Banking, finance, and taxes

The Countries With the Lowest Corporate Taxes (America Isn't Even Top 10)

Published:

Thinking of operating a business overseas? These are the countries with the lowest corporate taxes.

The countries with the lowest tax rates in the world generally offer those rates because of other problems that discourage investment. 4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

Key Points

The global average corporate tax rate in 1980 was a little over 40% with the U.S. higher than average at 46 percent. Corporate tax cuts by Republican presidents from Reagan to Trump have now lowered the U.S. rate to 21%. Other countries have followed suit so that in 2024, the average corporate tax rate around the world is 23.51%.

How low can taxes go? Over 140 countries have agreed to a 15% global minimum tax, including the United States. On Inauguration Day 2025, though, President Trump said that this tax deal “has no force or effect” in the United States. So now, it doesn’t exactly make sense to say the sky’s the limit in how low tax cuts can go. Maybe “the ground’s the limit?”

According to the nonprofit Tax Foundation, these are the countries that had the highest corporate tax rates in 2024. It’s worth noting that Puerto Rico, an American Commonwealth, has a rate of 37.5%. If the island were independent, this would give it the second highest corporate tax rate in the world, a serious impediment to business growth.

This Indian Ocean island country off the coast of Mozambique has the highest corporate tax rate in the world. It has a small economy and relies on this tax to fund the government, but it discourages investment and pushes economic activity into the black market.

Located on the north coast of South America, this former Dutch colony funds its spending largely through corporate taxes but this slows down the economy and encourages tax evasion.

This rate includes developing countries in Latin America and Africa that are all struggling economically. Malta is the odd man out on this list and worth taking a second look at. Although it has one of the highest corporate tax rates in the world, the country offsets it with a refund system that attracts foreign investment and keeps Malta competitive.

Brazil funds many of its social programs and public services through corporate taxes. Venezuela, though petroleum-rich, has a socialist government that has made poor economic decisions and plunged the country into poverty.

Cameroon, a Central African country, has a lot of natural resources and is in a strategic location for trade in the region. But it is beset with economic problems, corruption, red tape, and poor infrastructure. High business taxes don’t help.

The Tax Foundation lists these countries as having the lowest corporate tax rates in 2024. Obviously, these countries are not observing the global minimum tax agreement.

Rich in natural gas, this former Soviet country situated on the northern border of Iran offers the most attractive corporate tax rate in the world. It has some big disadvantages though, including being a former Soviet country situated on the northern border of Iran! An undemocratic government, political corruption, arbitrary changes to regulations, and vulnerability to aggressive neighbors are all big drawbacks to international investment.

These three countries all work hard to attract foreign investment with ultra-low tax rates. Barbados in the Caribbean, is a pretty safe bet. Hungary and the UAE are located close to Ukraine and Iran, respectively, so this creates a bit of geopolitical concern. But if anything can overcome the jitters of investors, it’s low tax rates like this.

The safest tax haven on this list is likely Andorra, a safe and peaceful little country nestled between France and Spain. The others on this list are mostly in Eastern Europe where the danger of spillover from the war in Ukraine is real.

Kyrgyzstan is a remote country on the border of China in the post-Soviet space. Qatar is in the dangerous neighborhood of the Persian Gulf but hosts a substantial American military presence.

Timor-Leste is one of the world’s newest countries and is still unstable.

