Yesterday Amazon (Nasdaq: AMZN) announced a plan to develop four nuclear reactors in Washington State. It’s just the latest in a sudden barrage of nuclear power announcements from big tech companies. Google parent company Alphabet (Nasdaq: GOOGL) is developing small modular nuclear reactors it hopes to have online by 2030. Microsoft (Nasdaq: MSFT) recently signed a deal to bring Three Mile Island back online to power its data centers.

The question is: after decades of little activity in the nuclear power space, why are technology companies suddenly battling for nuclear dominance? More importantly, what stocks could see the biggest gains from this trend that continues to pick up steam?

Key Points in This Article

- Data Center power capacity use is accelerating from a 12-15% compounded annual growth rate (CAGR) to estimates of a 25% rate in the years to come.

- This is projected to drive data center facilities spending from $49 billion in 2023 to $167 billion in 2026.

- We believe Vertiv (NYSE: VRT) and Schneider Electric (OTC: SBGSY) are two excellent ‘picks and shovels’ plays to ride the boom in nuclear power and data center creation.

- If you’re looking for our most in-depth report on the growth of artificial intelligence – make sure to grab a copy of our “The Next NVIDIA” report. It’s absolutely complementary and comes with dozens of stocks ideas including three in-depth research reports. Once again, it’s completely free but available for a limited-time only!

Watch Our Breakdown of Why Technology Companies Are Striking Nuclear Deals

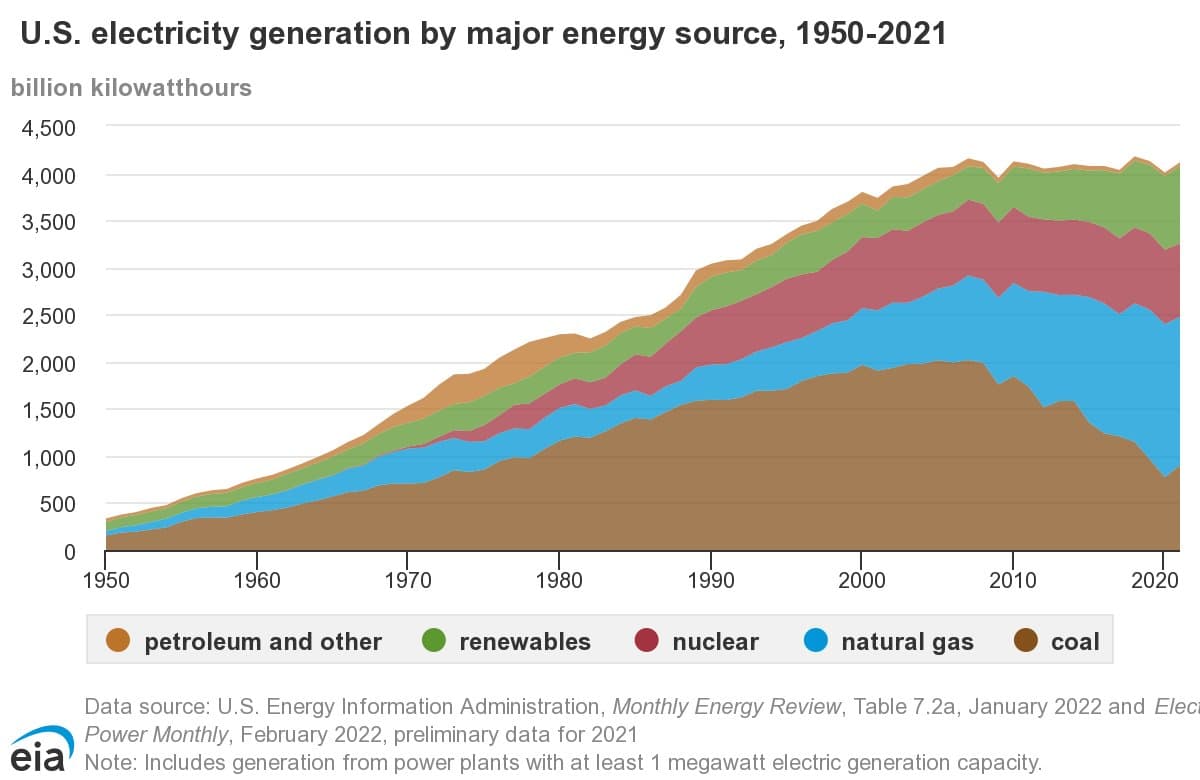

90% of data center power growth in the coming years will be AI-driven. One challenge is that most of these data centers will be built in the United States of America. The problem, as you can see from the chart below, is that power generation in the United States has been largely stagnant since the turn of the century.

