While all 31 banks appear to have passed on being adequately capitalized, there is still a lot of regulatory and pass-fail uncertainty in the next week.

As a reminder, the quantitative results from the Dodd-Frank stress tests are just one component of the Federal Reserve’s analysis conducted during the Comprehensive Capital Analysis and Review (CCAR). This CCAR is the annual Federal Reserve exercise which is the basis for the Fed to evaluate the capital planning processes and capital adequacy of large financial institutions.

The formal CCAR, which will determine which banks get to raise their dividends and which banks get to buy back more common stock, will be released on Wednesday, March 11, at 4:30 p.m. Eastern Time.

This was the fifth round of stress tests led by the Federal Reserve since 2009, but it is the third round required by the Dodd-Frank Act. These 31 firms tested are said to represent more than 80% of domestic banking assets, and each have $50 billion or more in consolidated assets.

The Federal Reserve uses its own independent projections of losses and incomes for each firm. Here are some of the stipulations of the tests:

- The “severely adverse” scenario is called a deep recession with the unemployment rate peaking at 10%, home prices dropping 25%, and a stock market drop of nearly 60%, and a notable rise in market volatility.

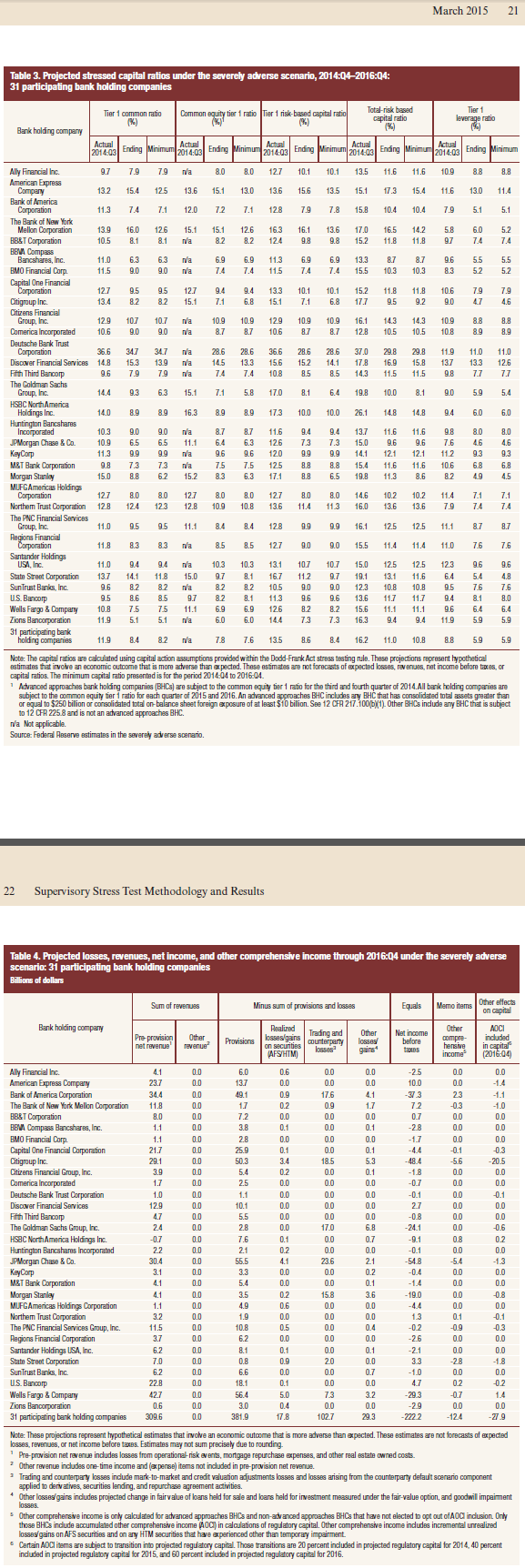

- Over the nine quarters of the planning horizon, losses at the 31 bank holding companies would be projected to lose a combined $490 billion under the severely adverse scenario.

- The 31 firms’ aggregate tier 1 common capital ratio would fall from an actual 11.9% in the third quarter of 2014 to a minimum level of 8.2% in the hypothetical stress scenario. This hypothetical post-stress minimum is significantly higher than the 31 firms’ aggregate tier 1 common capital ratio of 5.5% measured in the beginning of 2009.

- Of course, the results are not forecasts or expected outcomes.

- In an “adverse” scenario, which features a more moderate recession but a rapid increase in short-term and long-term interest rates, the aggregate tier 1 common capital ratio of all 31 firms would fall from an actual 11.9% in the third quarter of 2014 to the minimum level of 10.8%.

Again, Thursday’s results are good, but they do not disclose which of the big banks will and will not be cleared to increase their buybacks and common stock dividend payouts ahead.

24/7 Wall St. recently predicted by how much each bank should be able raise their dividends by after next week’s CCAR results have been released. Of course, there could be some wild cards there, but we will know in less than a week which ones can and cannot raise their payouts.

Below is a bank by bank review of the top 31 US financial institutions considered in the ‘too big to fail’ category. The tables can be expanded by clicking on them, and they include capital ratios under the severely adverse scenario, as well as projected losses in revenues and net income.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.