Banking, finance, and taxes

S&P Downgrades Russian Oil, Natural Gas Giants

Published:

Last Updated:

The ratings agency said its actions followed the recent downgrade to the foreign currency ratings for the Russian Federation. That rating was lowered to BBB- with a negative outlook last week. The ratings announced this morning on all six of the government-related entities were the result of these companies close ties to the ratings on the sovereign.

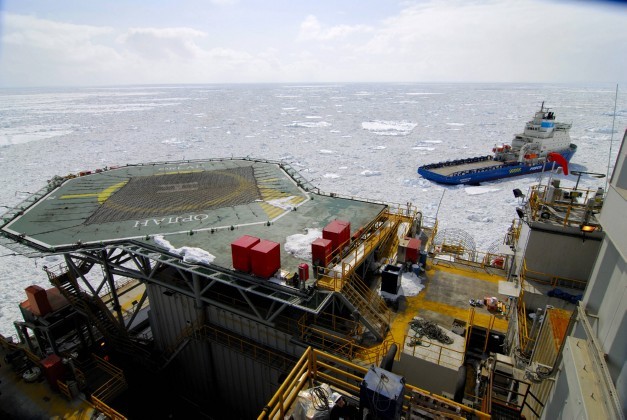

Rosneft’s corporate credit rating on both local and foreign currency dropped from BBB to BBB-. The negative outlook remained unchanged.

Gazprom’s foreign currency ratings were downgraded by a similar amount but the local currency debt was left at BBB.

Transneft’s local currency rating dropped from BBB+ to BBB while its foreign currency rating change was the same as Rosneft’s and Gazprom’s.

Here is S&P’s rationale for the change:

Our ratings on the GREs factor in our expectation of extraordinary government support or negative intervention by the government. In turn, our long-term sovereign rating on Russia captures our view of the government’s ability to provide timely and sufficient extraordinary support, or the government’s incentive to exercise negative influence. We base our opinion on our view of the “strong” or “very strong” links these GREs have with Russia. At this stage, we do not see any change in those GREs’ stand-alone credit profiles or their roles and links with the state.

The foreign currency rating is just one notch above junk. S&P is sending the Russian government a message. Whether the Russians get the message — or even care about it — is a different matter.

ALSO READ: The Most Corrupt Countries in the World

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.