The new planes include three in the 737 MAX family: the 737 MAX 8, due to enter service in 2018; the 737 MAX 9, in service scheduled for 2019; and the 737 MAX 7 due in 2020. The 737 MAX family already has some catching up to do with competitor Airbus SAS’s A320neo. Boeing took a long time before finally deciding in the summer of 2011 to put a new engine on the venerable 737 rather than build a whole new airplane from the ground up.

According to timetable released on Wednesday, Boeing plans to complete detailed design on the 737 MAX this year, begin building the planes next year for a first flight in 2016 and entry into service in 2017. That’s not unrealistic, but the A320neo is scheduled for its first flight in the fourth quarter of this year, at least 18 months ahead of the 737 MAX. That lead in time to delivery has produced a lead in orders: Airbus has firm orders for 2,667 A320neo aircraft and Boeing has firm orders for 1,939 737 MAX planes.

Boeing 777X will not begin flight testing until 2019 and first delivery is not scheduled until 2020. According to Reuters, there are 66 firm orders for the 777X along with 300 other orders and commitments. The competitor A350 from Airbus has 812 orders.

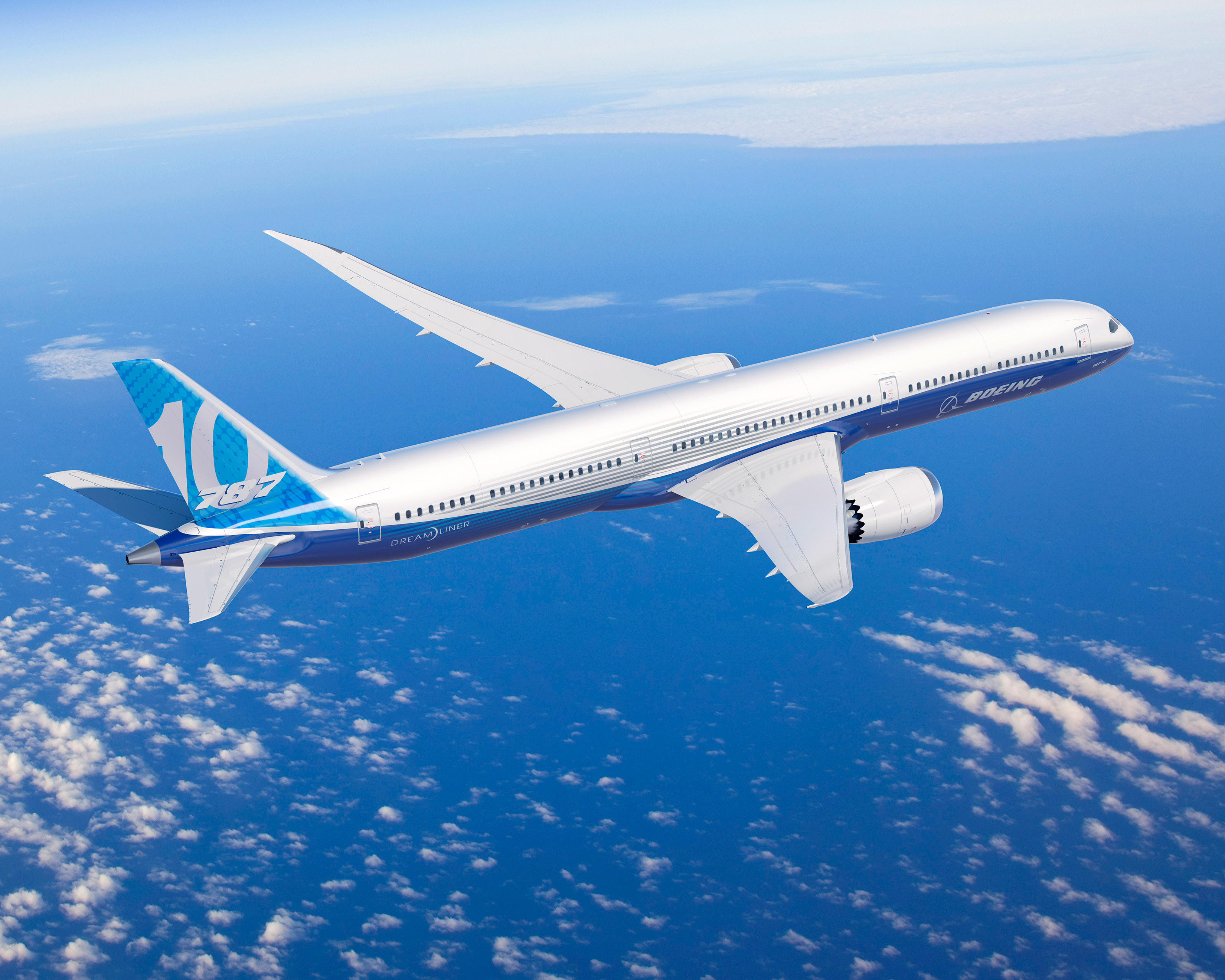

The stretch versions of Boeing’s 787 Dreamliner, the 787-9 and the 787-10, will be in service in 2014 and 2018, respectively, according to Boeing. Boeing has a clear lead on the Airbus competitor, the A350, which has not yet delivered a single plane. Airbus has 589 orders for its A350, compared with 1,031 for the three models of the 787.

The 737 MAX, the 777X and the 787 comprise more than half of all Boeing’s sales for the next decade, so how well the company can execute on its plans will be critical to its business and to its shareholders. Over the past 12 months, Boeing’s stock is up nearly 42%, but since posting a peak in mid-January shares have dropped 11%.

The stock closed at $129.02 on Wednesday, in a 52-week range of $91.20 to $144.57. Shares were up fractionally in Thursday’s premarket trading to $129.29.

ALSO READ: Why a Boeing 777 Costs $320 Million

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.