This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive

compensation for actions taken through them.

Customer retention is a key to almost every product or service. People who repeat as customers require almost no replacement costs. When a business loses a current customer, replacing that person can involve heavy marketing costs, both in terms of advertising and human sale efforts. For something like a car, which can cost $30,000 or much more, the replacement price can move into thousands of dollars.

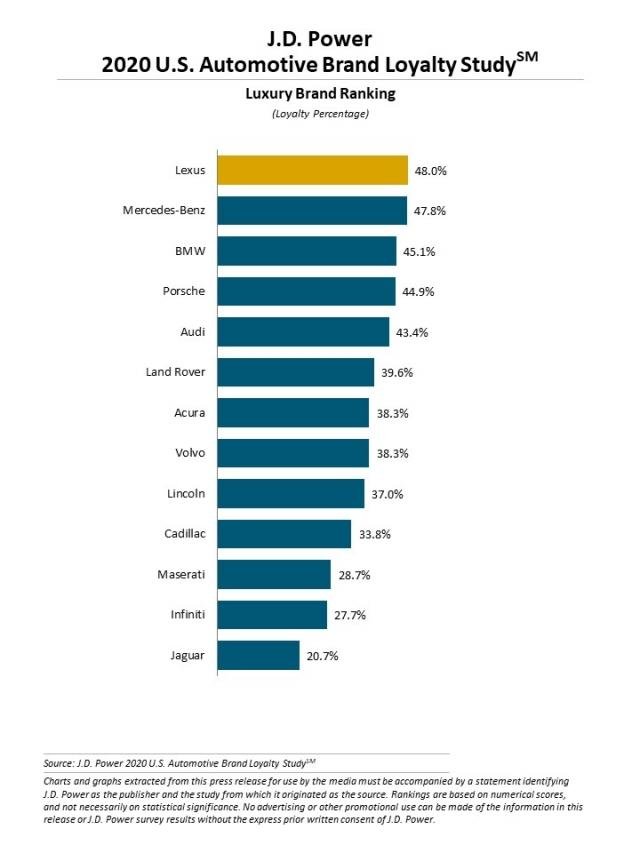

Gold standard car research firm J.D. Power conducts a study it calls its U.S. Automotive Brand Loyalty Study. The latest version is for 2020. The study is in its second year. Its simple measure is whether people who own a car brand will buy the same brand when they trade it in. The COVID-19 pandemic has increased brand loyalty.

Tyson Jominy, vice president of data and analytics at J.D. Power, commented:

Automakers are really focused on customer retention, as evidenced by the payment plans and incentives they’ve offered since the COVID-19 pandemic broke out. Many have gone above and beyond to offer customers financial assistance during a period of economic uncertainty, which does a lot to bolster consumer confidence in their chosen brand and repurchase it in the future.

The measure is called the loyalty rate.

Among luxury brands, Jaguar is the brand people are most likely to dump. Its retention rate is an extremely low 20.7%. By contrast, at the other end of the spectrum, Lexus has a number of 48.0%. Jaguar’s quality ratings have been low for years. Its sales levels have been rocky. It is a niche brand with only a few models.

Among mass market cars, the brand with the lowest customer loyalty rate is Fiat at 10.4%. Its sales in the United States have plunged for years. There are even questions about whether it will continue to be sold in the United States, although it has a good following in Europe.

Click here to see which car brand people are most likely to buy again.

The Average American Is Losing Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4% today, and inflation is much higher. Checking accounts are even worse.

Every day you don’t move to a high-yield savings account that beats inflation, you lose more and more value.

But there is good news. To win qualified customers, some accounts are paying 9-10x this national average. That’s an incredible way to keep your money safe, and get paid at the same time. Our top pick for high yield savings accounts includes other one time cash bonuses, and is FDIC insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes and your money could be working for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.