Perhaps the most important thing saving automakers from much worse sales performance is their ability to raise prices. As an industry, the May price for a new light vehicle (car, sport utility vehicle or pickup) rose by an average of 3.7% to $37,185 compared to a May 2018 average of $35,865. Every major automaker saw prices rise year over year.

The month-over-month story is not quite as happy. As a group, the average price of a light vehicle dropped 0.6% between April and May, a difference of $208. Only one automaker, Nissan, showed a higher price in May and that by just 0.5%. But Nissan also had the lowest year-over-year increase for the month at just 0.1%.

Cox Automotive has estimated May sales volume at 1.54 million units, a drop of 3% year over year. On a seasonally adjusted annual rate (SAAR) basis, this year’s rate is forecast at 16.9 million, well below the 17.2 million SAAR posted in May 2018.

Higher prices have offset lack of volume, affordability is beginning to take a toll on sales even with a robust job market and strong consumer confidence. Cox analysts are expecting a May SAAR of 16.8 million, down from 17.2 million a year ago.

Charlie Chesbrough, senior economist at Cox, commented: “If sales for the month exceed expectations, it is a strong indicator that a blazing summer sales season is ahead.” Lower-than-expected sales, of course, would indicate a slowdown. Sales have been volatile since December, dropping to a SAAR of 16.4 million in February before rising to a high of 17.4 million in March.

The automaker with the biggest month-over-month drop in May’s average transaction price is forecast to be Subaru, with a dip of 1.2%. From May of last year to May of this year, Subaru’s average price has increased by 5.7%.

The largest year-over-year price gain came from Fiat Chrysler, with a jump of 6.5% to an average of $40,021. Volkswagen posted the highest May transaction price at $42,964, up 3.4% year over year. Ford and GM posted May averages of $41,612 and $41,489, respectively.

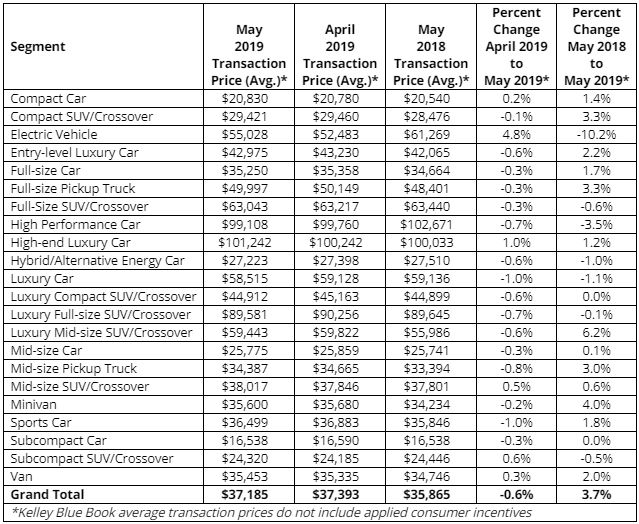

By segment, the transaction price average for electric vehicles (EVs) has dropped by 10.2%. That is the result of a loss of 50% of the federal tax credit to buyers of EVs from $7,500 to $3,750. Tesla and GM have both sold the maximum number of vehicles eligible for the full credit. Luxury midsize SUVs and crossovers have posted the biggest year-over-year increase in price, up 6.2%. Here’s a table from Kelley Blue Book showing transaction prices for all segments.

Tim Fleming, a Kelley Blue Book analyst, noted: “SUVs bounced back in May 2019 and drove many of those increases for automakers, especially those with new and redesigned models on dealer lots. However, with this expected to be the fifth down month in a row, the question for this year remains whether automakers will start to trade some of their pricing power for greater incentives and more sales.”

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.