Taxation and accounting jokes are almost as numerous as lawyer jokes. No doubt, the reason is partly because of the stress-induced tax season and a process many Americans complain is painful and anxiety-ridden. In addition to resenting the complexity of the tax system, a majority (56%) feel they pay more than their fair share in taxes, according to Pew Research Center.

Can relocating to another country help individuals and entrepreneurs seeking to optimize their taxes? Well, according to expat tax services company Greenback, quite a few countries have lower tax rates and less complex tax systems than the U.S.

To find the countries with the best tax rates, 24/7 Wall St. reviewed Greenback’s report Countries and States With the Best Tax Rates. Using PwC’s tax summaries, Greenback found the rates for personal income tax, value-added tax, capital gains tax, inheritance tax, and corporate tax for 144 countries, arriving at an overall tax score out of 100. The 40 countries with the highest score — best tax rates — are listed here. We also added from the World Bank data on gross domestic product per capita in current U.S. dollars and total population.

Several of the highest ranking countries are considered a tax haven, meaning certain taxes there are levied at a low rate or not levied at all, attracting foreign individuals and businesses. These regions also often offer financial secrecy and minimal regulatory oversight. While tax havens can significantly reduce income taxes, they raise ethical and political considerations, Greenback notes, including fairness “and the responsibility of individuals and corporations to contribute to the public finances of their home countries.”

Looking at all the tax categories, Bermuda, the Cayman Islands, Kuwait, the United Arab Emirates, Macau, Oman, Qatar, Hong Kong, Greenland, and Timor-Leste are offering some of the lowest tax rates. “These jurisdictions represent the pinnacle of tax competitiveness,” Greenback adds. While eight countries levy no personal income tax, only Bermuda and the Cayman Islands offer a 0% corporate income tax rate. (See Exactly How Much Each State Taxes Your Gas.)

In the U.S., individual income taxes are by far the government’s largest single source of revenue, with tax dollars mostly going to social services. The U.S. is known for its complex tax code, combining federal, state, and local taxes. Using a progressive tax system, the U.S. personal income tax rate ranges from 10% to 37% at the federal level. And while the U.S. does not have a federal value-added tax, there are state-level sales taxes. It ranks 49th for its overall tax score.

Here are the comparable U.S. figures:

- Overall tax score: 59.78 out of 100

- Maximum personal income tax rate: 37% — #103 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 21.0% — #58 lowest out of 144 countries

