Like other American automakers, Ford Motors (NYSE: FORD) is working hard to meet the federal goal of 50% of vehicles manufactured in the U.S. being EVs by 2030. The stakes are high, with climate change impacting daily life and the auto industry playing a significant role. The company has made inroads, establishing itself as Edmunds’ #2 electric car manufacturer of 2023, behind Tesla (NASDAQ: TSLA). Just because Ford has established itself near the top of the EV industry doesn’t mean its efforts are guaranteed to succeed. Several factors could derail Ford’s EV programs. Listed below are five potential pitfalls in no particular order. (Also see Ford’s Poor F-150 Lightning Sales.)

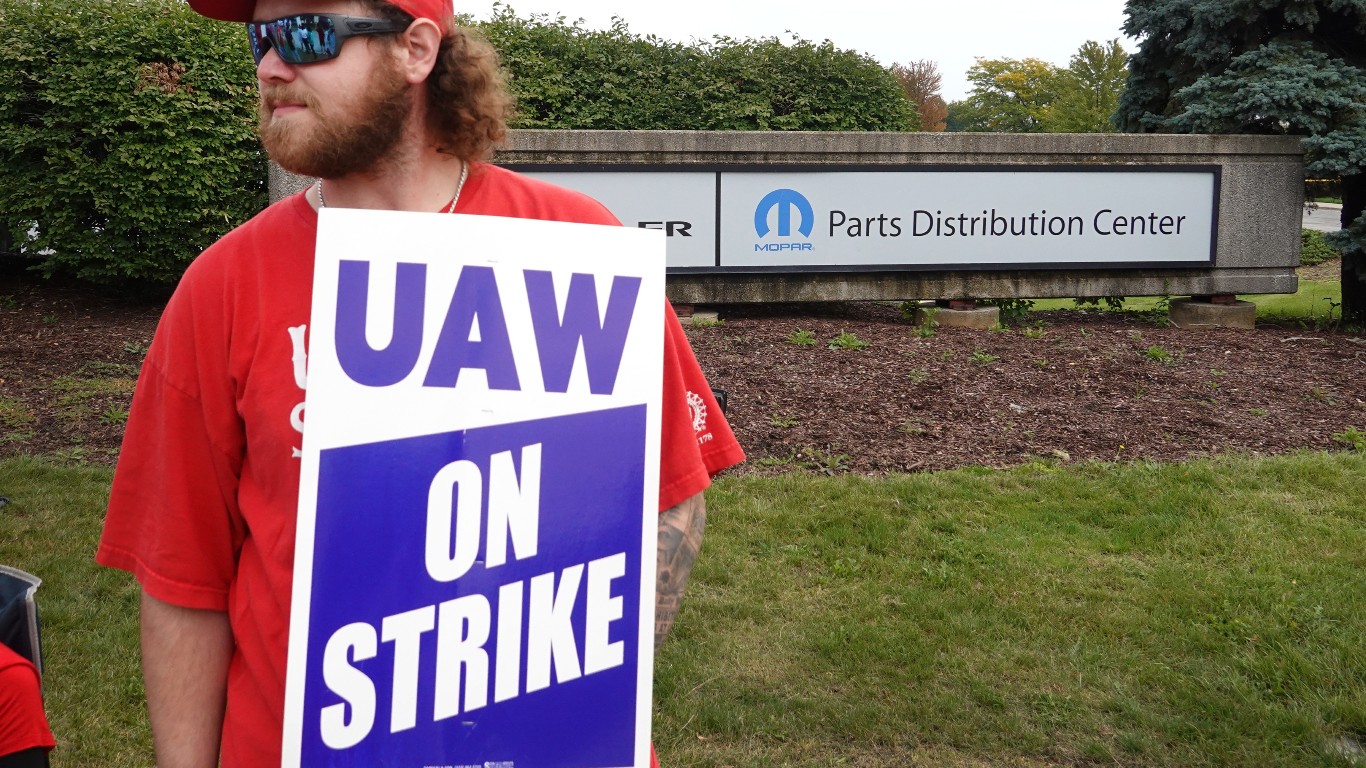

1. UAW Contract Costs

In September 2023, United Auto Workers union members went on strike, demanding pay increases, restoration of retirement funds to 2007 levels, a four-day work week, and restoration of overtime. They also demanded protection against plant closures resulting from increased EV production. The strike ended in October, with Ford accepting several of these demands. John Lawler, Ford’s chief financial officer, claimed in a conference call that the new UAW contract would add $850-900 to the price of each automobile, with EV prices already higher than their internal combustion counterparts. He also claimed that the contract would eat into profits needed to support the manufacture of EVs, which are already operating at a loss.

2. The Price War With Tesla

Ford has been in a price war with Tesla since January 2023, when the EV manufacturer cut prices to undercut Ford. Tesla cut its prices by nearly 20% to boost sales, challenging Ford, which has been selling its EVs at a loss. Nevertheless, Ford responded by offering steep discounts on its F-150 Lightning trucks and Mustang Mach-E EVs. With other costs building up on multiple fronts, Ford is ill-equipped to continue this price war.

3. Material Costs

Next, we come to some challenges throughout the EV industry. Though these are not restricted to Ford, they will still impact Ford’s EV aspirations. The first of these issues is the cost of materials. This includes the large touchscreen displays for information and entertainment (infotainment). However, the most significant contributor to EV cost is the battery. Battery supply chains have been fraught with disruption, especially during the pandemic, and the cost of the rare metals used in the battery is high. The added cost to EVs and the increased overall bill due to labor costs can make consumers think twice about the initial investment.

4. Infrastructure Challenges

While gasoline stations are available from coast to coast in the U.S. and can be found in nearly every neighborhood, EV charging stations are not as ubiquitous. These stations may cost a lot, and there is not always space for a new station. Customers must weigh the availability of charging stations against the one-charge range of EVs when considering whether or not to purchase one. Additionally, the lack of standardized charging ports and the small number of fast-charging stations across the country may cause consumers to think before investing in an EV.

5. Oversupply of EVs Relative to Demand

Customers who think twice about purchasing EVs are already considering moving back to hybrids, which is part of why demand is lagging right now. While Ford has been trying to compete with Tesla on price and has the resources to do so for a time, rising costs and flagging consumer confidence in EVs mean that Ford cannot keep up indefinitely. So, while Ford is working from a stronger position than others, there are some reasons for concern.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.