Banking, finance, and taxes

Could Hurricane Irma Cause $125 Billion in Insured Damages?

Published:

Last Updated:

Having a Category 5 hurricane coming your direction is nothing to be taken lightly. Reports of Hurricane Irma’s wind speeds of 185 miles per hour sound catastrophic enough, but many of the images and video footage of the damage in the Caribbean in the immediate aftermath of Irma are gut-wrenching.

Hurricane Harvey was severe in the damage to Houston, Texas, and the real overall cost is still not known there. Some initial thoughts on the damage that could come to Florida from Hurricane Irma are incredibly high numbers.

Credit Suisse has issued some initial views on what to expect from damages on the insurance side of the equation from Hurricane Irma. The firm’s initial belief is that private reinsurers are likely to be far more exposed to this “loss event” than the primary insurers. The firm noted that a one-in-100 year Florida hurricane event would correspond to a $125 billion insured loss event.

As a reminder, insured losses are always lower than total economic costs. The latter is the combined damage of insured losses with uninsured losses and the economic loss around disasters.

The best case scenario for the property and casualty stocks, according to Credit Suisse, would be for landfall projections to continue to move southwest. This would likely bring the subset of loss events back under $50 billion. Still, with this being somewhat early in the wind season, the firm feels this is likely to remain an overhang for the group.

Certain projections have been made for a south-Florida landfall of Hurricane Irma. These are very preliminary, and as of Wednesday the actual landfall destination remains far from certain and the range of losses will be subject to extreme variability. A report from Credit Suisse said:

To illustrate, a Karen Clark report from 2015 explained that a cat 5 landing in Miami could double the $125 billion expected loss projected from a cat 4. Additionally, a 1 in 100 landfall on the west side of Florida in Naples or Fort Myers would be expected to cause about one-fifth the damage of a Miami landing. We note that average hurricane tracking errors are about 175-225 miles 4 to 5 days out. Similarly, had Hurricane Andrew struck 50 miles north in 1992 ($55 billion insured loss event yesterday) it likely would have caused four times the damage. In smaller insured loss events ($15 billion to $50 billion), the Florida Hurricane Catastrophe Fund (FHCF) may see a large percentage of losses versus private insurers. If Irma losses exceed $7 billion, we expect the FHCF to pick up about $17 billion of the next $20 billion of insured losses.

The formation of Hurricane Jose behind Irma is a reminder that more threats linger. This, combined with the likelihood of an Irma landfall and the arithmetic still being done around Harvey losses, point to few scenarios by week end in which investors will be comfortable defending 3rd quarter end book value estimates in an interval narrower than 5%.

Credit Suisse also gave a loss estimate from Hurricane Harvey for a comparison, but the reminder here is that these are insured losses rather than the total economic cost. The firm noted that Hurricane Harvey’s losses are now projected at $15 billion, with industry experts signaling that Harvey’s private insured losses have settled in a range of $12 billion to $15 billion. That is higher than the $8 billion to $10 billion figure from last week.

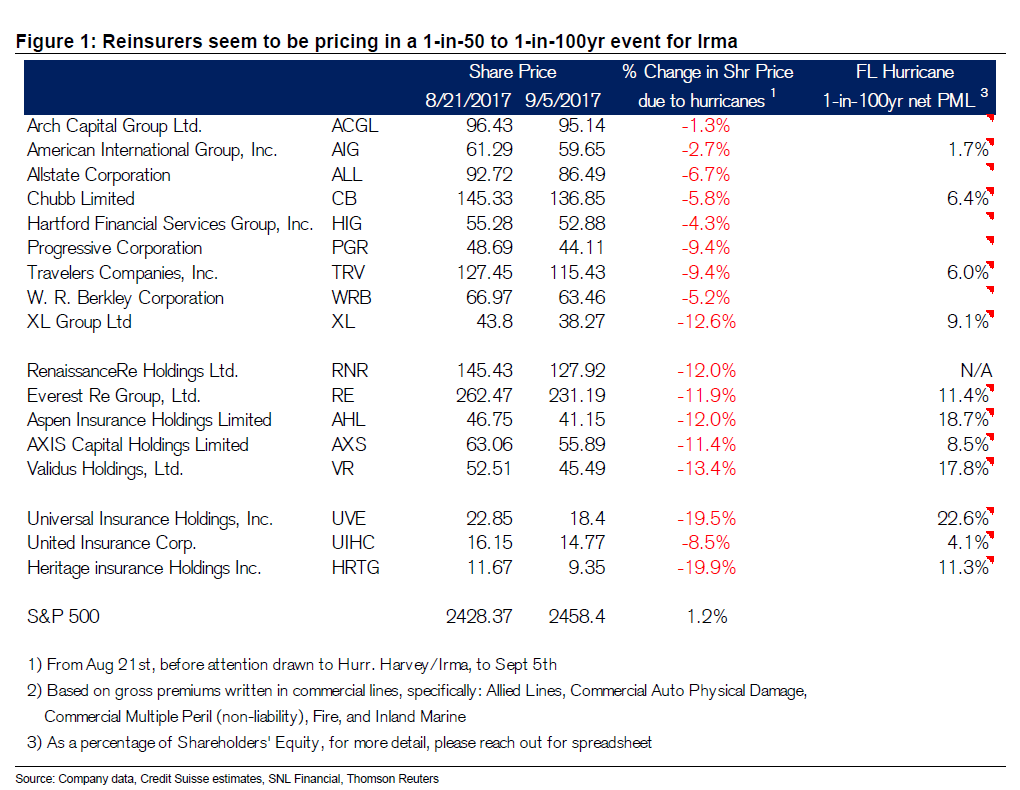

A chart showing the insurance and reinsurance impact from August 21 to September 5 shows just how much many of the major insurance and reinsurance firms have lost in value (see below).

Again, the exact outcome from Hurricane Irma remains an unknown at this point.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.