- GDP per capita, 2022: $76,330 — #11 highest of 144 countries

Why This Matters

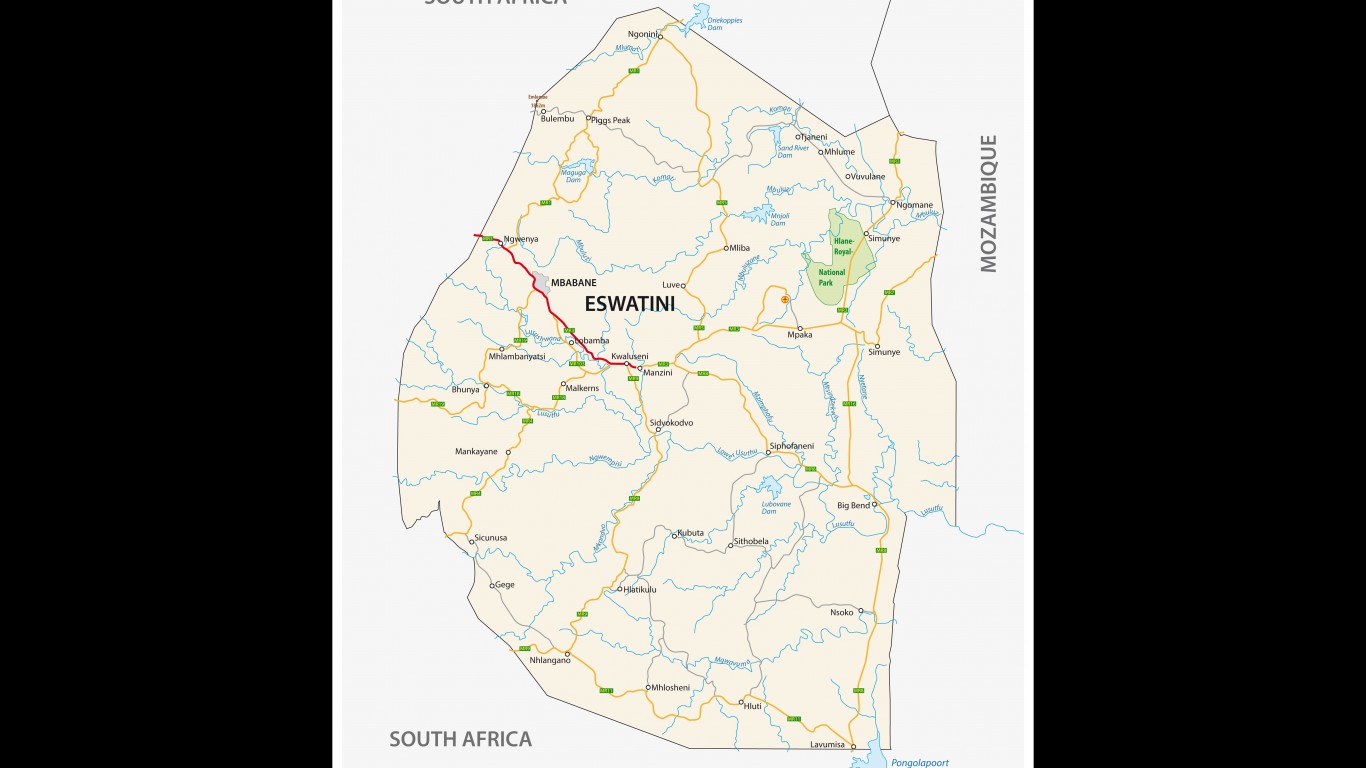

40. Eswatini

- Overall tax score: 63.28 out of 100

- Maximum personal income tax rate: 33% — #80 lowest out of 144 countries

- Maximum value-added tax rate: 15.0% — #54 lowest of 144 counties

- Maximum corporate tax rate: 27.5% — #103 lowest out of 144 countries

- GDP per capita, 2022: $3,987 — #105 highest of 144 countries

- Total population, 2022: 1,192,271

- Region: Sub-Saharan Africa

39. Montenegro

- Overall tax score: 63.76 out of 100

- Maximum personal income tax rate: 15% — #26 lowest out of 144 countries

- Maximum value-added tax rate: 21.0% — #122 lowest of 144 counties

- Maximum corporate tax rate: 15.0% — #17 lowest out of 144 countries

- GDP per capita, 2022: $10,093 — #72 highest of 144 countries

- Total population, 2022: 619,211

- Region: Europe and Northern America

38. Angola

- Overall tax score: 64.46 out of 100

- Maximum personal income tax rate: 25% — #48 lowest out of 144 countries

- Maximum value-added tax rate: 14.0% — #49 lowest of 144 counties

- Maximum corporate tax rate: 25.0% — #79 lowest out of 144 countries

- GDP per capita, 2022: $3,000 — #114 highest of 144 countries

- Total population, 2022: 34,503,774

- Region: Sub-Saharan Africa

37. Trinidad and Tobago

- Overall tax score: 64.51 out of 100

- Maximum personal income tax rate: 30% — #64 lowest out of 144 countries

- Maximum value-added tax rate: 12.5% — #43 lowest of 144 counties

- Maximum corporate tax rate: 35.0% — #132 lowest out of 144 countries

- GDP per capita, 2022: $19,629 — #52 highest of 144 countries

- Total population, 2022: 1,525,663

- Region: Latin America and the Caribbean

36. Tajikistan

- Overall tax score: 66.07 out of 100

- Maximum personal income tax rate: 20% — #30 lowest out of 144 countries

- Maximum value-added tax rate: 15.0% — #54 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2022: $1,054 — #134 highest of 144 countries

- Total population, 2022: 9,750,064

- Region: Central and Southern Asia

35. Saint Lucia

- Overall tax score: 66.07 out of 100

- Maximum personal income tax rate: 30% — #64 lowest out of 144 countries

- Maximum value-added tax rate: 12.5% — #43 lowest of 144 counties

- Maximum corporate tax rate: 30.0% — #109 lowest out of 144 countries

- GDP per capita, 2022: $13,031 — #63 highest of 144 countries

- Total population, 2022: 179,857

- Region: Latin America and the Caribbean

34. Isle of Man

- Overall tax score: 66.96 out of 100

- Maximum personal income tax rate: 20% — #30 lowest out of 144 countries

- Maximum value-added tax rate: 20.0% — #108 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2020: $79,531 — #10 highest of 144 countries

