Banking, finance, and taxes

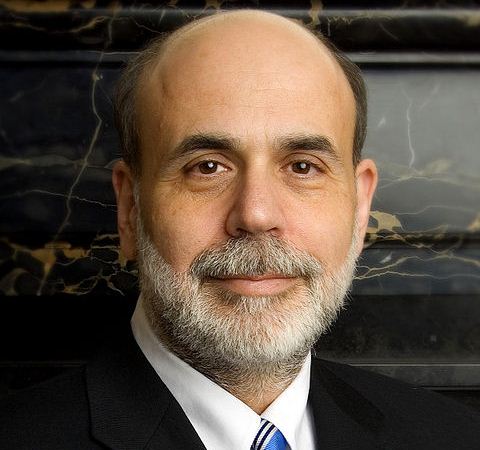

FOMC and Bernanke Remain Committed to Bond Buying and Quantitative Easing

Published:

The Federal Reserve statement from the July FOMC meeting has been released. Ben Bernanke and the team inside the Fed are looking for the economy to continue improving, but there will currently not be any rapid changes to the quantitative easing measures under the $85 billion in monthly bond buying nor in any outlook toward raising interest rates much sooner. Esther George remained the one dissenting vote.

Today’s statement shows concerns remain. The economic concerns remain that the current unemployment rate remains elevated, but mortgage rates have risen somewhat and they signaled that the current fiscal policy is restraining economic growth. It was also brought up that inflation is persistently below its 2% objective and this could pose risks to economic performance. The FOMC signaled that it anticipates that inflation will move back toward its objective over the medium term.

Here is what the easy money crowd has to focus on under quantitative easing measures remaining in place:

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

Here is the current verbiage on the timing of a Fed QE exit:

The Committee will closely monitor incoming information on economic and financial developments in coming months. The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. The Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes. In determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.