Banking, finance, and taxes

Countries With the Highest Taxes: Where Does the US Rank?

Published:

Nobody likes taxes. Well, maybe the IRS. But we can safely say even their agents don’t like paying taxes. Everybody likes spending them. Even the most fiscally conservative advocate of small government still doesn’t enjoy having a highway bridge fall into the river or North Korean troops landing on the beach—with no one but their local town council to deal with it. Americans have a substantial tax burden, but it is neither the highest nor the lowest in the world. However, perceptions are often more important in how people feel about paying taxes than reality, so all democratic governments have to build a case with the public that they are getting their money’s worth from their tax dollars.

24/7 Wall St. Insights

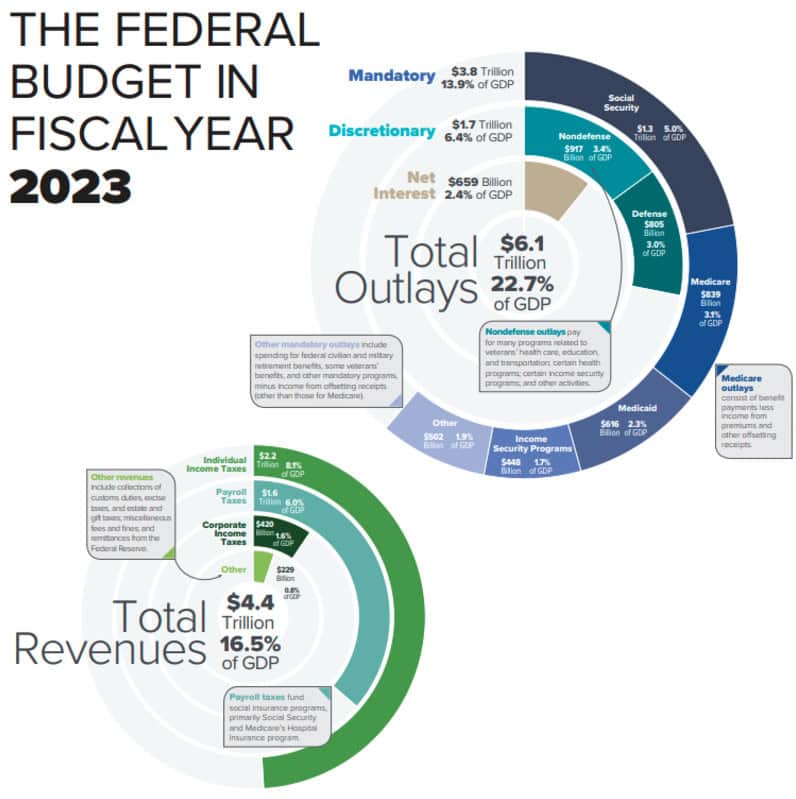

This chart from the Congressional Budget Office shows the main budget areas your tax dollars are spent on, and how revenues fall short of expenditures, increasing the national debt. Today the debt stands at over $36 trillion.

Social Security, Medicare, Medicaid, and Defense are the largest budget categories. Reforming healthcare to lower costs for medical care, which are now about twice that in other developed countries, would be an effective way to lower the budget deficit and improve the pocketbooks of Americans. But all of these budget areas and any potential cuts or reforms to them are politically difficult because each of them affects millions of people’s lives and the bottom lines of powerful business interests.

The government can use taxation policy to accomplish different goals. If the goal is to reduce economic inequality, taxes can be decreased for lower income people and families with children. Tax credits can be provided to people buying their first home, taking out a loan to start a business, or getting an education. This puts more money from the lower and middle classes into the economy, fueling growth, and it incentivizes people to do things that will improve their long-term financial prospects. Which of course means they can pay more taxes in the future as their income increases.

Conversely, reducing taxes for wealthy people and businesses leaves them with more resources to invest in moneymaking ventures. Large concentrations of wealth professionally managed can create thousands of jobs. It can also be invested in research and development that can lead to technological breakthroughs. While those things can also be accomplished with government tax money, people in the private sector are investing their own wealth and are more attentive to cutting waste and maximizing profits than government bureaucrats who don’t have a personal stake in how tax dollars are spent.

This so-called “supply-side economics” was particularly popularized during the Reagan administration and contributed to the economic boom of the 1980s. However, excessive government spending on defense and social programs caused the deficit to swell so that it did not relieve our long-term debt problem.

To have the best of both worlds, most countries used a graduated tax system, where people are obligated to pay a higher percentage of their income in taxes the more money they make. In the United States income tax brackets range from 10% to 37%. In practice, some of the wealthiest people pay little or no income tax by taking advantage of various loopholes that allow them to shelter their money overseas, claim business losses, and use bankruptcy laws strategically.

Is it fair?