- Total population, 2022: 84,263

- Region: Europe and Northern America

33. Cambodia

- Overall tax score: 68.75 out of 100

- Maximum personal income tax rate: 20% — #30 lowest out of 144 countries

- Maximum value-added tax rate: 10.0% — #24 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2022: $1,760 — #125 highest of 144 countries

- Total population, 2022: 16,589,023

- Region: Eastern and South-Eastern Asia

32. Moldova

- Overall tax score: 68.75 out of 100

- Maximum personal income tax rate: 12% — #22 lowest out of 144 countries

- Maximum value-added tax rate: 20.0% — #108 lowest of 144 counties

- Maximum corporate tax rate: 12.0% — #13 lowest out of 144 countries

- GDP per capita, 2022: $5,714 — #92 highest of 144 countries

- Total population, 2022: 2,595,809

- Region: Europe and Northern America

31. Maldives

- Overall tax score: 68.97 out of 100

- Maximum personal income tax rate: 15% — #26 lowest out of 144 countries

- Maximum value-added tax rate: 16.0% — #72 lowest of 144 counties

- Maximum corporate tax rate: 15.0% — #17 lowest out of 144 countries

- GDP per capita, 2022: $11,781 — #66 highest of 144 countries

- Total population, 2022: 521,457

- Region: Central and Southern Asia

30. Nigeria

- Overall tax score: 69.64 out of 100

- Maximum personal income tax rate: 24% — #46 lowest out of 144 countries

- Maximum value-added tax rate: 7.5% — #19 lowest of 144 counties

- Maximum corporate tax rate: 30.0% — #109 lowest out of 144 countries

- GDP per capita, 2022: $2,163 — #121 highest of 144 countries

- Total population, 2022: 213,401,323

- Region: Sub-Saharan Africa

29. Bolivia

- Overall tax score: 69.78 out of 100

- Maximum personal income tax rate: 13% — #25 lowest out of 144 countries

- Maximum value-added tax rate: 13.0% — #45 lowest of 144 counties

- Maximum corporate tax rate: 25.0% — #79 lowest out of 144 countries

- GDP per capita, 2022: $3,600 — #108 highest of 144 countries

- Total population, 2022: 12,079,472

- Region: Latin America and the Caribbean

28. Barbados

- Overall tax score: 69.93 out of 100

- Maximum personal income tax rate: 29% — #63 lowest out of 144 countries

- Maximum value-added tax rate: 17.5% — #84 lowest of 144 counties

- Maximum corporate tax rate: 5.5% — #3 lowest out of 144 countries

- GDP per capita, 2022: $20,239 — #51 highest of 144 countries

- Total population, 2022: 281,200

- Region: Latin America and the Caribbean

27. Romania

- Overall tax score: 70 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 19.0% — #100 lowest of 144 counties

- Maximum corporate tax rate: 16.0% — #28 lowest out of 144 countries

- GDP per capita, 2022: $15,787 — #58 highest of 144 countries

- Total population, 2022: 19,122,059

- Region: Europe and Northern America

26. Liechtenstein

- Overall tax score: 70.65 out of 100

- Maximum personal income tax rate: 22% — #43 lowest out of 144 countries

- Maximum value-added tax rate: 7.7% — #20 lowest of 144 counties

- Maximum corporate tax rate: 12.5% — #15 lowest out of 144 countries

- GDP per capita, 2021: $197,505 — #1 highest of 144 countries

- Total population, 2022: 39,039

- Region: Europe and Northern America

25. North Macedonia

- Overall tax score: 71.52 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 18.0% — #85 lowest of 144 counties

- Maximum corporate tax rate: 10.0% — #6 lowest out of 144 countries

- GDP per capita, 2022: $6,591 — #88 highest of 144 countries

- Total population, 2022: 2,065,092

- Region: Europe and Northern America

24. Turkmenistan

- Overall tax score: 72.32 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 15.0% — #54 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2022: $8,793 — #76 highest of 144 countries