So, a period of rising energy demand will tax the grid. According to researcher Semi Analysis, power generation going data centers alone is expected to climb from 4.5% in 2023 to 14.6% in 2028.

Nuclear power is appealing because it provides clean, dense, and continuous power. A single nuclear plant can power the largest AI data centers currently being planned. However, with about 60 gigawatts of new power generation likely required to meet new data center construction in the years to come, a single small modular nuclear reactor provides less than 1/100th the incremental power generation needed for the AI boom.

Two Stocks to Play The Data Center Trend

With all this in mind, we’re adding two new stocks to the $500,000 real money AI portfolio we’ve created for 24/7 Wall Street readers.

(If you’re unfamiliar with our $500,000 AI portfolio you can get the full details here)

While buying stocks in the nuclear power chain is one way to play the boom in data centers, another strategy is to buy the ‘picks and shovels’ plays that supply data center equipment. This market is absolutely booming right now.

In 2023, spending on data center facilities was about $49 billion. Thanks to all the new data centers being created to train and run AI models, that number is expected to surge to $167 billion in 2026. Up to half that spending will go to companies building out power systems (generators, transformers, uninterruptible power supplies, power distribution, etc.). Another 1/3 of this spending could go toward cooling systems.

Our top cooling play is Vertiv (NYSE: VRT). Cooling is becoming increasingly complex. NVIDIA‘s (Nasdaq: NVDA) new Blackwell chips are pushing 1,000 watts, and require advanced cooling techniques that bring coolant into direct contact with a chip plate on top of the processor itself.

Vertiv has a wide portfolio of equipment they sell into data centers, but their leadership in cooling is the most exciting part of the business. By our estimates, the company is trading for about 30X forward earnings, but can significantly expand margins in the years ahead as cooling systems come with added complexity.

Another stock we’ll be adding to our $500,000 AI portfolio is Schneider Electric (OTC: SBGSY). The company has a wider portfolio of power products than Vertiv, and has made strong acquisitions in the cooling space to become Vertiv’s strongest rival. Since we believe this overall trend is extremely attractive, we’d like to own both companies in our AI portfolio.

Listen to Our Full Conversation on the ‘AI Investor Podcast’

This discussion on nuclear power is an except from our ‘AI Investor Podcast’ that’s updated biweekly and breaks down AI investing news and also recommends our favorite stocks in the space. You can visit our ‘AI Investor Podcast’ Hub Page for a full listing of episodes. In addition, you can listen to the entire recent episode where in addition to nuclear power we discussed earnings from ASML, AI stocks we’re avoiding, and analyzed recent AI product announcements from Microsoft and Apple.

Transcript of Our Conversation

[00:00:00] David Hanson: All right, let’s move on to our last topic. You talked about, uh, the, the big emerging story just in the last couple of months, it feels like a nuclear power is becoming a much bigger topic. Five, 10 years ago. I don’t know if anyone was talking about nuclear power other than maybe “Can we just decommission more plants?”

[00:00:16] David Hanson: It was just not on the radar at all. And now, um, with the amount of energy required to operate, uh, some of this infrastructure for AI, it’s, it’s needing to come back in a big way. Um, so let’s talk a little bit about nuclear power. Why it’s on your mind? And then let’s talk about those new companies that you’re going to be adding to the portfolio.

[00:00:36] Eric Bleeker: Yeah. I mean, you said nuclear power, it had this boom from 1970 to 1990. Almost no facilities have been built since then. It’s almost like saying, “Oh, what’s the big trend for AI? It’s paper!” Right? Like it’s, it’s something so from the past, it’s a little interesting that we’re seeing reversion back to it.

[00:00:55] Eric Bleeker: But there are very important reasons that this is happening. So, as you mentioned, the background is we’ve seen a wave of nuclear deals. I’ve got them right here. Constellation struck a deal to give Three Mile Island’s power supply to Microsoft. Google with the deal with Kairos, they’re trying to create small modular nuclear reactors by 2030.

