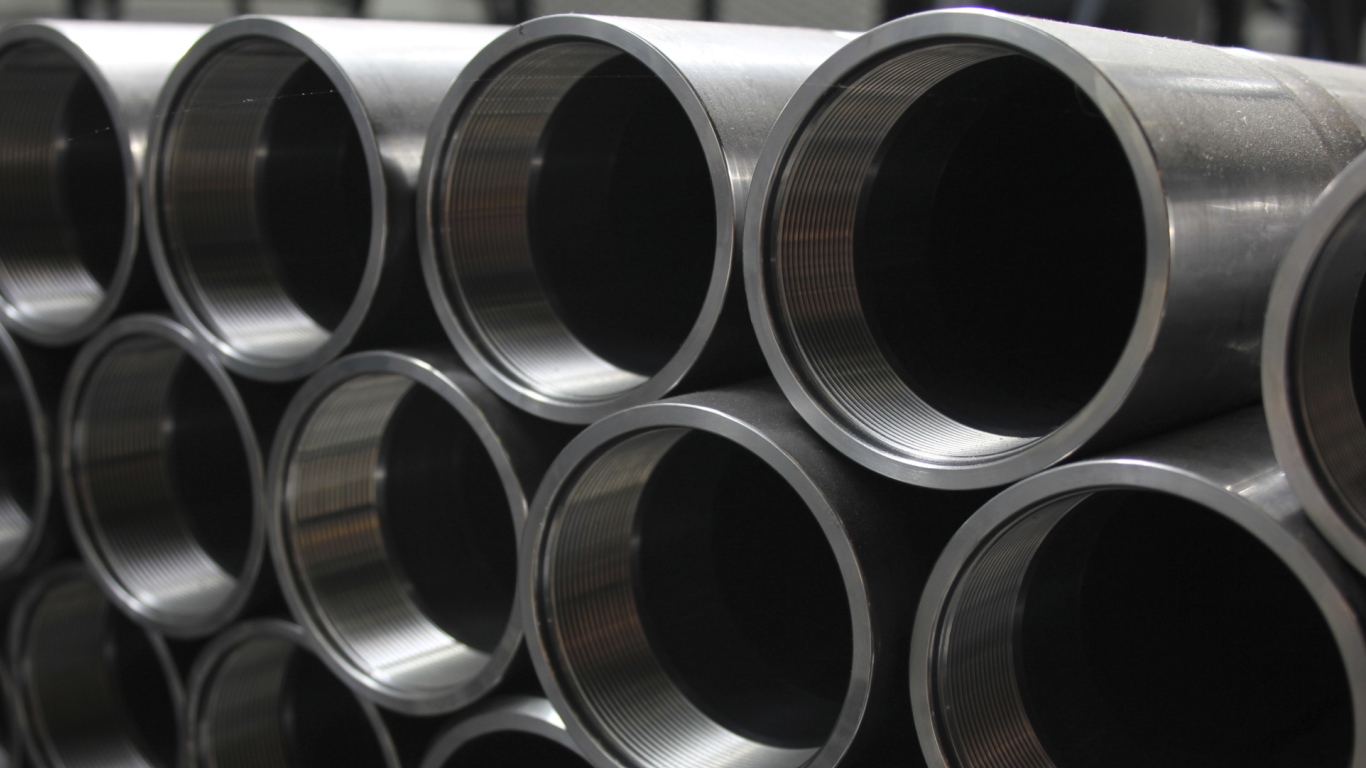

One of the key components for fixing the nation's infrastructure is steel, and with pricing starting to improve, one Wall Street analyst thinks there are some solid stocks to buy now.

Published:

Investors should understand from the get-go that this gold merger would seem to be unlikely from a shareholder voting and regulatory stance. The reaction in the shares also seems to reflect some...

Published:

Lithium miner Albemarle posted better-than-expected quarterly and full-year results Wednesday night. The company's outlook for 2019 is solid and investors are showing their approval with the wallets.

Published:

Last Updated:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.