When the U.S. House of Representatives passed the federal highway bill on Thursday, included among the various unrelated items in the bill was reauthorization of the Export-Import Bank. The House reached agreement on reauthorizing the Ex-Im Bank in late October, but the legislation was attached to the highway bill, which took another month or so to get through. President Obama is expected to sign the legislation.

Two of the country’s largest companies, General Electric Co. (NYSE: GE) and Boeing Co. (NYSE: BA), lobbied long and hard to reauthorize the Ex-Im Bank. Both use the bank’s guarantees to help foreign buyers finance purchases of the two companies’ big-ticket products. Both companies also had suggested that if the bank weren’t reauthorized they may be forced to move some production overseas.

Boeing, in fact, has already done so. In late August the company’s defense division lost the sale of an $85 million satellite contract that the potential buyer said was the result of the shutdown of the Ex-Im Bank’s authority to finance new loans. The bank’s financing authority ended on June 30 of this year.

Within days of that announcement, Boeing said it had begun laying off workers at its satellite business and said that it could lay off several hundred over the rest of this year and into next. A company spokesman told The Wall Street Journal at the time, “While this is not solely being caused by the expiration of Ex-Im Bank, this is a factor for the customers who have decided to maybe hit the pause button or look somewhere else.”

Ironically perhaps, the reauthorization of the Ex-Im Bank’s financing authority could also help Boeing’s arch-rival Airbus, which is building a final assembly facility for its A320 passenger jets in Alabama. A non-U.S. buyer of one of the planes could receive financing help from the Ex-Im Bank, according to the bank’s president.

And that’s where GE enters the picture again. GE and its French partner Snecma build the CFM engines used on the Airbus A320. Some of GE’s heavy machinery, such as gas turbines for electricity generation, also benefit from reauthorization of the Ex-Im Bank.

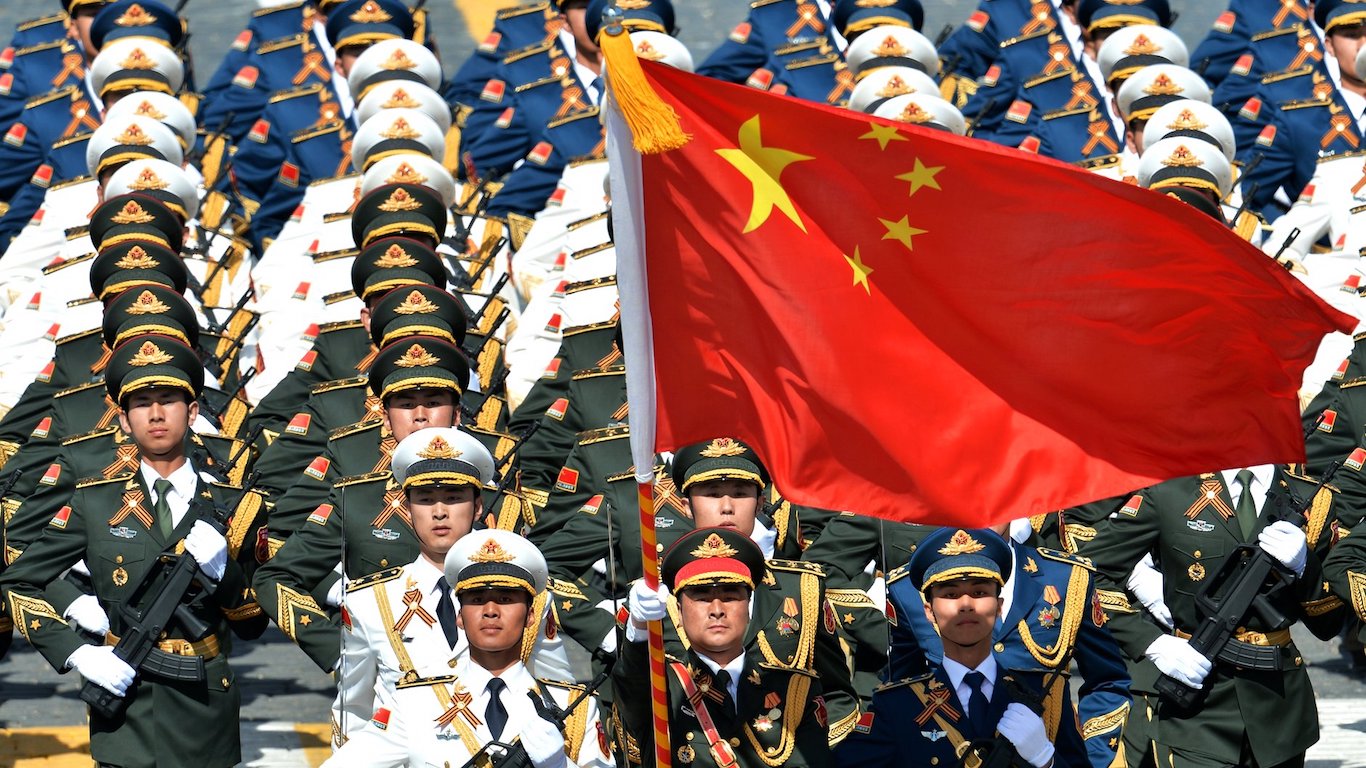

Just this past September, GE said that it planned to move as many as 500 jobs making gas turbines to France and China because it could no longer get financial backing from the Ex-Im Bank. At the time, the company said it was competing for $11 billion in international power projects that required government-backed export financing.

Even though the Ex-Im Bank is often maligned as the “Bank of Boeing,” about 90% of its 3,746 authorizations for guarantees, insurance and working capital in 2014 and $5.1 billion of its authorized funds went to U.S. small businesses. Boeing received $6.1 billion in guarantees in 2014. The bank’s president, Fred Hochberg, said in September of 2014 that failing to reauthorize the bank threatened 250,000 U.S. jobs.

Besides conservative politicians’ opposition to reauthorizing the bank, several U.S. airlines, most notably Delta, also fought against the renewal. In the airlines’ view, the primary beneficiary of the bank’s guarantees were Middle Eastern carriers who had an advantage in competing for routes that U.S. carriers coveted. In April a federal court ruled against Delta in suit against the bank.

In a statement late Thursday night, Boeing CEO Dennis Muilenburg said:

By reopening the Export-Import Bank, Congress has taken strong action enabling American exporters and the skilled workers they employ to compete successfully in tough global markets. We commend the bipartisan majorities in both the House and the Senate that recognized the Ex-Im Bank’s value to the U.S. economy by voting several times in recent months to reauthorize. With these votes, Congress did the right thing for workers at companies large and small across the nation, including the 1.5 million workers at nearly 15,000 U.S. companies that help Boeing design, make and support America’s aerospace exports.

No comment yet from Delta.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.