Technicians are an interesting lot. After all, they use charts, inflows and other overbought or oversold indicators to see what the story is telling you. It is no secret that longer-term gains in the stock market generally come with participation from the financial sector. So what happens when a key market technician followed widely by the markets points out trouble in the financial sector?

Sterne Agee’s Chief Market Technician is Carter Worth, and he is well-known throughout the financial industry with many routine media appearances. Worth confirms that the financial sector is generally the most important sector in the market by all accounts, and on Monday’s “Money in Motion” feature for a weekly technical outlook he points out that the financial sector continues to act poorly.

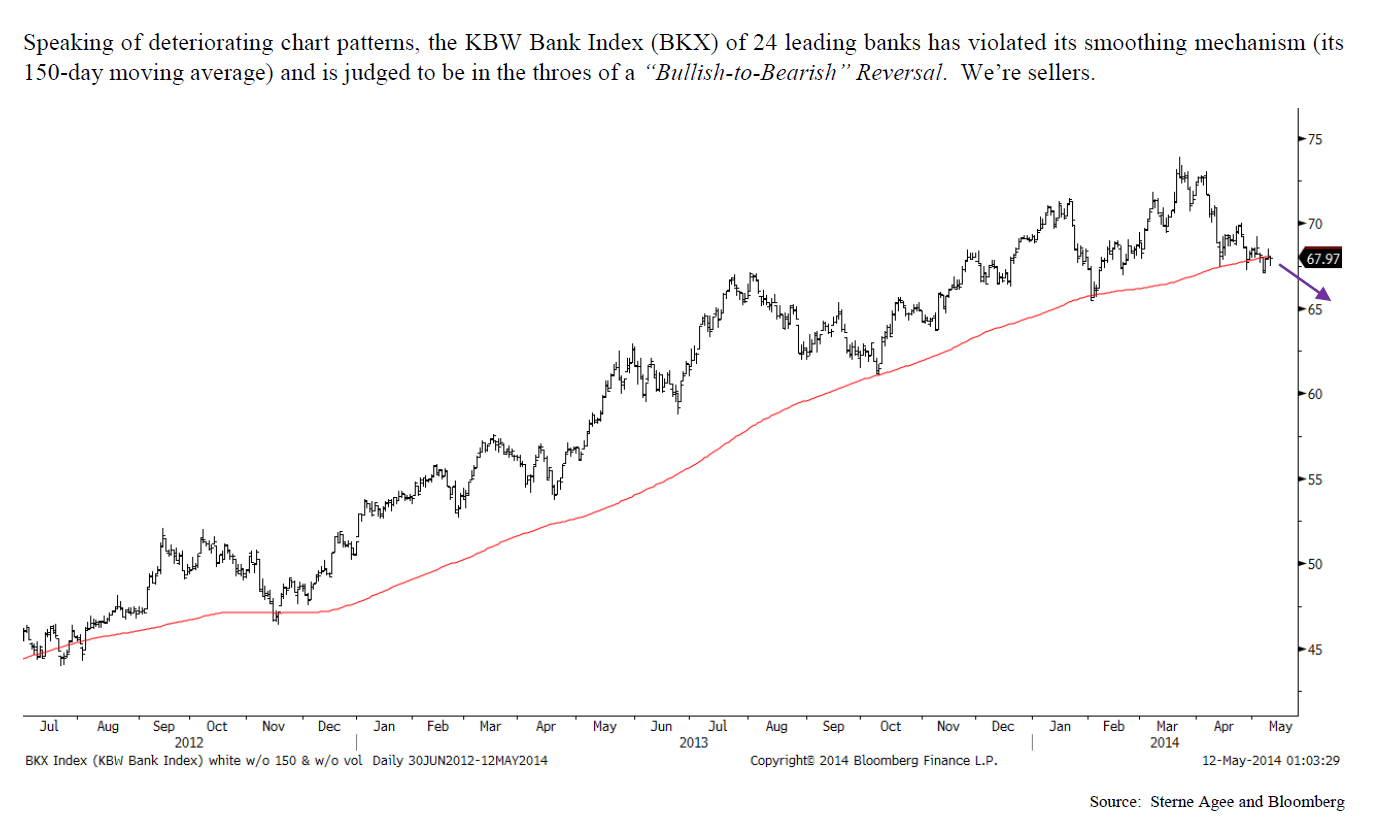

The call is effectively reiterating that it is right to be Underweight the financial sector. Worth pointed out:

At 16.09% of the total value of the S&P 500 (second only to Information Technology at 18.48%), Financials matter a great deal. And it goes without saying, therefore, that the recent deterioration in certain marquee financial stocks is very disconcerting.

Worth says that there are not many actionable buys, and that there are plenty of actionable sells from the 285 stocks in the S&P 1500 designated in the financial sector. Some of the notes on key names were as follows.

Bank of America Corp. (NYSE: BAC) had a poor chart, breaking down under an upward trendline that had been in place for two years. The recent accounting error and settlement news may be the cause, but a technician would simply point to the chart. Another concern was Goldman Sachs Group Inc. (NYSE: GS), with its key trendline now broken since March. Neither are really rated by the fundamental team at Sterne Agee.

READ MORE: Irony in Pairs: Time to Short Treasuries While Buying the Big Banks?

The Average American Is Losing Momentum On Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4%1 today. Checking accounts are even worse.

But there is good news. To win qualified customers, some accounts are paying more than 7x the national average. That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn a $200 bonus and up to 7X the national average with qualifying deposits. Terms apply. Member, FDIC.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.