Commodities & Metals

Has Gold Moved From 'Safe Haven' To 'Risk-On'?... Reading the Charts (GLD, IAU)

Published:

Last Updated:

Paper money was supposed to be dead, the dollar was supposed to implode, and hyperinflation from all of the bailout money and deficit spending was supposed to eat us alive. It was the perfect storm to drive gold to $2,000 or $3,000 or higher. Of course, that all depends upon whom you are talking to and whose analysis you believe.

Paper money was supposed to be dead, the dollar was supposed to implode, and hyperinflation from all of the bailout money and deficit spending was supposed to eat us alive. It was the perfect storm to drive gold to $2,000 or $3,000 or higher. Of course, that all depends upon whom you are talking to and whose analysis you believe.

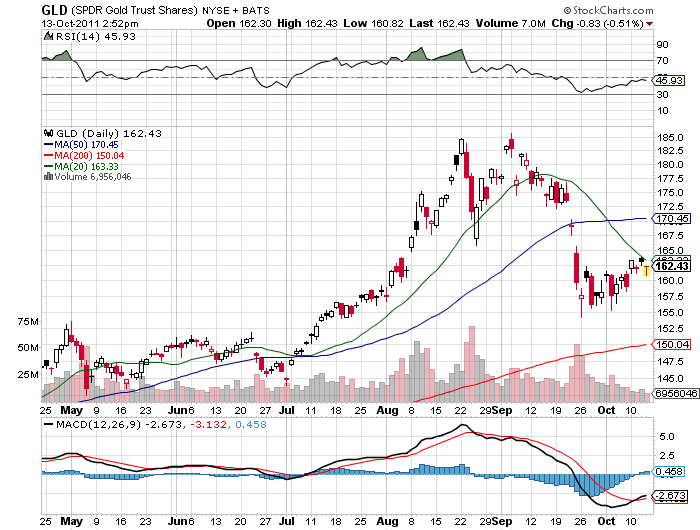

Gold has lost its runaway status. The safe-haven trade has gone dark. The margins were raised and the dollar became the world reserve currency again as the Euro bubble has been popped. The SPDR Gold Shares (NYSE: GLD) has come off more than $25.00 from its highs. A basic look at the chart puts resistance back around $165 to $167… iShares Gold Trust (NYSE: IAU) is back above $16.25 but is finding some resistance around the $16.50 mark again.

So, does this make the cash to endlessly bash gold? No, not at all. We are tracking gold via the SPDR Gold Trust (NYSE: GLD) and this one tanked after peaking in August. What is so interesting is that as stocks have recovered now that Europe is going to do a bank bailout of its own we have seen gold actually rise again.

Gold may not be a safe-haven trade now, but it has been acting like a “risk-on” trade again. If you use “the GLD” as the benchmark another “risk-on” resistance will come into play as the price gets closer to $170. At that point, anyone who bought gold on the last pullback during the last month will be profitable. All of those investors (or speculators) who were caught long and wrong at the top start to run back into their breakeven levels at about $175 and we would look for more resistance there.

If you look at the chart from stockcharts.com for the GLD, the 50-day moving average is up around the $170.45 level where big resistance comes in. The floor today is wad down at $150.04 and just above that $150 mark (say $152) had been the resistance level before gold went parabolic in early July.

If you look at the chart from stockcharts.com for the GLD, the 50-day moving average is up around the $170.45 level where big resistance comes in. The floor today is wad down at $150.04 and just above that $150 mark (say $152) had been the resistance level before gold went parabolic in early July.

So, our take… Gold has lost the safe-haven status but the bounce of late has been for buyers buying the risk trade again. For now…

JON C. OGG

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.