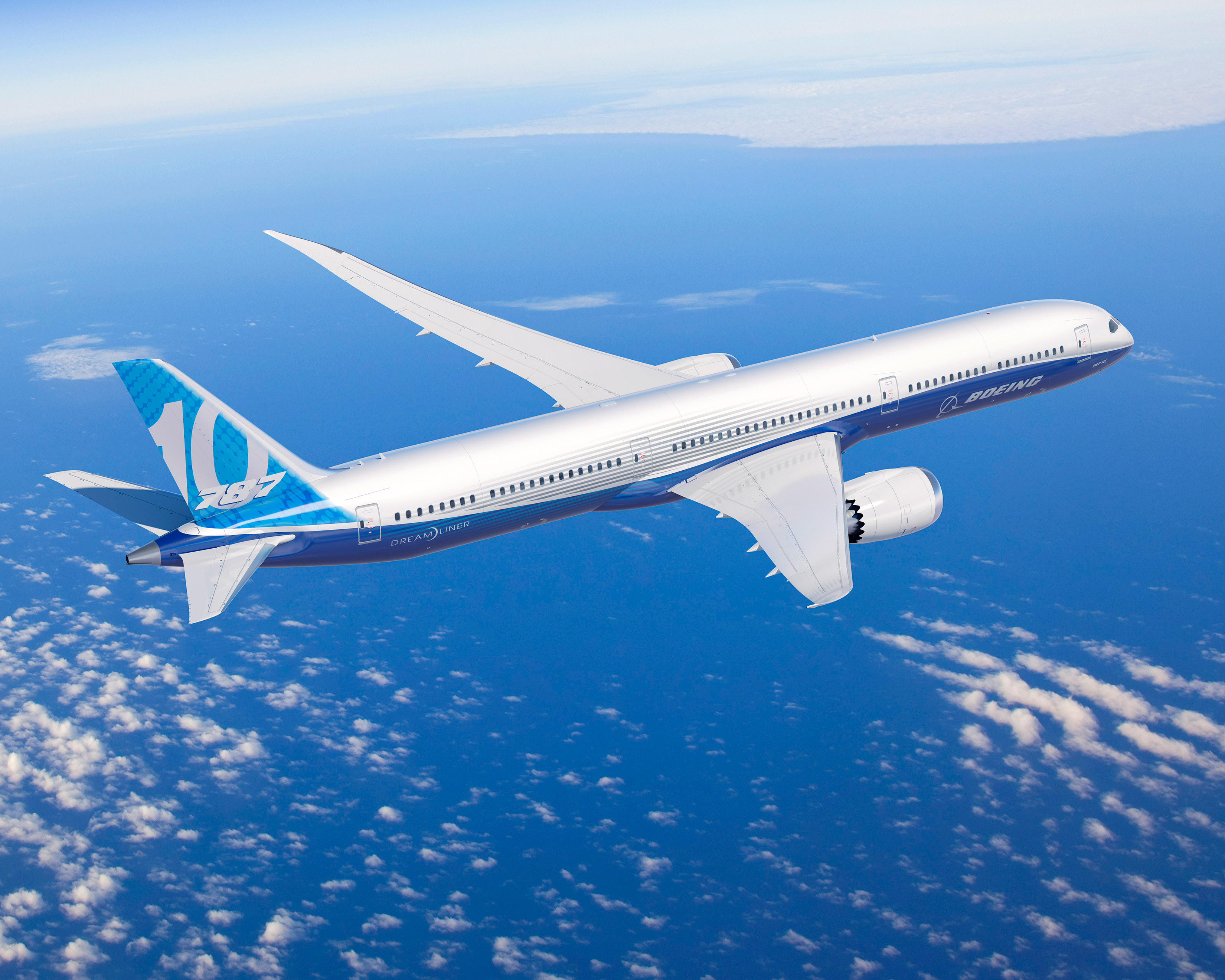

Boeing Co. (NYSE: BA) is a very important company to the U.S. stock market. It is not just that Boeing is involved in our national defense and not just that Boeing makes the 787 Dreamliner and many other commercial jets and cargo jets used for the world’s air transportation sector. Boeing is currently the fourth largest weighting of the 30 DJIA stocks. If a Wall Street analyst is correct, Boeing is about to significantly lead the DJIA much higher to new records.

Boeing is only $4.00 or so shy of 3M Co. (NYSE: MMM) in the nominal share price. That makes it a runner-up for the number three spot of the 30 DJIA components, since the DJIA is simply an old-school price-weighted index. The consensus price target for 3M is $120, versus about $119 as of now. Boeing’s consensus analyst price target is actually $122.59, versus $115 on Monday, and that is even after a 3% gain.

Chevron Corp. (NYSE: CVX) is currently the second highest weighting of the DJIA, with a price of just under $125 on Monday. Boeing could become the second highest weighting of the DJIA very soon, if it continues to perform well, although that would be a lower stake if you consider that the Goldman Sachs Group Inc. (NYSE: GS) and Visa Inc. (NYSE: V) are about to become members of the DJIA. Goldman Sachs has a current price of $168 and Visa is up at $190, just trailing the share price of $193 for International Business Machines Corp. (NYSE: IBM).

What has taken place is that a Wall Street firm has issued an incredibly bullish analyst research report on Boeing. Sterne Agee reiterated its Buy rating, but it raised the old price target of $120 all the way up to $164. Peter Arment, the analyst making the call, said that the much higher price target reflects a ramping up in cash flow beyond the middle of this decade.

Armet sees very favorable free cash flows from 2013 out to 2017, with per share cash flows as follows: $6.45 per share in 2013, $9.55 per share in 2014, $13.70 per share in 2015, $16.50 per share in 2016 and finally $16.40 per share in 2017. What is obvious is that this is based on a 10-times free cash flow valuation. He expects healthy share buybacks to rule the day here. He was quoted on the future share buybacks as saying:

There are several catalysts still in front of Boeing, such as the 777X launch, the 787-10 orders coupled with extension of the 787 accounting block, and a new buyback authorization. Boeing resumed its repurchase program in 2Q13 with 10.2 million shares totaling $1 billion. This commitment taps into the existing $3.5 billion authorization, which is likely reset towards the end of the year as BA completes its milestones for 2013. The 777X launch could occur in November and we expect the 787 accounting block to be expanded before year-end.

Stern Agee also lifted the official earnings per share estimates. Arment sees earnings now being $0.30 per share higher to $7.50 in 2014 and also $0.60 higher to $7.50 per share in 2015. That is expected to be driven on production gains and margin gains.

So, here is how and why the $164 new price target matters so much. We have both Goldman Sachs Group Inc. (NYSE: GS) and Visa Inc. (NYSE: V) entering the DJIA imminently. The prior highest analyst price target before Peter Arment lifted his to $164 was only $135.

Imagine how well this would bode for the DJIA if one of its top three components rises 25%. Even if the other 29 stocks just remained static, that would create market gains better than we saw in many of the quiet years. That being said, it is very rare for one DJIA stock to continue rallying to all-time highs without performance of other key stocks. Rising tides can lift all ships in the harbor.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.