Casinos & Hotels

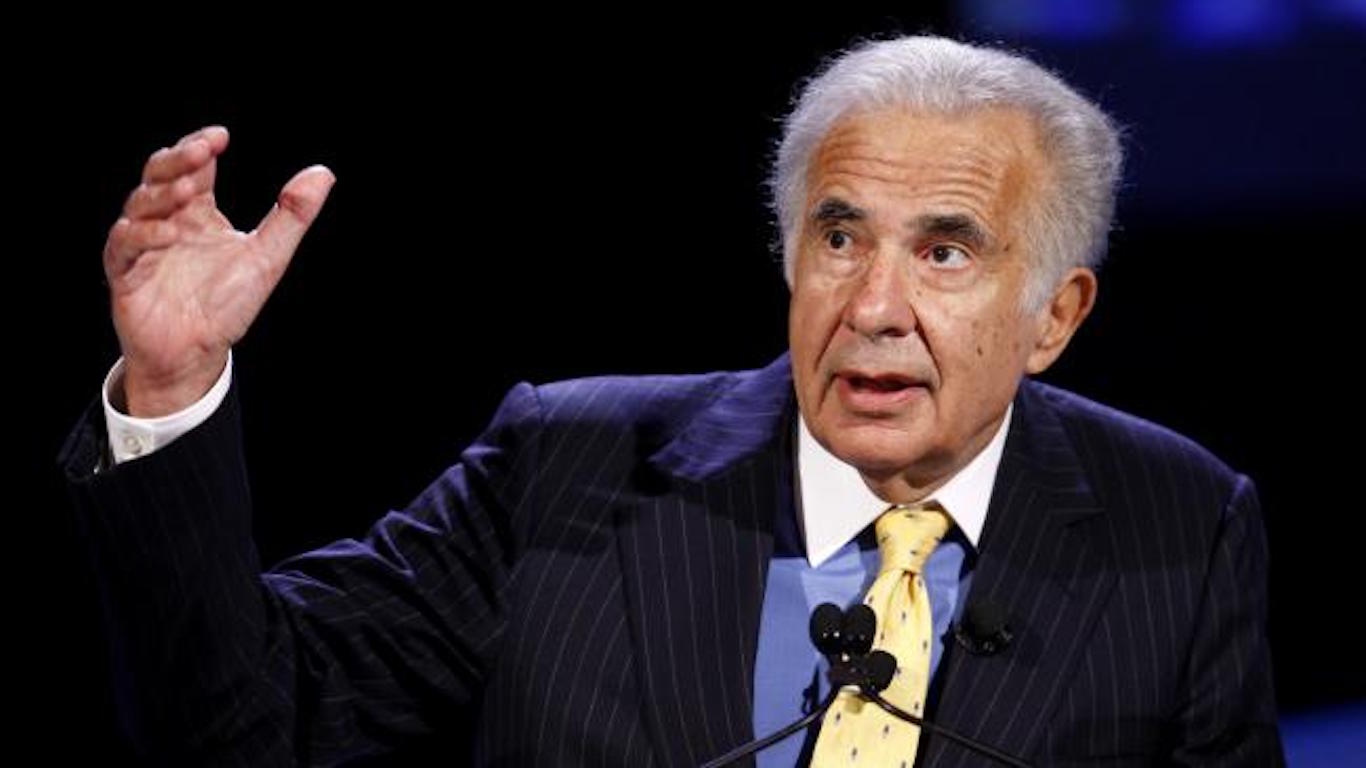

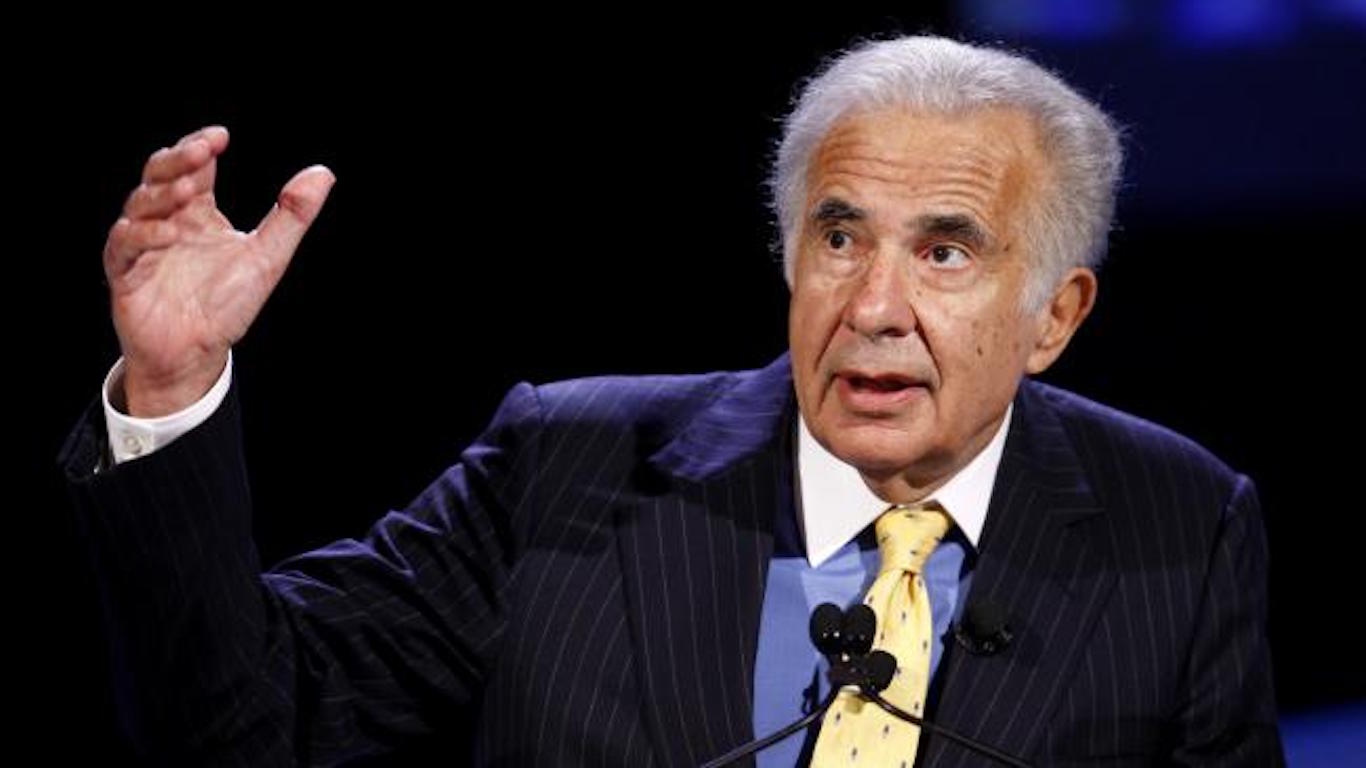

How Carl Icahn and Friends Want to Boost the Shares of Caesars

Published:

Last Updated:

It’s official: Carl Icahn wants a strategic review and an ultimate sale of Caesars Entertainment Corp. (NASDAQ: CZR). After reports were out the prior week about the activist investor and manager, an SEC filing has been made by Icahn Enterprises L.P. (NASDAQ: IEP) disclosing roughly a 10% stake in Caesars Entertainment.

The entities with stakes tied to Icahn and associates are Icahn Capital (IEP) and are shortened into the names of High River, Hopper, Barberry, Icahn Offshore, Icahn Partners, Icahn Master, Icahn Onshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Beckton and Icahn Enterprises GP.

Tuesday’s SEC filing shows the cumulative group (or reporting persons) is deemed to beneficially own an aggregate of 66,053,725 shares, which includes 5,724,421 underlying shares related to convertible bonds. All in, that represents approximately 9.78% of the total outstanding shares of Caesars Entertainment. It might be an even larger stake of over 71.9 million shares if the cash-settled swap agreements are included (see below).

Icahn’s logic for the stock purchase was that the shares are undervalued, that the company should pursue a strategic review and, ultimately, that selling the company is the best path for Caesars. Tuesday’s SEC filing said:

The Reporting Persons acquired their positions in the Shares in the belief that the Shares were undervalued. The Reporting Persons have spoken to, and intend to continue to speak with, representatives of the Issuer’s board of directors and management to discuss enhancing shareholder value, improving asset optimization and seeking board representation, including, if necessary, by nominating a slate of directors at the 2019 Annual Meeting. We also intend to have discussions with other stockholders to understand their perspectives and priorities.

