The Boeing Co. (NYSE: BA) has a problem. It’s called the Airbus A321neo, the aircraft that Airbus Group SE is positioning as the solution to demand for a so-called “middle-of-the-market” (MOM) aircraft to fly long, thin routes (about 200 to 270 passengers at a range of around 5,000 nautical miles). The only airplane that met those requirements was Boeing’s 757, and the company stopped building those planes in 2005.

Boeing has considered several replacement scenarios for the twin-engine, single-aisle 757, and the latest one appears to be a clean-sheet design according to a report Friday at The Wall Street Journal. The company is apparently looking at a widebody (dual-aisle) design that would not be ready for delivery to customers until 2024 or 2025.

The big difference between the 757 replacement and the 787-8 is range; the 787’s range is 50% greater than needed for the long, thin routes. The 787 is just too much airplane. Boeing has considered stretching the narrowbody 737 MAX 9 to a MAX 10 version, keeping the single-aisle design and adding new engines and wings. According to the WSJ report the company may build both.

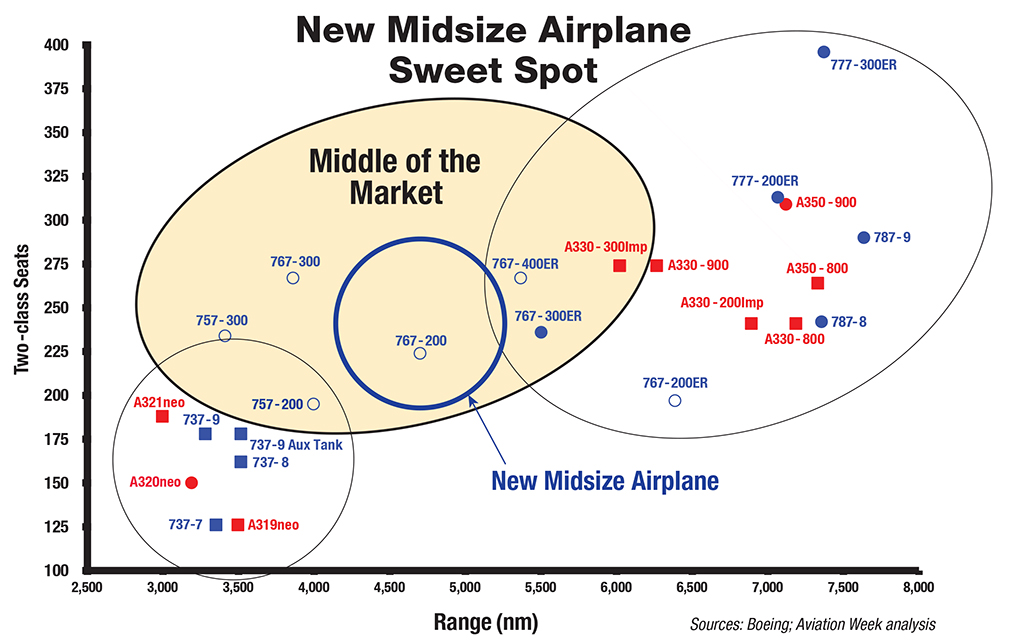

The following chart from Boeing and Aviation Week magazine shows where the MoM plane fits. Boeing for a long-time denied that there was enough of a market for a 757 replacement now thinks that between 2,000 and 5,000 planes could be required to replace both the aging 757s and 767s.

A Boeing executive told Aviation Week:

The MOM is starting to shape out to be in an area from where the 757 used to fly to where the 767-200/300 flies. That’s not 100% across the board. You have three groups: those that want to fly more people, those that want more range and the group that wants to fly more people with more range. However, this airplane really wants to be transatlantic, so most of the customers want [it] to fly 4,800-5,000 [nautical miles]. That’s significantly longer than the 757, but the seat count wants to be between 200 and 260 to 270 max. So it is a little bit bigger than a current single-aisle but not quite as big as a 767-type aircraft.

Airbus officially launched its A321LR in January of 2015 with an order for 30 of the planes from Air Lease Corp. (NYSE: AL). The company reckons to have the planes ready for first deliveries to customers by 2019. Looking at the chart, the A321neo on which the -LR version is based has a range of about 3,000 nautical miles with a seating capacity of around 190. In order to boost the plane’s range to 4,100 nautical miles, fuel tanks will replace seats so that capacity is likely to be around 165 to 170.

What Boeing needs to hear from potential customers is that they will wait until 2025 for a “real” replacement for the 757.

Boeing’s most consistent skeptic, and not just about the MOM plane, has been Goldman Sachs which has had a Sell rating on the stock for a long time. Leeham News cites a March note from the Goldman analysts:

Boeing has no true 757 replacement and is losing share in the segment to the A321NEO. We see a lose-lose scenario where Boeing either invests heavily and arrives late-to-market, or foregoes the segment completely.

It would be extremely costly for Boeing to start developing a replacement today, and it would likely not enter service for another seven years. By then we expect the majority of 757s to already have been replaced or retired. On the other hand, if Boeing elects not to develop a 757 replacement, it will almost undoubtedly lose market share long-term in this larger narrow-body category.

Boeing’s stock closed at $129.87 on Thursday, up about 2.3% on the day in a 52-week range of $102.10 to $150.59. The consensus price target on the stock is $145.47.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.