Banking, finance, and taxes

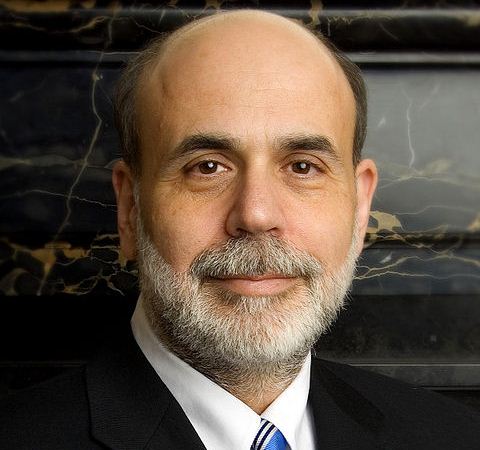

Ben Bernanke Testimony Rescues Fed Communications Snafu from Last Week

Published:

It was just last week that we accused the Federal Reserve presidents and governors of wishing they could take back their wording and statements made in the January 20 to 30 FOMC Minutes. The Fed wanted to make communication more transparent about what sort of exit the markets could expect from the endless quantitative easing via bond buying and the low-rate or no-rate climate. All that was accomplished was a communications snafu that just confused the markets even more.

Now we have Ben Bernanke speaking today at the semi-annual testimony before Senate Banking Committee in Washington. His comments remain about expansion continuing but at a “moderate if somewhat uneven pace.” The most important takeaway is that bond-buying programs are expected to continue.

Bernanke said on jobs:

Despite these gains, however, the job market remains generally weak, with the unemployment rate well above its longer-run normal level. About 4.7 million of the unemployed have been without a job for six months or more, and millions more would like full-time employment but are able to find only part-time work.

Bernanke said about sequestration:

To address both the near- and longer-term issues, the Congress and the Administration should consider replacing the sharp, frontloaded spending cuts required by the sequestration with policies that reduce the federal deficit more gradually in the near term but more substantially in the longer run. Such an approach could lessen the near-term fiscal headwinds facing the recovery while more effectively addressing the longer-term imbalances in the federal budget.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.