The Reporting Persons believe the Board should conduct a strategic process to comprehensively assess the best path forward for Caesars and believe that shareholder value might be best served, and enhanced, by selling the company. We believe that our brand of activism is well-suited to the situation at Caesars, which requires new thought, new leadership and new strategies and have acquired a substantial investment in the Issuer in the belief that it will provide us with significant influence in the company’s future. We look forward to holding discussions with the Board, and importantly, we expect the Issuer to refrain from appointing a new CEO (or further extending Mark Frissora’s tenure), until we have had an opportunity to meaningfully engage with the Board.

The Reporting Persons are considering all their options and, while they have no present plan to do so (except as otherwise disclosed in this Item 4), they reserve the right and are considering whether to propose other transactions which relate to or would result in one or more of the actions specified in clauses (a) through (j) of Item 4 of Schedule 13D.

The Reporting Persons may, from time to time and at any time: (i) acquire additional Shares and/or other equity, debt, notes, instruments or other securities of the Issuer and/or its affiliates (collectively, “Securities”) in the open market or otherwise; (ii) dispose of any or all of their Securities in the open market or otherwise; or (iii) engage in any hedging or similar transactions with respect to the Securities.

There is also a slight bump to the stake if you consider cash-settled swap agreements:

As of the date hereof, the Reporting Persons have entered into cash-settled swap agreements (the “Cash-Settled Swaps”) with unaffiliated third-party financial institutions that reference 71,929,336 Shares (representing economic exposure comparable to approximately 10.7% of the outstanding Shares). The Cash-Settled Swaps only settle for cash and do not permit settlement in the form of Shares. The Reporting Persons do not have direct or indirect voting, investment or dispositive control of any Shares that are referenced by the Cash-Settled Swaps. The Reporting Persons disclaim beneficial ownership of the Shares referenced by the Cash-Settled Swaps.

All things considered, analysts seem to not have massive expectations here. 24/7 Wall St. wanted to see what the more recent analyst coverage has been to find out if there are any huge upside share price expectations for Caesars:

Shares of Caesars were last seen trading up 5.6% at $9.66, in a 52-week range of $5.84 to $13.54 and with a consensus target price of $11.55.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.