Marc Guberti - Author for 24/7 Wall St.

Lastest Stories by Marc Guberti

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. When you are at the start of your financial journey, you...

Published:

The Salary Reddit group contains many posts from people who talk about their salary increases over the years. However, taxes recently came up in a post from a 35-year-old female in New York. She...

Published:

The Salary subreddit contains many inspirational posts from people who show their salary progression over the years. This recent post comes from a mechanical engineer who went from a $58k salary to...

Published:

Nvidia (NASDAQ:NVDA) is set to report earnings on February 26, and it can be a major catalyst for the AI chipmaker. Investors will get to see how much the business is growing and receive guidance...

Published:

Warren Buffett has outperformed the S&P 500 for many years, and he continues to deliver impressive gains for investors. Berkshire Hathaway Inc. (NYSE: BRK-B) has gained 23% over the past year...

Published:

A 33-year-old woman posted in the Salary Reddit group detailing her progression from $6,611 per year to $113k per year. While that’s an inspirational story already, she has a base salary of $133k...

Published:

A Redditor recently posted in the FIRE Reddit group looking for advice about starting an LLC. The Redditor doubts that there are any tax benefits with starting an LLC over collecting W2 income...

Published:

Giving money to your children can set them up for financial success. Extra funds may make it easier for them to buy a house and work toward other financial objectives. However, giving your children a...

Published:

A Redditor has accumulated $2.2 million in his portfolio. That doesn’t include $500k in a 401k, $3 million in residential rental properties, and $750k in cash. He has also saved $500k in each of...

Published:

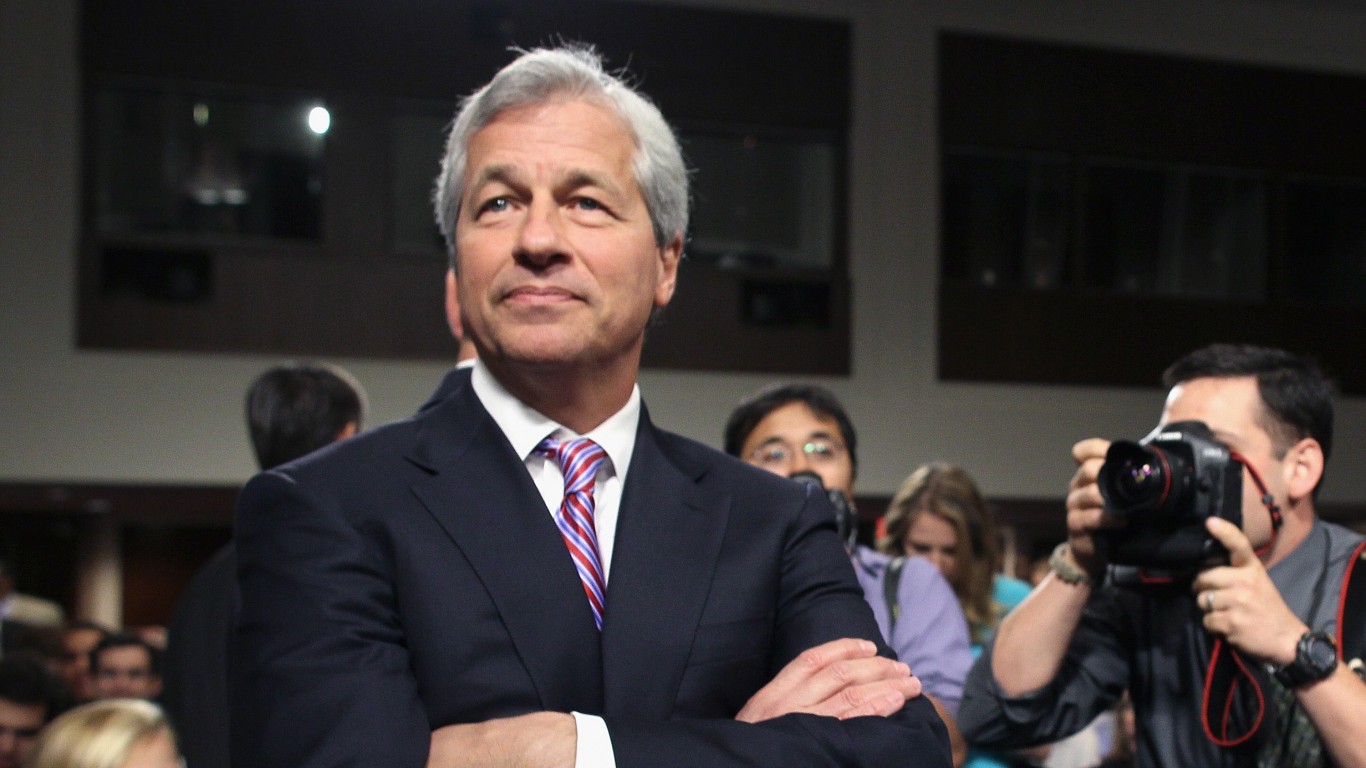

2024 was a great year for financial stocks, including a 28% gain for XLF, an ETF that tracks the financial sector. However, the financial industry can be primed for additional wins in 2025. While...

Published:

A Redditor recently posted in the Fat FIRE subreddit to gauge if he’s ready to live off dividends and interest payments. The Redditor has $10.8 million in stocks and treasuries plus $650k in cash....

Published:

Most divorces get messy due to finances, emotions, and other factors. It’s an unfortunate reality, and one woman in her 40s turned to the Fat FIRE Reddit community for advice. She explains in...

Published:

A divorce has significant ramifications on all aspects of a person’s life, including their finances. While some of these changes may be unpleasant, it’s important to prepare for them. People who...

Published:

Rising costs have made it more difficult for many people to afford basic goods and services. Inflation impacts poor and middle-class families more than the upper class. However, there are some...

Published:

A Redditor is approaching his Coast FIRE goals but is considering an early exit. He didn’t share financials but posted in the FIRE Reddit group looking for some advice. It’s harder to share...

Published:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.