Banking, finance, and taxes

6 Reasons to Avoid JPMorgan (JPM) Immediately

Published:

Last Updated:

Co-founded by American financier J.P. Morgan and Anthony Drexel in 1871 as Drexel Morgan, the company became JP Morgan and Company in 1895. The company grew so powerful in financial circles that by 1907, J.P. Morgan and the company helped prevent a massive market crash, which led the government to create the Federal Reserve System.

In 2000, JPMorgan Chase & Co. was created by merging JPMorgan and The Chase Manhattan Bank. JPMorgan Chase & Co. is an American multinational financial services firm headquartered in New York City and incorporated in Delaware. It is the largest bank in the United States and the world’s largest bank by market capitalization as of 2023.

According to the firm’s website: “We trace our roots to 1799 in New York City, and our many well-known heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First National Bank of Chicago, National Bank of Detroit, The Bear Stearns Companies Inc., Robert Fleming Holdings, Cazenove Group and the business acquired in the Washington Mutual transaction. Each of these firms, in its time, was closely tied to innovations in finance and the growth of the U.S. and global economies.”

While a compelling and influential investment and money center banking giant, there are six essential reasons investors may want to pass on owning the shares now.

While trading at a reasonable ten times trailing 2023 earnings, revenue is expected to drop almost 7.5 % in 2024, boosting the PE to 11.7 times earnings, a premium for slower profits and revenue growth.

With JPMorgan stock trading just below a 52-week high, the dividend has shrunk to 2.5%, which, while still solid, other central money center banks like Bank Of America Inc. (NYSE: BAC), which pays a 2.87% dividend, and PNC Financial Services, Inc. (NYSE: PNC) which produces a strong 4.03% dividend.

With an election year coming up and the potential for the economy to slow dramatically, financial conditions could significantly affect a company trading at all-time highs. In addition, after a substantial rise in the equity markets, a prolonged sell-off next year could be troublesome.

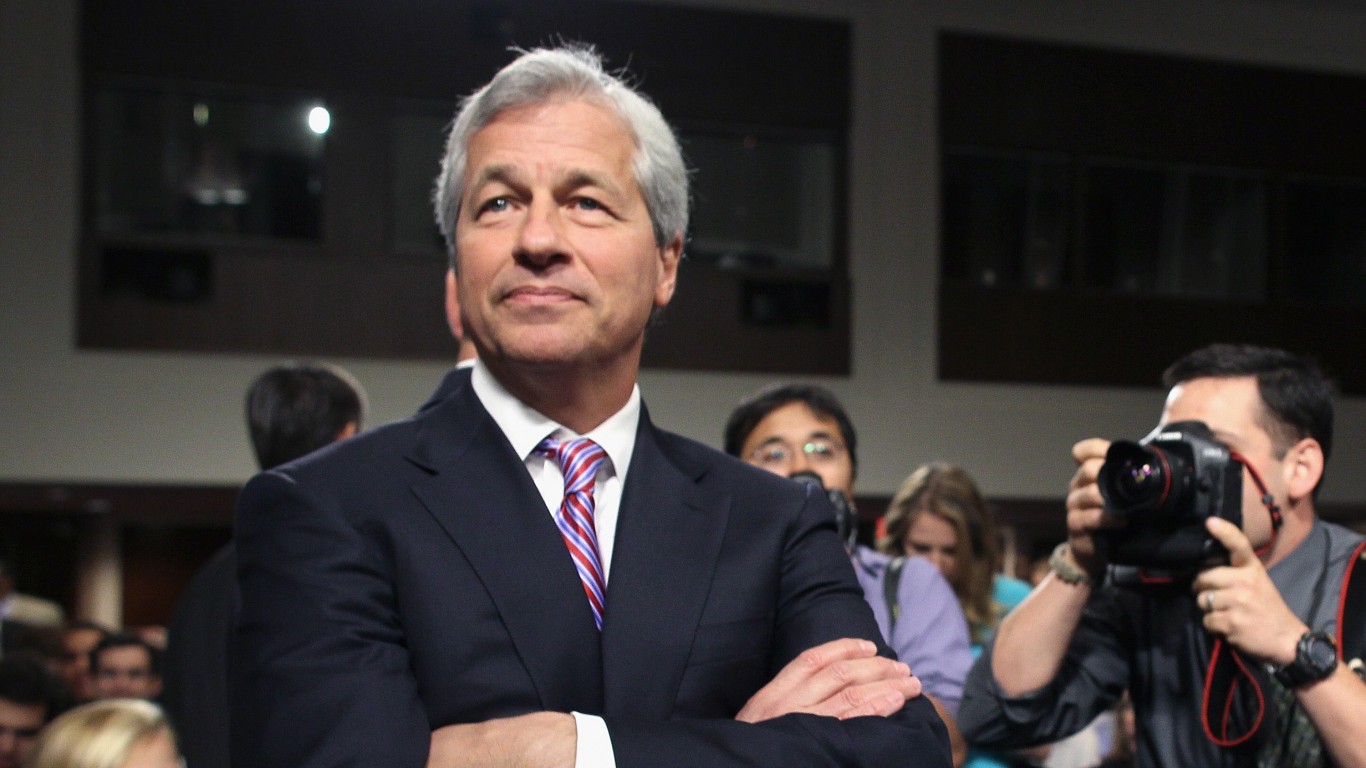

While a true giant in the financial world, Jamie Dimon is also growing older as he turned 67 this year. While vowing to continue at the bank, the respected leader would be a huge loss when he finally does step down. While some have speculated he could run for political office, he has squashed that idea.

In late October, the bank announced Mr. Dimon was selling stock for the first time in his 18 years as the CEO of the bank. He cited financial and tax planning when announcing the plans to sell one million of his 8.6 million shares. While trading at or near the top is always intelligent, it says whether others should buy now.

JPMorgan has been cited for a need for account types besides vanilla offerings. In addition, the company does not offer individual investors a competitive trading platform, as many other big and small banks do. Some feel that the technology the bank offers investors could be improved.

JPMorgan Chase & Co. is one of the premier banks in the world, and investing in the company is a great idea, just not now. Trading just shy of a 52-week high, and with revenues expected to tumble in 2024, it makes sense to wait for the stock to trade lower before buying shares.

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.