Nomura has issued a very different sort of research report on the U.S. regional and large banks. The firm’s Bill Carcache has a Neutral rating on the sector, but he has identified which banks have done very well and which ones should perhaps be ashamed about how their stock buyback plans have performed.

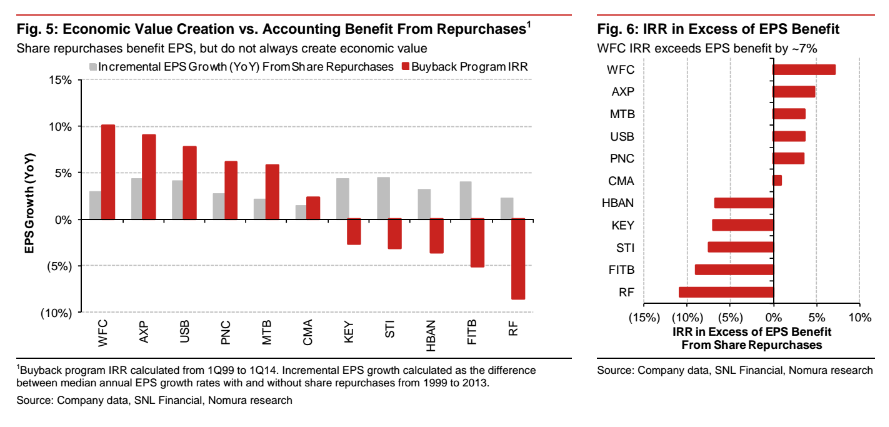

The Federal Reserve has been more allowing of stock buybacks than they have of committing to higher dividends in the sector. It turns out that some of the banks have not recovered enough or their buyback plans have been weak enough that they would have a negative internal rate of return (IRR) if you were to factor in the savings of the dividend-related expenses.

The successful buybacks saved billions of dollars in dividend liabilities and generated positive internal rates of return. Unfortunately, history has shown that some of the banks might have been better off holding their capital for reserves or to acquire growth opportunities after the recession.

Carcache’s research goes all the way back to 1999. As his report says, not all buybacks are created equally. Many of the banks have perhaps lost money or had to pass up growth opportunities due to negative internal rates of return on their buybacks. Too bad the banks did not have a crystal ball.

Note that there are almost certainly other buybacks out there that were much worse. These are just the ones in the Nomura report on Tuesday. Another issue to consider is what the market caps and current dividend yields of these names are.

24/7 Wall St. has broken up this research feature into two pieces: first is the best bank buybacks programs, and the worst buyback plans are featured here.

ALSO READ: Banks With the Most Successful Stock Buyback Plans

KeyCorp (NYSE: KEY) has paid $4.1 billion for shares that are worth $2.7 billion today, and the $0.8 billion in dividend-related savings generated a negative IRR of -2.7% in its buyback program. KeyCorp’s market cap is $12.3 billion, and its dividend yield is currently 1.9%.

SunTrust Banks Inc. (NYSE: STI) paid $5.1 billion for shares worth $2.9 billion now. With $1.0 billion in dividend-related savings, that generates a negative IRR of -3.0% for its buyback plan. SunTrust’s market cap is $20.75 billion currently, and its dividend yield is 2.1%.

Huntington Bancshares Inc. (NASDAQ: HBAN) paid $1.7 billion for shares that now are worth $1.1 billion. The $0.3 billion in dividend-related savings generates a negative IRR of -3.5% for its buyback program. Its market cap is $7.8 billion, and its dividend yield is currently 2.2%.

Fifth Third Bancorp (NASDAQ: FITB) has paid $7.5 billion for shares worth only $4.7 billion today. The $0.8 billion in dividend-related savings generates a negative IRR of -5.0% for its buyback program. Its market cap is $18.15 billion, and its dividend yield is currently 2.3%.

Regions Financial Corp. (NYSE: RF) paid out $4.2 billion for shares that are worth only about $1.7 billion today. The $0.8 billion in dividend-related savings was projected to generate a dismal -8.6% IRR for its stock buyback program. The current market cap is $14.35 billion, with a current dividend yield of 2.0%.

ALSO READ: 11 Ways to Protect Your Portfolio From the Next Stock Market Crash

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.