[00:01:16] Eric Bleeker: Amazon has a deal with a nuclear plant in Pennsylvania. Oracle has talked about using nuclear power. So it’s kind of like… Everybody on the ship! Clearly, something important is happening here, and we need to understand why that is, and what profit opportunities there might be across the value chain. So what nuclear does, is it provides a lot of power density and consistency and importantly as well, it’s clean energy.

[00:01:44] Eric Bleeker: All of these companies have signed pledges to essentially be carbon neutral. So if you want to spin up a lot of coal power, that is a big-time non-starter. They would not be fulfilling the promises they’ve made. So they need some ability to be able to get this consistent, high-density power that’s clean, and nuclear is one of the easiest ways to fit the bill.

[00:02:05] Eric Bleeker: So if we’re looking at kind of the numbers behind this, let’s establish the situation with data centers and what the opportunity is right now. Data center capacity has been growing at a compounded annual growth rate of about 12 to 15 percent annually, that’s about to spike to 25%. So you see a doubling in that rate of change.

[00:02:27] Eric Bleeker: 90 percent of this power growth is going to be driven by AI. Now, globally, data centers will only be about four per 4.5% of total power. I’m getting these numbers from Semi Analysis, which they do a lot of really in-depth research and tracking. And they have estimated about 4. 5 percent by 2030, which that sounds very manageable, but here’s the problem.

[00:02:51] Eric Bleeker: Almost all this new power generation is being built in one place. That’s the United States of America. And that’s where 70 percent of new power generation is going to happen for this AI boom. Why is that? Well, the average cost of electricity in America, it’s eight cents per kilowatt hour.

[00:03:11] Eric Bleeker: In Europe, that number is 18. You go places like Great Britain, it’s like 23 cents. So, I mean, the cost to operate one of these giga-scale data centers in the US would be $300 million to $400 million a year and in a place like the UK, it would be over a billion dollars annually.

[00:03:38] Eric Bleeker: Other countries can produce power at a scale and cheapness relative to the US like China… But, China, that’s a nonstarter politically, right? You’re not gonna keep all your data in China, full stop. Second, the Middle East, which they are starting to build some data centers. But again, you have you have a political situation where it’s like, if we have the cheapest power, most of the companies that are leading AI are in America.

[00:04:03] Eric Bleeker: And while America’s regulatory situation is not perfect – we’ll describe that a little bit more later – it’s much better than areas like Europe where getting started on incremental power generation is close to impossible. So add this all up and here’s kind of the bottom line, U.S. power generation from data centers is expected to grow from 4 to

[00:04:23] Eric Bleeker: 5 percent of the total to 14.6% in the next, in a five year span. This is causing incredible stress on the grid because power generation in the U. S. has been largely flat since 2000. So we go from 20-plus years of no change to all of a sudden a huge step change regulatory-wise. That’s stressing things.

[00:04:44] Eric Bleeker: It’s about five year wait to connect new clean energy to the grid. Supply chains are a challenge too. Elon Musk famously said, we can’t even build enough transformers. There are so many pieces and components in power supply to get here.

[00:05:07] Eric Bleeker: So you can see why this is attractive because it’s an industry that’s been largely static and it’s about to see this incremental boom. We’re always looking for that. Where is there a step change? Where is there an incremental boom? And, you know, is it still underestimated by the market? So you look at nuclear power.

[00:05:26] Eric Bleeker: This is why people have been running to it. It’s something that every company is striking a deal with. The problem is: this incremental data center demand, it’s going to require about 60 gigawatts of new power in the span I’ve been talking about. So one of those nuclear deals, like the one that Amazon struck, that’s one, one hundredth the need.

[00:05:45] Eric Bleeker: And then you look at what Google’s building, which is the project with Kairos, it’s an ambitious target and they’re hoping to get things done by 2030. So the, you know, the problem with nuclear, right? It takes a long time. The costs are all front-loaded. The other problem is the costs are in steel, they’re in concrete, they’re in labor.

[00:06:06] Eric Bleeker: Those are all things that generally kind of increase in time and with demand. Whereas the other power sources that are growing like solar and batteries, they actually have scaling laws to make them cheaper. So, if nuclear takes 10 years, you might actually have cheaper alternatives by the time it’s ready.

[00:06:24] Eric Bleeker: So David, I trust, you know, you can follow, right? Nothing is, nothing is simple here, right? Nothing, this is. This is a very complex, you know, situation at hand.

