Banking, finance, and taxes

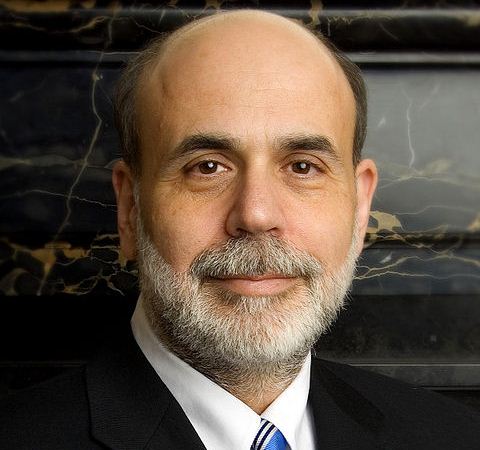

Bernanke Cannot Over-Regulate Big Banks Either

Published:

Last Updated:

Federal Reserve Chairman Ben Bernanke is speaking this morning to bankers at the Federal Reserve Bank of Chicago. His speech is called “Monitoring the Financial System,” but it really involves the fallout from after the financial crisis and regulatory control over liquidity at the banks labeled “too big to fail.”

Bernanke starts out saying we are more than four years beyond the most intense phase of the financial crisis but notes that the legacy of that crisis remains. The jobs lost have not been fully recovered and the financial system continues to struggle with the consequences of what happened in 2007 to 2009.

Regulatory pressures from Dodd-Frank, reform on Wall Street and the Consumer Protection Act have come at a time when the Basel III standards are hitting internationally. Bernanke said that the Federal Reserve has already made significant changes to how it conceptualizes and carries out regulation and supervision.

Bernanke’s full speech is here. We would advise that you take a read of our views on why it is so easy to talk up regulation and liquidity rules at the big “too big to fail” banks but why it is nearly impossible to create actionable efforts that can really force change. The reality is that you could end up in a regulatory-enduced recession.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.