Intuitively, many people think a flat tax rate for everyone would be fairer. “Everyone should pay their fair share, and no one should be penalized for being successful,” so the argument goes. Of course, this argument assumes that people who have a lot of money worked to get it, rather than marrying into it, inheriting it, or having it by some other means fall into their lap. Regardless, in practice a flat tax is considered a regressive tax that falls more heavily on the have-nots.

An Analogy

Think about this analogy: You go out for drinks with friends after work but only have $20. Your plan is to spend $10 and use the rest for gas to get you to work the rest of the week. Afterwards, they decide to split the tab evenly and everyone needs to chip in $17. They all have a lot more cash than you, so for them it comes out of a surplus they won’t really miss. But for you, it cuts into a necessity and has a noticeable impact on your life.

Another tax proposal is that we shouldn’t have to pay taxes when we earn money, only when we spend it. Eliminating income tax in favor of sales tax-only would incentivize people to save and invest. Those who are spending the most money would pay the most taxes.

Is It Still Unfair?

But this, too, can create an imbalance that favors the haves over the have-nots. Lower and middle class people often live paycheck-to-paycheck, and this is not always from wasteful spending. They simply don’t make enough money to cover all the expenses of living and raising a family in modern America. Incentivizing saving by using a sales tax in place of an income tax is a moot point for most of them, as they don’t have money to save even if they wanted to.

How It Could Work

A way this proposal could work better is to exempt necessities, like basic foodstuffs, medicines, etc. from the tax and even to increase it on high-end purchases like new cars, designer clothes, and luxury vacation packages. But then we’re back to a graduated tax system, which some people think is punitive to the wealthy.

One of the most insidious things about taxes is how hard it is to know exactly how much we’re paying, because nearly everything is taxed: what we earn from working and investing, sales taxes on what we buy, property taxes on things we own, and estate taxes when we pass it on to our heirs. Taxation happens all through the manufacturing process of goods as well. Companies have to take their own tax burdens into account when they set their prices, meaning business taxes actually get passed on to the consumer as well.

This is, of course, a way of concealing the true scope of the tax burden citizens shoulder. After all, taxation was the key issue that sparked the American Revolution. Nobody wants to tick off the American people too much.

Some countries don’t charge any income tax on money earned inside their country. This is the case with many of the oil-rich Persian Gulf countries. These governments fund their operations through oil wealth. They are able to provide generous social services, medical care, education, subsidized housing, and other perks to their citizens, hire foreign workers to do undesirable heavy labor, maintain state-of-the-art military forces, spend on massive infrastructure projects, and invest vast sums of money in the world markets—all at the same time. These countries are all monarchies with a great many restrictions on citizen’s rights. But the posh lifestyle they provide has a way of making most people feel ok about not having all the civil rights people in the Western democracies have.

A few countries, particularly in Europe, have some of the highest tax rates in the world, up to 60% for the highest income brackets. In their case, the government provides generous social services, including affordable and universally-available medical care. Their defense expenditures are eased by being part of the NATO alliance, which combines the capabilities of all 32 members against attack and means each individual country does not have to build military forces for the entirety of their defense. And European societies culturally have more of an emphasis on shared social responsibility than the strict individualism and competitive capitalism of American culture. So they are able to charge higher tax rates than the U.S. without sparking social unrest.

Next up, we’ve scoured the net to find examples of countries charging different income tax rates and ranked them for you to help you see where the United States stands globally. The tax figure given for each country is the current maximum income tax rate charged to people in the highest earning bracket in their country. We’ve got a countdown of 50 countries. Can you guess what country charges the highest income tax in the world?

50. Qatar: 0%

49. Saudi Arabia: 0%

48. United Arab Emirates: 0%

47. Iraq; 15%

46. Serbia: 20%

45. Ukraine: 20%

44. Russia: 22%

43. Czech Republic: 23%

42. Egypt: 24%

41. Nigeria: 24%

40. Singapore: 24%

39. Brazil: 27.5%

38. Croatia: 30%

37. Iran: 30%

36. Jordan: 30%

35. Poland: 32%

34. Canada: 33%

33. Indonesia: 35%

32. Kenya: 35%

31. Mexico: 35%

30. Pakistan: 35%

29. United States: 37%

28. New Zealand: 39%

27. Turkey: 40%

26. Ireland: 40%

25. India: 42.7%

24. Italy: 43%

23. Greece: 44%

22. Australia: 45%

21. China: 45%

20. Germany: 45%

19. Japan: 45%

18. Luxembourg: 45%

17. South Africa: 45%

16. South Korea: 45%

15. United Kingdom: 45%

14. Iceland: 46%

13. Hungary: 46.5%

12. Spain 47%

11. Netherlands: 49.5%

10. Belgium: 50%

9. Israel: 50%

8. Slovenia: 50%

7. Finland: 51.4%

6. Sweden: 52%

5. Portugal: 53%

4. Austria: 55%

3. Norway: 55.8%

2. Denmark: 55.9%

1. Ivory Coast: 60%

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: am I ahead, or behind on my goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With Zoe Financial’s free matching tool, you can connect with trusted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.