[00:06:36] David Hanson: Then you sprinkle in how people feel about nuclear and there’s a lot of fear, yeah, it doesn’t help things.

[00:06:41] Eric Bleeker: And then you have that. So I’m looking at the situation.

[00:06:44] Eric Bleeker: You asked which stocks are overheated in that last lightning round. And I did say Palantir, but another great one for that answer is Oklo because that’s Sam Altman’s company that I think went public through SPAC and ita nuclear power focused. It was up 150 percent in just a week as some of these deals broke, right?

[00:07:02] Eric Bleeker: So there’s a lot of people chasing enthusiasm, but the picture around whether or not nuclear is actually the majority of the solution or it’s a small amount of the solution to basically power the largest data centers… Those, those are two different issues. So here’s what I’m going to focus on today.

[00:07:21] Eric Bleeker: I’m going to add two recommendations focused on this. I want to focus on this boom in data centers, all these numbers I’ve talked about, because data center spending for just the facilities is expected to grow from $49 billion in 2023. To $167 billion in 2026. So that’s more than a threefold jump in just a matter of years.

[00:07:43] Eric Bleeker: You can look at where the spending is going roughly half of it’s in power systems. up to a third of it in cooling systems and the rest is, you know, miscellaneous stuff. So one of our key themes that we’ve talked about, one of our trends for 2025 is the growth of Blackwell. Well, this is the new chip from NVIDIA.

[00:08:02] Eric Bleeker: One of the features of it, it is incredibly power hungry and the NVIDIA chips are just going to get more power hungry so that, that, that has, you know, a power outcome. It also means that if you put these chips close to each other, they will essentially cook each other. Right? You will lose it. So you need to have advanced cooling strategies.

[00:08:22] Eric Bleeker: So the company that we’re going to add first is Vertiv. David, this is a company you own in your own portfolio. Its ticker symbol is VRT. They, they have a very wide portfolio of power supplies, things like switch gears and basically the power systems to make sure that these data centers get continuous power. They’ve also made a significant investment in cooling systems.

[00:08:47] Eric Bleeker: And this is pretty advanced technology. You’re actually taking the cooling systems to the chip itself, a plate above it to dissipate all the heat. So, you know, they have this, it is now essential technology, largely thanks to the growth of where NVIDIA is driving the market. And what this is going to do, they can command higher margins on this because it’s very complex technology.

[00:09:09] Eric Bleeker: Microsoft’s going from like 180 data centers to 900 in this five-year stretch. As these companies are looking at how they get to market faster, and how they build faster, companies with this design and build expertise like Vertiv that have been building it for years, get to apply this all into a window of intense demand.

[00:09:29] Eric Bleeker: So I love the competitive positioning of Vertiv. I love their ability to drive margins. I love their executive team. They’re led by the former CEO of Honeywell, who’s kind of legendary in this industrials market. He has a big vision for the company. On a trailing basis. They look expensive, but if you look to forward earnings, I have them around 30 times forward earnings.

[00:09:52] Eric Bleeker: And then as we’ve talked about, we can see the data center projections that these companies are planning on. I think there’s going to be a lot of incremental spending for Vertiv, not just in 2025, but into the uncertain years we’ve talked about: 2026, 2027, 2028. So I like their ability to continue growing earnings.

[00:10:10] Eric Bleeker: It’s a company that’s run up a lot, but you know, I think, :Could this, see another double in the years to come?” Yeah, I definitely see the potential there. The other stock I’ll be adding to this is Schneider Electric and there’s no rocket science to this. They are just Vertiv’s number one competitor.

[00:10:28] Eric Bleeker: They’ve got a little bit wider portfolio and some more share of the power equipment side. They did a major acquisition to get more cooling. And I just see them kind of as the two top dogs. And I want the two top dogs in this kind of growth rate. So David, I know that was a lot. We almost need a PowerPoint to break this all down.

[00:10:48] Eric Bleeker: But the key theme here is whenever I’m looking for a new aspect of the trend, I want to break it down from its most foundational levels, because I think getting the trend right is probably more important than the specifics of the individual stocks. So we’ve really framed this trend, why we like it.

[00:11:08] Eric Bleeker: As kind of a first play, this infrastructure equipment, we’ve picked out our two companies. And if we want to go back in the future and we want to add, you know, a nuclear player, something like that, we can. But we’ve gotten kind of those foundational and structural winners. And we can add more across them now that we’ve kind of established this opportunity.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.