- Total population, 2022: 6,341,855

- Region: Central and Southern Asia

23. Kosovo

- Overall tax score: 72.77 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 18.0% — #85 lowest of 144 counties

- Maximum corporate tax rate: 10.0% — #6 lowest out of 144 countries

- GDP per capita, 2022: $5,340 — #95 highest of 144 countries

- Total population, 2022: 1,786,038

- Region: Europe and Northern America

22. Mauritius

- Overall tax score: 72.99 out of 100

- Maximum personal income tax rate: 20% — #30 lowest out of 144 countries

- Maximum value-added tax rate: 15.0% — #54 lowest of 144 counties

- Maximum corporate tax rate: 15.0% — #17 lowest out of 144 countries

- GDP per capita, 2022: $10,256 — #70 highest of 144 countries

- Total population, 2022: 1,266,334

- Region: Sub-Saharan Africa

21. Myanmar

- Overall tax score: 73.93 out of 100

- Maximum personal income tax rate: 25% — #48 lowest out of 144 countries

- Maximum value-added tax rate: 5.0% — #11 lowest of 144 counties

- Maximum corporate tax rate: 22.0% — #63 lowest out of 144 countries

- GDP per capita, 2022: $1,149 — #133 highest of 144 countries

- Total population, 2022: 53,798,084

- Region: Eastern and South-Eastern Asia

20. Uzbekistan

- Overall tax score: 74.96 out of 100

- Maximum personal income tax rate: 12% — #22 lowest out of 144 countries

- Maximum value-added tax rate: 12.0% — #37 lowest of 144 counties

- Maximum corporate tax rate: 15.0% — #17 lowest out of 144 countries

- GDP per capita, 2022: $2,255 — #119 highest of 144 countries

- Total population, 2022: 34,915,100

- Region: Central and Southern Asia

19. Kazakhstan

- Overall tax score: 75 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 12.0% — #37 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2022: $11,492 — #68 highest of 144 countries

- Total population, 2022: 19,000,988

- Region: Central and Southern Asia

18. Laos

- Overall tax score: 75.63 out of 100

- Maximum personal income tax rate: 25% — #48 lowest out of 144 countries

- Maximum value-added tax rate: 7.0% — #16 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2022: $2,054 — #124 highest of 144 countries

- Total population, 2022: 7,529,475

- Region: Eastern and South-Eastern Asia

17. Singapore

- Overall tax score: 75.94 out of 100

- Maximum personal income tax rate: 24% — #46 lowest out of 144 countries

- Maximum value-added tax rate: 9.0% — #22 lowest of 144 counties

- Maximum corporate tax rate: 17.0% — #30 lowest out of 144 countries

- GDP per capita, 2022: $82,808 — #9 highest of 144 countries

- Total population, 2022: 5,453,566

- Region: Eastern and South-Eastern Asia

16. Bahrain

- Overall tax score: 76.7 out of 100

- Maximum personal income tax rate: 0% — #1 lowest out of 144 countries

- Maximum value-added tax rate: 10.0% — #24 lowest of 144 counties

- Maximum corporate tax rate: 46.0% — #143 lowest out of 144 countries

- GDP per capita, 2022: $30,147 — #39 highest of 144 countries

- Total population, 2022: 1,463,265

- Region: Northern Africa and Western Asia

15. Kyrgyzstan

- Overall tax score: 78.13 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 12.0% — #37 lowest of 144 counties

- Maximum corporate tax rate: 10.0% — #6 lowest out of 144 countries

- GDP per capita, 2022: $1,655 — #127 highest of 144 countries

- Total population, 2022: 6,974,900

- Region: Central and Southern Asia

14. Paraguay

- Overall tax score: 79.91 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 10.0% — #24 lowest of 144 counties

- Maximum corporate tax rate: 10.0% — #6 lowest out of 144 countries

- GDP per capita, 2022: $6,153 — #90 highest of 144 countries

- Total population, 2022: 6,703,799

- Region: Latin America and the Caribbean

13. Jersey

- Overall tax score: 80.17 out of 100

- Maximum personal income tax rate: 20% — #30 lowest out of 144 countries

- Maximum value-added tax rate: 5.0% — #11 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2022: N/A — #N/A highest of 144 countries

