Economy

Economy Articles

Many investors seem to get scared going into some Federal Reserve meetings, particularly when we are in a period of time where investors, consumers and business owners worry that the Federal Open...

Published:

Last Updated:

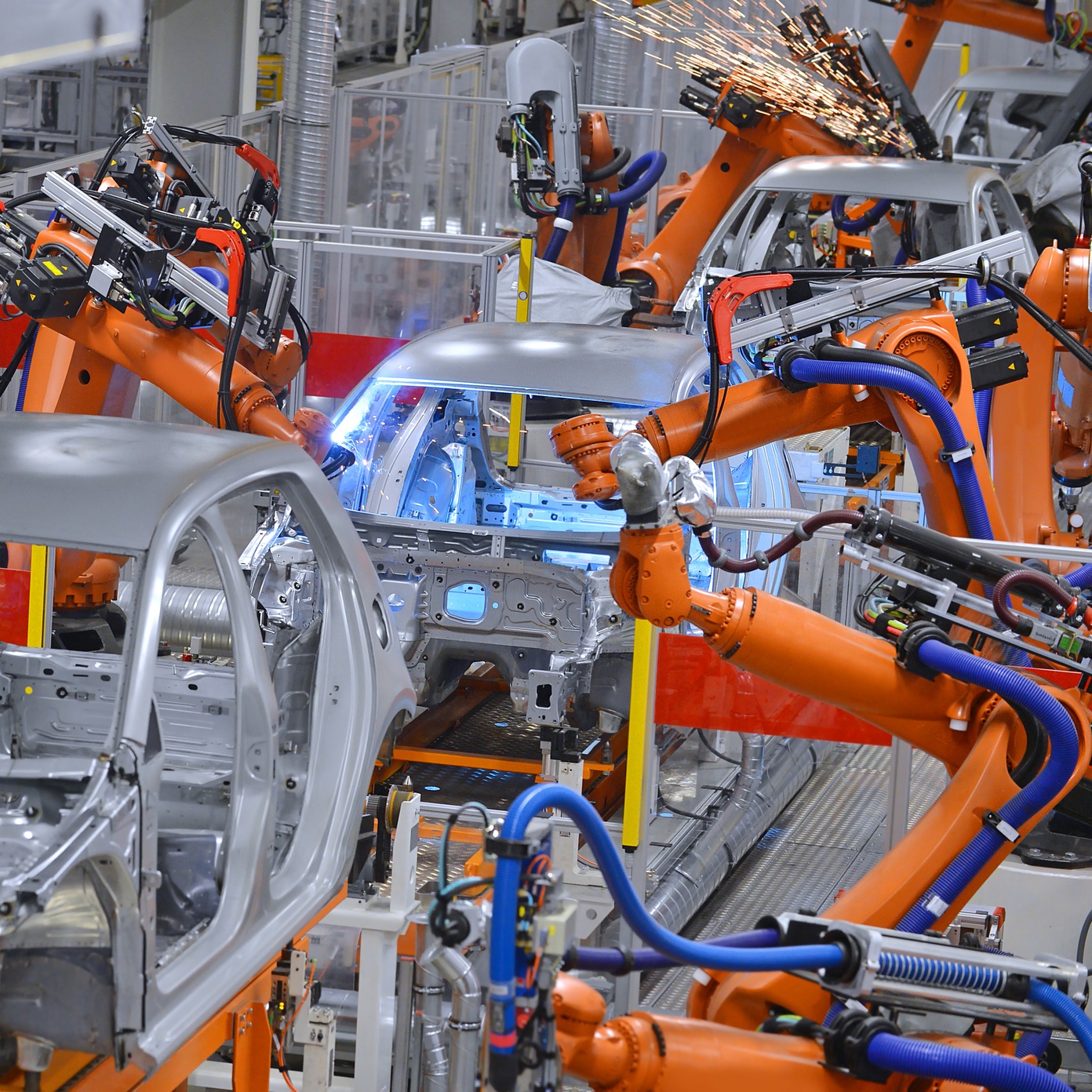

Economists and investors just got to see two fresh views on the U.S. manufacturing segment of the economy. While growth remains in the air, it may be deemed to be at a less robust rate.

Published:

Last Updated:

The final April consumer sentiment index reading from the University of Michigan was down more than 2% month over month but remains up 1.9% year over year.

Published:

Last Updated:

What should stand out in the latest GDP report is that the U.S. economy is about to hit $20 trillion in GDP, if any of the expected growth comes to pass in 2018.

Published:

Last Updated:

It is no secret that the United States is heavily bogged down with student debt. A recent Federal Reserve study on debt showed that there more than 44 million Americans with student debt. The tally...

Published:

Last Updated:

If there is one economic report that can be very volatile and can come in well above or well below expectations, it is the monthly durable goods report.

Published:

Last Updated:

The National Retail Federation estimates spending on Mother's Day gifts this year will top $23 billion for only the second time in 15 years.

Published:

Last Updated:

Interest rates rocketed higher to start the week. The next jolt to the bond market though might come by the end of the week.

Published:

Last Updated:

Walmart CEO Doug McMillon's pay last year was 1,188 times the pay of a median company employee. That's way above the already high median ratio of CEO-to-median-employee pay.

Published:

Last Updated:

The IMF posted its comments last week as the organization marked the 10th anniversary of the global financial meltdown. Whether the warnings are fair or not is another matter The primary advice for...

Published:

Last Updated:

The April 2018 update to the IMF's World Economic Outlook includes some upbeat forecasts for near-term economic growth but warns that medium-term growth faces several threats.

Published:

Last Updated:

The Federal Reserve released its March reading for industrial production and capacity utilization. Some sources look strong, but also parts of the report look less than robust.

Published:

Last Updated:

The so-called China Miracle continues to trump American economic progress and its economic advantage over the United States based on growth is unlikely to change.

Published:

Last Updated:

U.S. housholds with credit card debt carry an average balance of nearly $16,000, in addition to mortgages, car loans and student debt totaling another $117,000 on average.

Published:

Last Updated:

The University of Michigan's preliminary consumer sentiment index for April fell month over month but still remains slightly higher year over year.

Published:

Last Updated: