J.D. Power U.S. just released the results of its Automotive Performance, Execution and Layout (APEAL) study. It measures “owners’ emotional attachment and level of excitement with their new vehicle.'” Toyota, usually high on lists of this kind, was battered in the ratings. (These cars are still mostly made in America.)

[in-text-ad]

According to J.D. Power researchers, the study used 37 yardsticks. The research polled 84,555 owners of 2023 models after 90 days of ownership. The survey ran from February through May 2023.

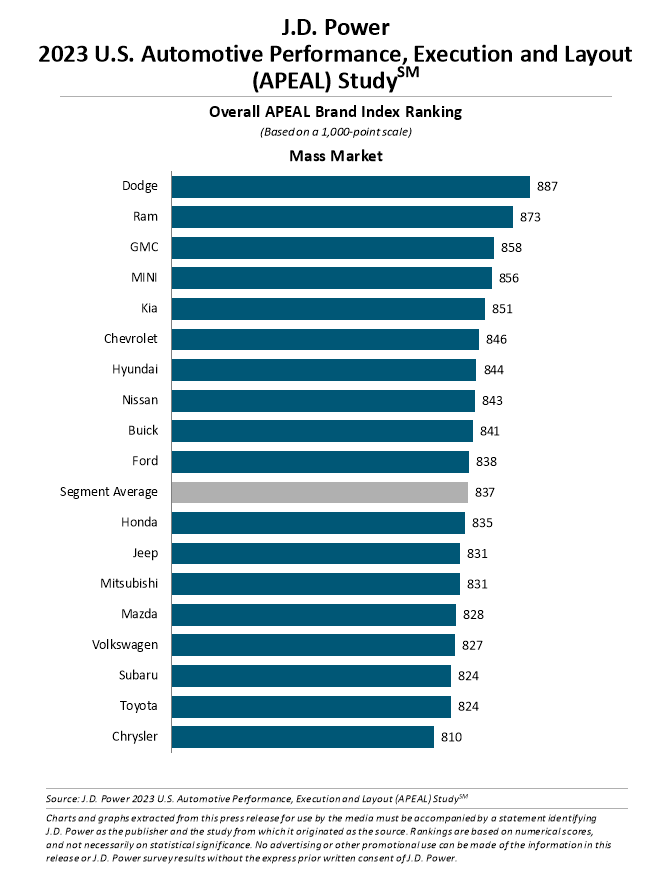

The study’s results are divided into two categories: mass-market cars and luxury vehicles. The highest possible score was 1,000. Among mass-market cars, the average score was 837. Dodge topped the list with a score of 887. Toyota was second to last, behind Chrysler, with a score of 824.

For decades, Toyota’s brand has been widely regarded by drivers for both quality and design. It continues to be at the top of many quality studies. It appears this is not the case with performance and layout.

The new J.D. Power study must come as a blow to Toyota, the largest car company in the world.

Toyota’s Luxury brand, Lexus, fell in the middle of the premium car study. The average in this category was 871. Lexus had a score of 864, just behind Ford’s weak brand Cadillac, which had a score of 865. The top brand was Jaguar at 887.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.