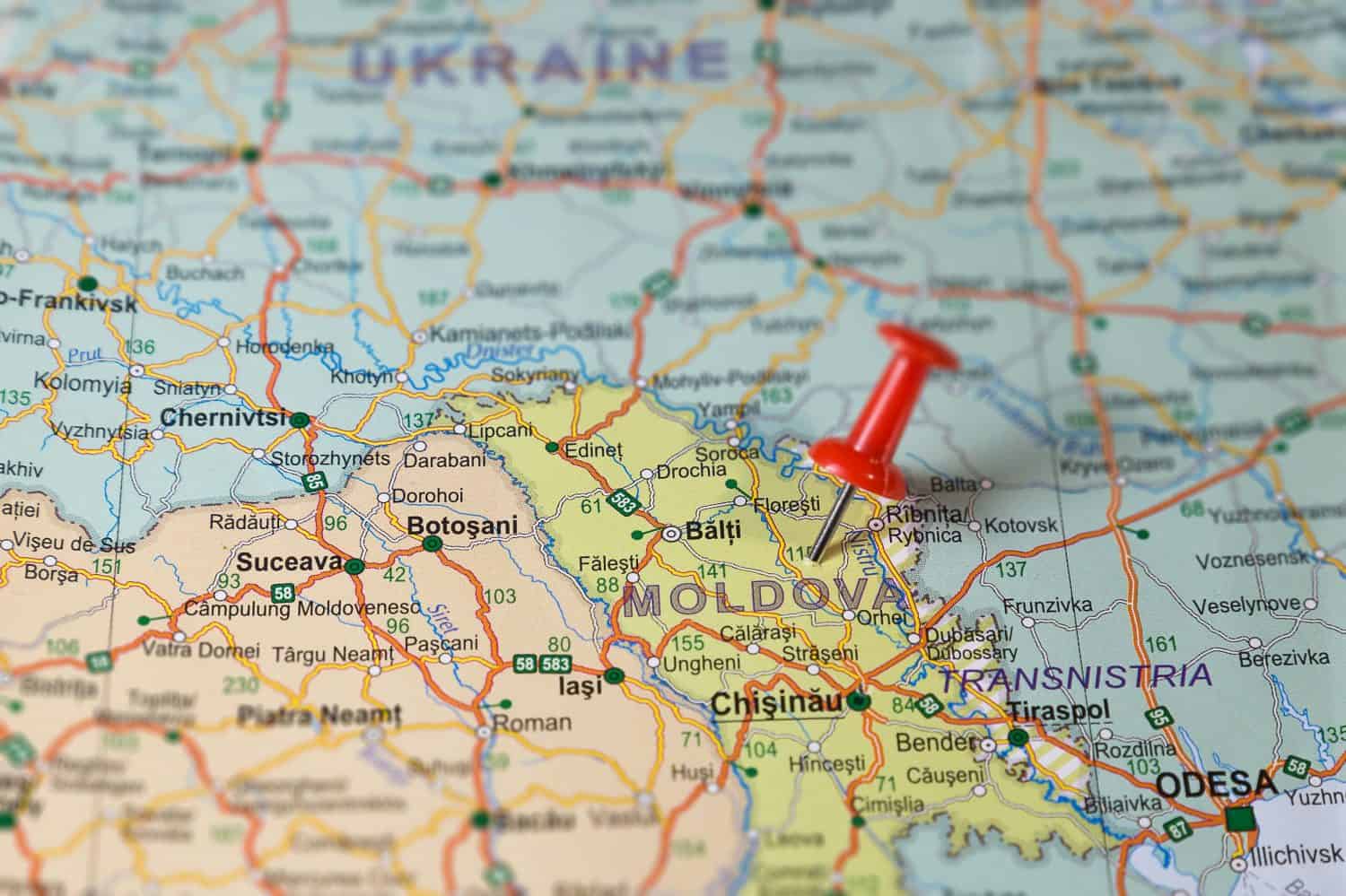

Invest in Moldova at your own risk. They offer an attractive corporate tax rate to attract investment to overcome some real disadvantages. The country is landlocked, working its way through post-Soviet legacies of corruption and poor business practices, borders war-torn Ukraine, and has a separatist movement with about 8,000 Russian troops in the rebel territory supporting them against the government.

The beautiful island nation of Cyprus has long been an idyllic vacation spot and still has great potential for further development in that direction. But it’s divided in half between Turkish and Greek Cypriots, separated by international peacekeeping troops in the UN’s longest-running such mission. The risk of conflict and the legal difficulties of sorting out contested ownership in areas of the island that changed hands during the last war create a real challenge for people trying to do business there.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s made it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.