- Total population, 2022: 103,387

- Region: Europe and Northern America

12. Saudi Arabia

- Overall tax score: 80.36 out of 100

- Maximum personal income tax rate: 0% — #1 lowest out of 144 countries

- Maximum value-added tax rate: 15.0% — #54 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2022: $30,448 — #38 highest of 144 countries

- Total population, 2022: 35,950,396

- Region: Northern Africa and Western Asia

11. Guernsey

- Overall tax score: 84.82 out of 100

- Maximum personal income tax rate: 20% — #30 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 20.0% — #36 lowest out of 144 countries

- GDP per capita, 2022: N/A — #N/A highest of 144 countries

- Total population, 2022: 67,787

- Region: Europe and Northern America

10. Timor-Leste

- Overall tax score: 86.61 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 2.5% — #10 lowest of 144 counties

- Maximum corporate tax rate: 10.0% — #6 lowest out of 144 countries

- GDP per capita, 2022: $2,389 — #117 highest of 144 countries

- Total population, 2022: 1,320,942

- Region: Eastern and South-Eastern Asia

9. Greenland

- Overall tax score: 87.25 out of 100

- Maximum personal income tax rate: 10% — #10 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 26.5% — #99 lowest out of 144 countries

- GDP per capita, 2021: $57,116 — #15 highest of 144 countries

- Total population, 2022: 56,653

- Region: Europe and Northern America

8. Hong Kong

- Overall tax score: 88.15 out of 100

- Maximum personal income tax rate: 15% — #26 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 16.5% — #29 lowest out of 144 countries

- GDP per capita, 2022: $48,984 — #24 highest of 144 countries

- Total population, 2022: 7,346,100

- Region: Eastern and South-Eastern Asia

7. Qatar

- Overall tax score: 89.06 out of 100

- Maximum personal income tax rate: 0% — #1 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 35.0% — #132 lowest out of 144 countries

- GDP per capita, 2022: $87,661 — #8 highest of 144 countries

- Total population, 2022: 2,688,235

- Region: Northern Africa and Western Asia

6. Oman

- Overall tax score: 90.85 out of 100

- Maximum personal income tax rate: 0% — #1 lowest out of 144 countries

- Maximum value-added tax rate: 5.0% — #11 lowest of 144 counties

- Maximum corporate tax rate: 15.0% — #17 lowest out of 144 countries

- GDP per capita, 2022: $25,057 — #45 highest of 144 countries

- Total population, 2022: 4,520,471

- Region: Northern Africa and Western Asia

5. Macau

- Overall tax score: 90.89 out of 100

- Maximum personal income tax rate: 12% — #22 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 12.0% — #13 lowest out of 144 countries

- GDP per capita, 2022: $34,585 — #32 highest of 144 countries

- Total population, 2022: 695,168

- Region: Eastern and South-Eastern Asia

4. United Arab Emirates

- Overall tax score: 92.72 out of 100

- Maximum personal income tax rate: 0% — #1 lowest out of 144 countries

- Maximum value-added tax rate: 5.0% — #11 lowest of 144 counties

- Maximum corporate tax rate: 9.0% — #4 lowest out of 144 countries

- GDP per capita, 2022: $53,708 — #20 highest of 144 countries

- Total population, 2022: 9,365,145

- Region: Northern Africa and Western Asia

3. Kuwait

- Overall tax score: 95.31 out of 100

- Maximum personal income tax rate: 0% — #1 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 15.0% — #17 lowest out of 144 countries

- GDP per capita, 2022: $41,080 — #28 highest of 144 countries

- Total population, 2022: 4,250,114

- Region: Northern Africa and Western Asia

1. Bermuda

- Overall tax score: 100 out of 100

- Maximum personal income tax rate: 0% — #1 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 0.0% — #1 lowest out of 144 countries

- GDP per capita, 2022: $118,775 — #3 highest of 144 countries

- Total population, 2022: 63,764

- Region: Europe and Northern America

1. Cayman Islands

- Overall tax score: 100 out of 100

- Maximum personal income tax rate: 0% — #1 lowest out of 144 countries

- Maximum value-added tax rate: 0.0% — #1 lowest of 144 counties

- Maximum corporate tax rate: 0.0% — #1 lowest out of 144 countries

- GDP per capita, 2022: $99,625 — #6 highest of 144 countries

- Total population, 2022: 68,136

- Region: Latin America and the Caribbean

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.