Banking, finance, and taxes

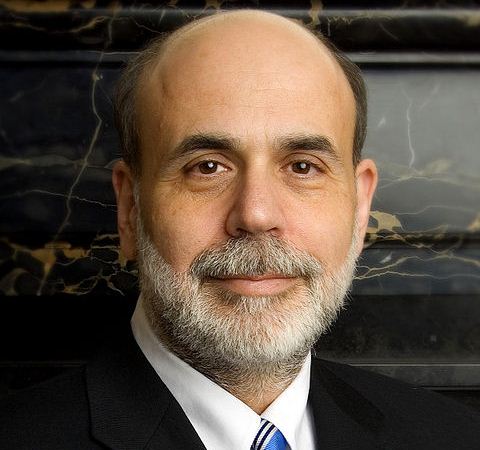

No Change to Interest Rate, QE; Forecast Mixed -- FOMC

Published:

Last Updated:

The vote was 11 to 1, with only Fed Governor Elizabeth George voting against. George’s “no” vote was based on here that “continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.”

The Fed’s economic projections got a pretty good workover, though, since the publication of the December projections. The projected GDP growth for 2013 has been lowered from a range of 2.3% to 3% to a new range of 2.3% to 2.8%. Estimated GDP growth for 2014 has dropped from 3% to 3.5% to a new range of 2.9% to 3.4%.

The projected unemployment rate for the year has fallen from a December range of 7.4% to 7.7% to a new range of 7.3% to 7.5%. U.S. unemployment came in at 7.7% in February. The projection for U.S. unemployment to fall to 6.5% remains projected for 2015.

Inflation projections fell slightly from a December projection for 2013 inflation in the range of 1.3% to 2% to a new range of 1.3% to 1.7%. Projections for 2014 and 2015 were unchanged.

There is nothing in the Fed’s statement that indicates a quicker end to asset purchases or near-zero interest rates other than a mild statement that “labor market conditions have shown signs of improvement.” Now, let the close analysis begin.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.