Banking, finance, and taxes

Is The VIX Signaling Another Selling Climax? (VXX, VXZ, SPY)

Published:

Last Updated:

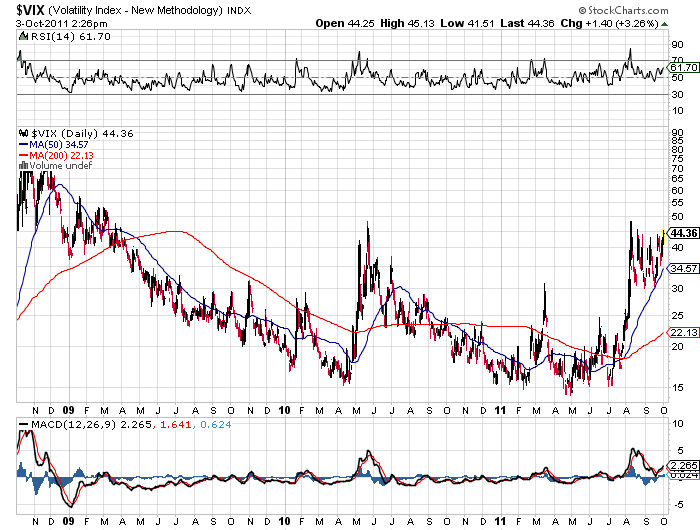

The CBOE Volatility Index, or ‘The Fear Index,’ is reaching levels not seen since the height of the August selling panic. That peaked around 47 in August and we just briefly went back over the 45.0 mark again today. Anything over 25.0 or over 30.0 tends to indicate oversold readings, but when a market moves over 40.0 and higher you know the bears are in control.

The CBOE Volatility Index, or ‘The Fear Index,’ is reaching levels not seen since the height of the August selling panic. That peaked around 47 in August and we just briefly went back over the 45.0 mark again today. Anything over 25.0 or over 30.0 tends to indicate oversold readings, but when a market moves over 40.0 and higher you know the bears are in control.

iPath S&P 500 VIX Short-Term Futures ETN (NYSE: VXX) is up 5.6% at $56.40 and the iPath S&P 500 VIX Mid-Term Futures ETN (NYSE: VXZ) is up 2.9% at $75.33. These ETF prices are both higher than at the peak of selling you see on the actual VIX index chart because of how they trade with futures.

Technicians and technical analysts try to not look at anything other than the charts and the internal market statistics. Fundamental investors are smart to at least take note of what the charts are saying, but they try to look at what the economic and company fundamentals are going to be in the next quarter to next year. Right now the market is at a point where the technicians are in charge on the downside when the fundamentalists cannot agree whether or not we are entering (or have already entered) the next (or double dip) recession.

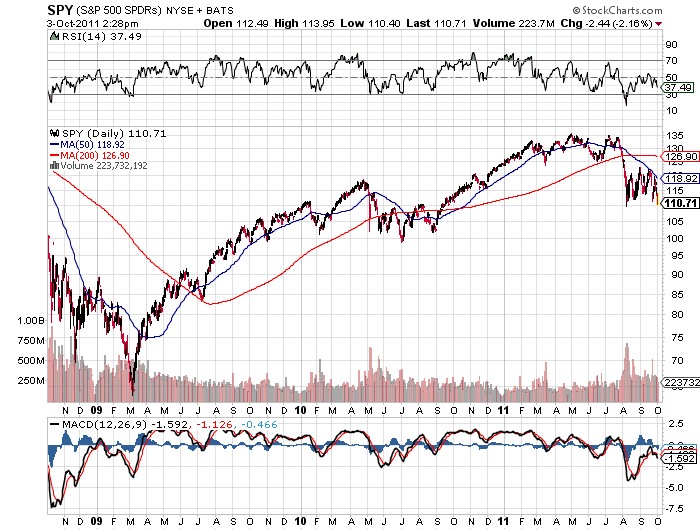

As you will see, here is the current VIX chart going back three years to show the S&P 500 SPDR (NYSE: SPY) after that.

JON C. OGG

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.