Customer retention is a key to almost every product or service. People who repeat as customers require almost no replacement costs. When a business loses a current customer, replacing that person can involve heavy marketing costs, both in terms of advertising and human sale efforts. For something like a car, which can cost $30,000 or much more, the replacement price can move into thousands of dollars.

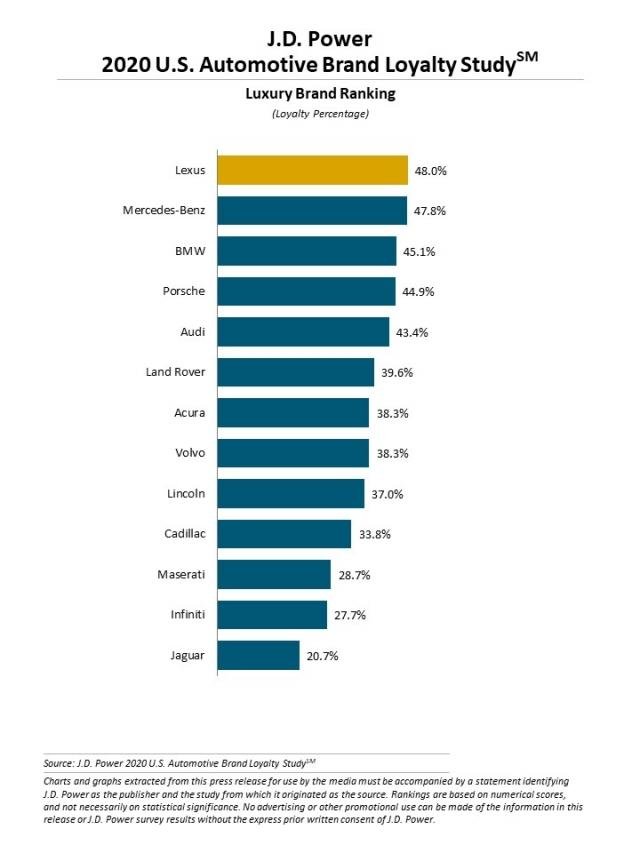

Gold standard car research firm J.D. Power conducts a study it calls its U.S. Automotive Brand Loyalty Study. The latest version is for 2020. The study is in its second year. Its simple measure is whether people who own a car brand will buy the same brand when they trade it in. The COVID-19 pandemic has increased brand loyalty.

Tyson Jominy, vice president of data and analytics at J.D. Power, commented:

Automakers are really focused on customer retention, as evidenced by the payment plans and incentives they’ve offered since the COVID-19 pandemic broke out. Many have gone above and beyond to offer customers financial assistance during a period of economic uncertainty, which does a lot to bolster consumer confidence in their chosen brand and repurchase it in the future.

The measure is called the loyalty rate.

Among luxury brands, Lexus, the luxury brand of Toyota, ranks in first place for the second year with a loyalty rate of 48.0%. Lexus has received strong grades for quality for many years from research firms and the car media.

Among mass market cars, Subaru is in first place at startlingly high 60.5%, followed closely by Toyota at 60.3%. Subaru is a somewhat niche brand among Japanese manufacturers, which include Toyota, Nissan and Honda. Subaru is known for small, fuel-efficient four-wheel-drive cars. Like all manufacturers, it has added a line of sport utility vehicles and crossovers to cater to the recent American preference for these kinds of vehicles. The brand has received strong reviews for quality and its reasonable prices models.

Click here to see which car brand people are most likely to dump.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.