Companies and Brands

Why ESPN BET Could Absolutely Crush DraftKings and Fan Duel

Published:

When your legacy franchise cable channel is struggling some after being the mainstay of cable sports since the beginning, making a considerable change, and embracing the now solidly legal and fast-growing sports gaming industry as a corporate entity, it makes a ton of sense to make a significant and potential game-changing deal.

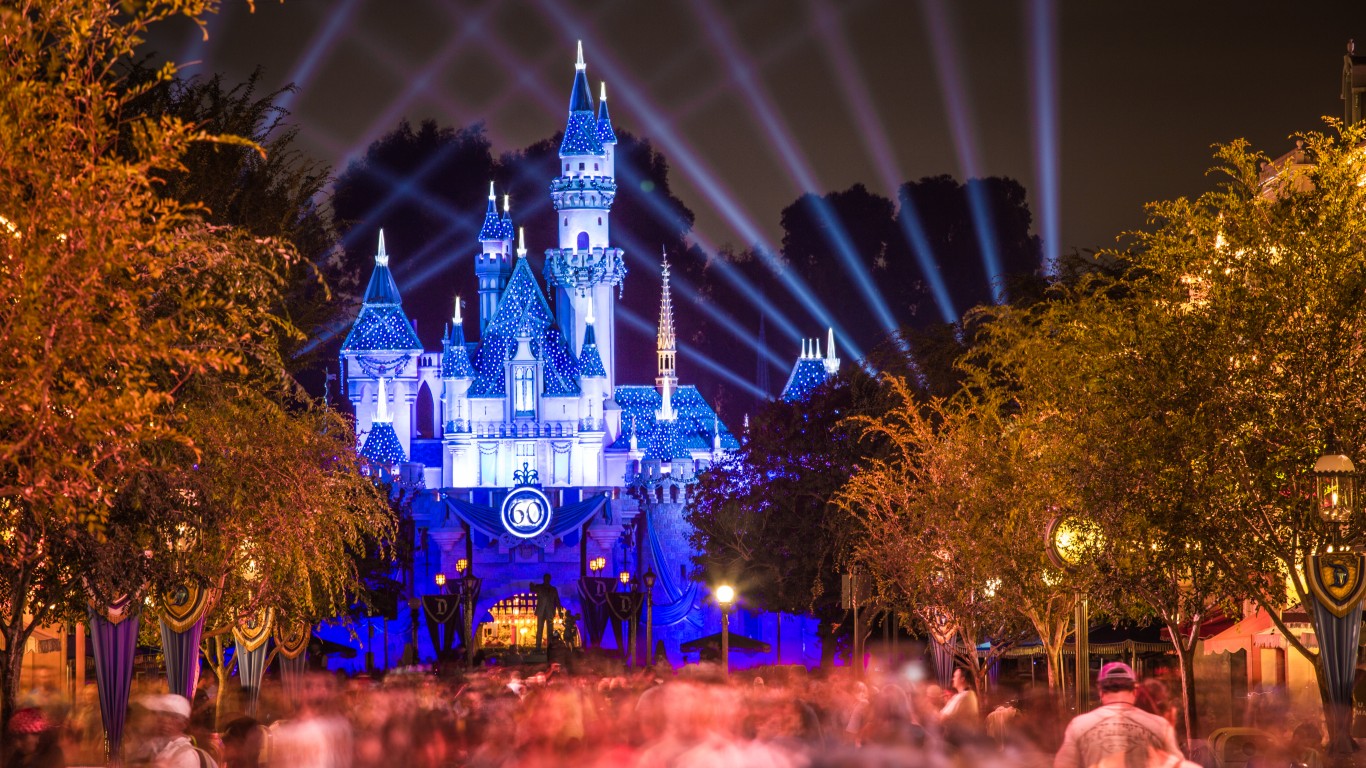

That is precisely what The Walt Disney Company (NYSE: DIS), the owner of ESPN, is doing. With consumers fleeing cable for streaming services and Disney taking some big hits on horrible offerings from their entertainment segment, it’s no surprise they embraced sports gambling, especially when they get paid in a big way for their brand.

Under a recently signed deal, the legacy sports broadcasting giant and casino owner PENN Entertainment Inc. (NASDAQ: PENN) agreed to launch a sports betting business under the brand ESPN BET.

Under the terms of the deal, Penn will pay ESPN $1.5 billion in cash over the next ten years and offer about $500 million worth of warrants to purchase its shares over an initial 10-year term in exchange for the brand, promotional services and other rights. While expensive, the sheer magnitude of ESPN’s reach is a potential game changer for the sports gaming business. Penn believes it will receive severe media and betting integration throughout ESPN’s multi-platform sports complex.

DraftKings and FanDuel control an estimated 75% of the online sports betting market, and DraftKings posted a staggering 57% jump in third-quarter earnings as revenues soared to $790 million from $288 million in 2022. In addition, the company raised 2023 guidance to $3.72 billion from the former guidance of $3.5 billion.

ESPN has a staggering 25 million subscribers, and a stunning half of all Americans between 30 and 49 watch ESPN via either cable or streaming services. 75% of ESPN’s audience base is male. In addition, ESPN led all other networks in daytime viewership by a considerable margin.

ESPN Bet will be in all the top betting markets in these states.

While DraftKings has aggressively fought off the competition, they have yet to face a challenger with the reach, strength, and deep pockets of ESPN and PENN Entertainment. While DraftKings currently holds an estimated 34% share of sports betting and iGaming, ESPN BET could severely challenge that.

While likely offering some early teaser odds and action, it is expected that ESPN Bet will provide lines comparable to the competition. But, given the network’s massive reach and personalities, you can expect to see some of the best-known on-air talent pitching bets. Elle Duncan was touting a chance for the Georgia Bulldogs to win yet another National Championship with good odds, while Mike Green had a “Seeing Green” bet on the board for customers.

The main offer to get gamblers and clients onboard is enormous. Make any bet, and get $250 in free bets in five $50 multiples. This isn’t just for new customers. According to reports, all PENN Entertainment’s current customers will also get the same offer. In addition, new customers will get an up-to-deposit match of an incredible $1000. The catch is you have 30 days to get your trades done, and the money unlocks at a 5% rate. So you would have to bet a lot to receive all of the bonus, according to reports.

With very liberal withdrawal and deposit terms, a very smooth betting app with an incredible look and feel, and a vast ESPN partnership, you can bet that PENN Entertainment will go all in to become the market leader. While pulling ahead of DraftKings, FanDuel, and the rest of the competition won’t be easy, it probably makes sense not to bet against ESPN BET.

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.