The incidents follow a three-month grounding of Boeing’s newest aircraft following a battery problem that sent smoke billowing into the cockpit of a plane and could have been a fire danger unless corrected. Since the planes have been retrofitted and cleared for flight, no further battery incidents have been reported.

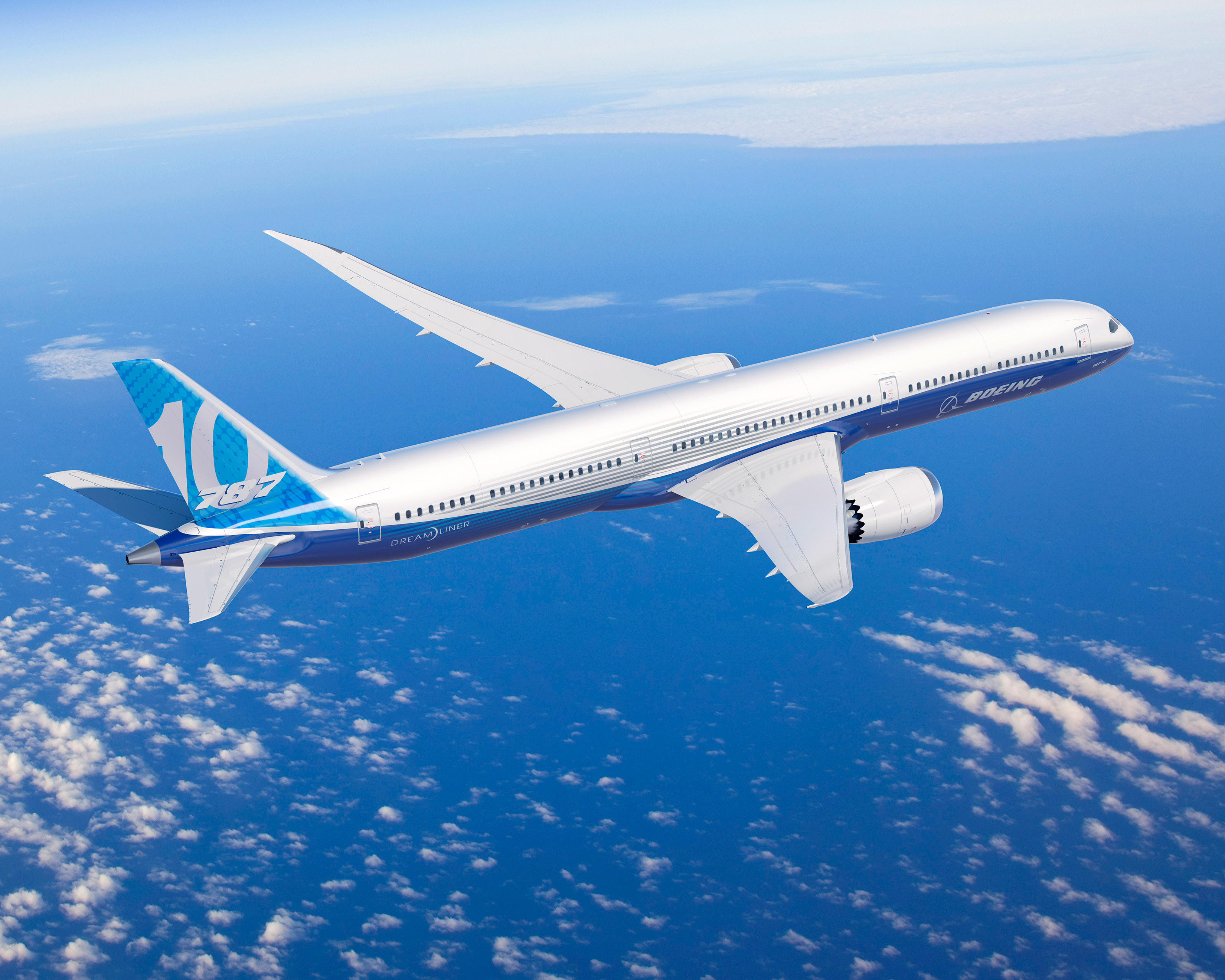

We know these latest incidents are not good news for Boeing, but how bad are they? The company booked orders for 102 of the latest, stretch version of the Dreamliner, the 787-10, at last week’s Paris Air Show. Boeing posted orders and commitments from the Paris show valued at about $66.4 billion, just less than the $68.7 billion in new bookings claimed by competitor Airbus.

Order books for the two firms are bulging, with each expected to nab around 800 new bookings this year. But booking is not the same as delivering, and Boeing will have to get much better at delivering problem-free planes if those bookings are going to turn into revenues.

Every new problem makes it seem like the aircraft maker is depending on its customers to complete its flight testing. At the very least, airlines are going to get fed up with doing Boeing’s work for it. We do not even want to think about the worst that could happen.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.