Customer retention is a key to almost every product or service. People who repeat as customers require almost no replacement costs. When a business loses a current customer, replacing that person can involve heavy marketing costs, both in terms of advertising and human sale efforts. For something like a car, which can cost $30,000 or much more, the replacement price can move into thousands of dollars.

Gold standard car research firm J.D. Power conducts a study it calls its U.S. Automotive Brand Loyalty Study. The latest version is for 2020. The study is in its second year. Its simple measure is whether people who own a car brand will buy the same brand when they trade it in. The COVID-19 pandemic has increased brand loyalty.

Tyson Jominy, vice president of data and analytics at J.D. Power, commented:

Automakers are really focused on customer retention, as evidenced by the payment plans and incentives they’ve offered since the COVID-19 pandemic broke out. Many have gone above and beyond to offer customers financial assistance during a period of economic uncertainty, which does a lot to bolster consumer confidence in their chosen brand and repurchase it in the future.

The measure is called the loyalty rate.

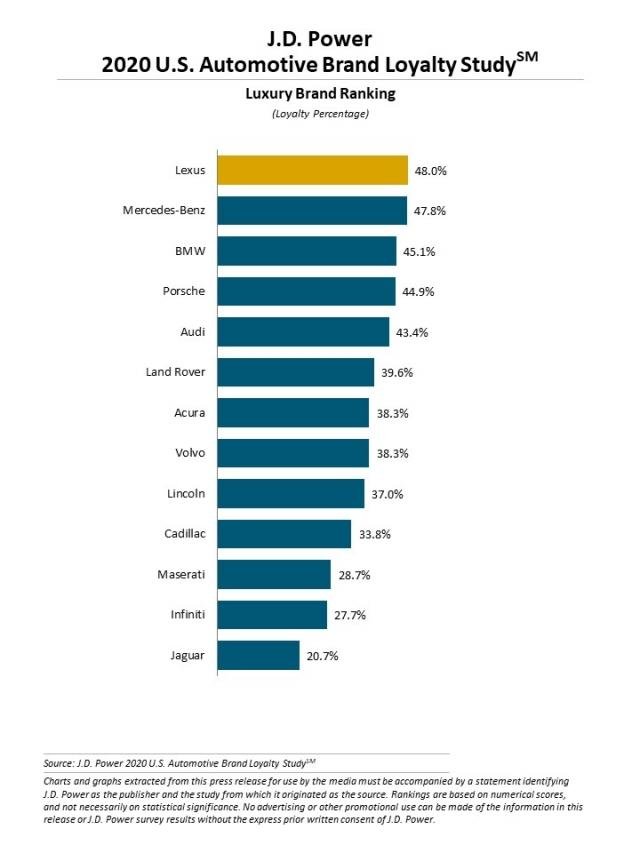

Among luxury brands, Jaguar is the brand people are most likely to dump. Its retention rate is an extremely low 20.7%. By contrast, at the other end of the spectrum, Lexus has a number of 48.0%. Jaguar’s quality ratings have been low for years. Its sales levels have been rocky. It is a niche brand with only a few models.

Among mass market cars, the brand with the lowest customer loyalty rate is Fiat at 10.4%. Its sales in the United States have plunged for years. There are even questions about whether it will continue to be sold in the United States, although it has a good following in Europe.

Click here to see which car brand people are most likely to buy again.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.