Nomura’s Bill Carcache has a Neutral rating on the U.S. regional bank sector. Still, this report highlights just how different the results have been from the various stock buyback plans of the big regional banks.

With the Federal Reserve selectively limiting dividend commitments, buybacks may have turned out to be the biggest method of returning capital to shareholders. It also turns out that the successful buybacks have also saved billions of dollars in dividend liabilities that the banks would have made had they not repurchased those shares.

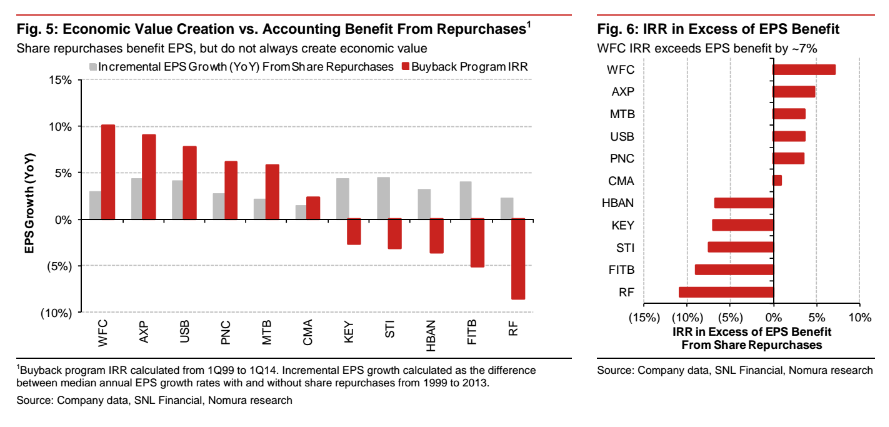

Carcache’s research goes all the way back to 1999 as well, so you can see just how much the winners have been able to save. He has even calculated an internal rate of return (IRR) based on the savings by not paying dividends.

In order to show the significance of these buybacks compared to today, we have included each bank’s market cap and its current dividend yield.

24/7 Wall St. has divided the report into two features: this one on the most successful bank buybacks and another on the least successful bank buyback plans.

ALSO READ: Banks With the Worst Stock Buyback Plans

Wells Fargo & Co. (NYSE: WFC) is the de facto winner here in size and in return. Its shares held up the best in the recession and in the aftermath of the regulatory pressures, and it has the size of its behemoth balance sheet working for it as well. Nomura maintains that Wells Fargo paid $39.9 billion for shares that are worth $69.5 billion today. After factoring in $9.1 billion in dividend-related savings, Carcache estimated that the IRR of its buyback program was 10.1%. Its market cap is a massive $269 billion, and its dividend yield is currently 2.8%.

American Express Co. (NYSE: AXP) has paid $31.7 billion for shares that are worth $54.3 billion today. With $2.9 billion in dividend-related savings, its projected IRR of its buyback program was 9.0%. The market cap is almost $97 billion now, and the dividend yield is currently a low 1.1%.

U.S. Bancorp (NYSE: USB) has paid some $18.8 billion for shares that are worth $26.6 billion today. After $4.5 billion in dividend-related savings, the IRR of its buyback program was put at 7.7%. U.S. Bancorp has a market cap of almost $77 billion, with a yield of about 2.2% today.

PNC Financial Services Group Inc. (NYSE: PNC) paid $5.3 billion for shares that are worth $7.4 billion today. After factoring in $1.4 billion in dividend-related savings, it was given an IRR of 6.2% for its buyback program. PNC’s market cap is $45.75 billion and its dividend yield is currently 2.3%.

M&T Bank Corp. (NYSE: MTB) has paid $2.9 billion for shares that now are worth $3.8 billion, and the $0.8 billion in dividend-related savings is projected to be an IRR of 5.7% for its buyback program. M&T Bank currently has a market cap of $16.1 billion, and its dividend yield is now 2.3%.

Comerica Inc. (NYSE: CMA) paid $3.1 billion for shares that are worth $3.1 billion. Its $0.5 billion in dividend-related savings is projected to have generated an IRR of 2.3% for its buyback program. Its market cap is $8.83 billion, and its dividend yield is currently only showing up as about 1.7%.

ALSO READ: The Highest-Yielding Dividends That Are Safe to Hold

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.