Banking, finance, and taxes

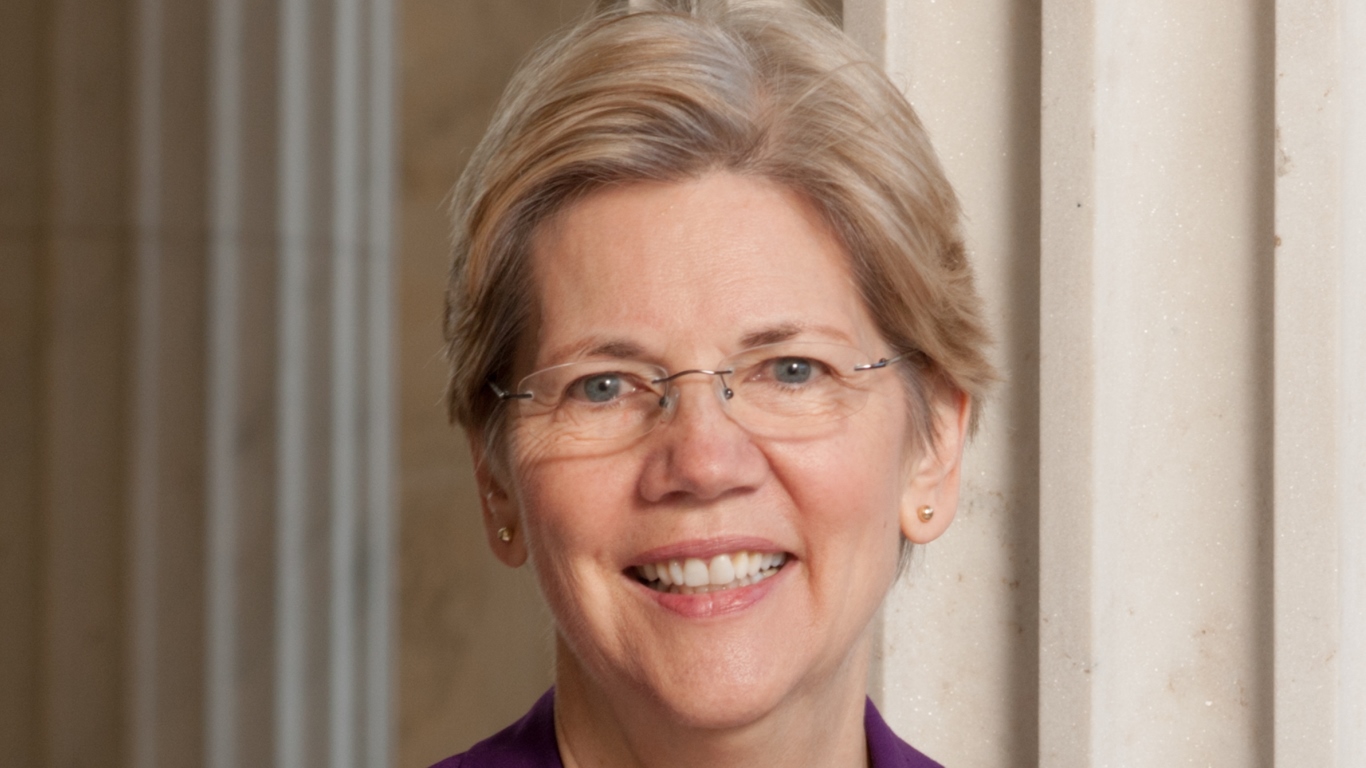

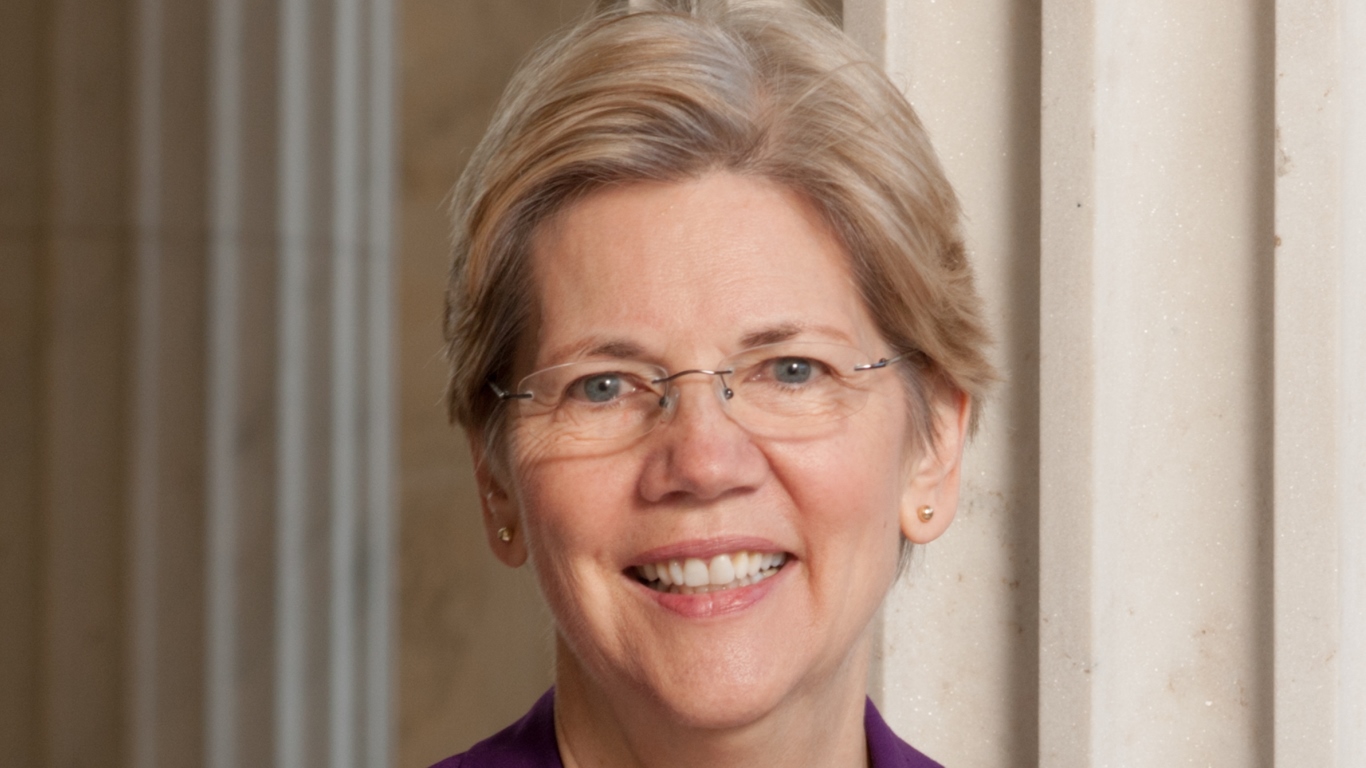

Elizabeth Warren Wants Head of Wells Fargo Fired

Published:

Last Updated:

Senator Elizabeth Warren pressed the extent of the power of her office as she insisted that the CEO of Wells Fargo & Co. (NYSE: WFC) be fired. Some of the points she made to the Federal Reserve are accurate, even if her opinion that she has leverage over such a decision is not.

[in-text-ad]

According to her office:

United States Senator Elizabeth Warren (D-Mass.) today sent a letter to Federal Reserve Board Chairman Jerome Powell urging him to maintain the Federal Reserve’s growth restriction on Wells Fargo until the bank replaces CEO Tim Sloan with someone who is not deeply implicated in the bank’s misconduct. The letter states that the Wells Fargo Board of Directors cannot comply with the Federal Reserve’s requirements for rescinding the growth restriction if it continues to employ a CEO who served in senior management roles as the bank repeatedly mistreated its customers and employees.

The Fed’s defenders often say it is important for the central bank to be cordoned off from political considerations. Warren assumes otherwise.

However, much of the trouble at Wells Fargo has happened on Sloan’s watch. Warren’s office points out:

The letter notes that Mr. Sloan served in senior management positions at Wells Fargo from 2011 onwards, including as Chief Financial Officer, head of Wholesale Banking, and Chief Operating Officer before being elevated to CEO in the wake of the fake-accounts scandal in 2016. During that time period, Mr. Sloan was involved with the fake-accounts scam – and defended Wells Fargo’s high-pressure sales goals despite knowing they had led thousands of employees to open millions of fake accounts – and helped oversee the bank as it engaged in nearly a dozen other significant consumer frauds. In just the eight months since the Federal Reserve imposed the growth restriction, there have been several new reports of misconduct at Wells Fargo during times when Mr. Sloan served in senior management.

Many observers believed that when the Wells Fargo board replaced shamed former CEO John Stumpf with Sloan two years ago this month, it should have picked an outsider. It did not. Wells Fargo’s woes have continued, along with punishments from the federal government. Warren wants to leverage these events into a bit of arm-twisting at the Fed. While that will not work, she has some points.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.