Commodities & Metals

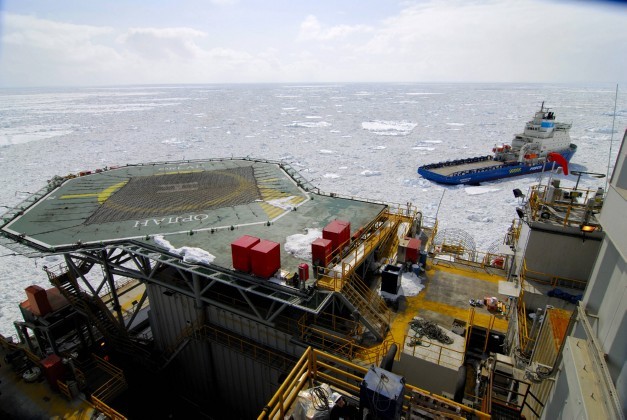

Morgan Stanley Dumps Global Oil Trading on Russia's Rosneft

Published:

Last Updated:

Most of the big U.S. banks took advantage of a 2003 change in U.S. law that allowed them to own and trade physical commodities not just contracts on those commodities. When the financial crisis hit in 2008-2009 and the banks changed their status from investment banks to bank holding companies, the Federal Reserve began reviewing banks’ commodities business and making it more difficult for the banks to continue trading oil, metals, and other commodities.

Lately the Federal Reserve has been reviewing its policies and is considering imposing a surcharge on bank-owned commodities and warehouses in an effort to get the banks to reduce their investments in the risky and volatile commodities trading business. A decision is likely next year.

Morgan Stanley and Goldman Sachs Group Inc. (NYSE: GS) get a pass, however, because both had commodity trading businesses before 1997 and both were grandfathered when they became bank holding companies. Goldman’s position has been that it can still make money in commodities, while Morgan Stanley has decided that the business is not worth the return.

What’s really interesting about this sale though, is the buyer. Rosneft will join other big oil companies like BP plc (NYSE: BP), Royal Dutch Shell plc (NYSE: RDS-A), and Total SA (NYSE: TOT) as an owner of its own oil trading desk. Rosneft already owns an oil trading business and late last year essentially borrowed $10 billion from commodity traders Vitol and Glencore to help fund Rosneft’s purchase of BP’s stake in BP-TNK. The Russian company pledged some 500 million barrels of future production to the two trading houses in exchange for the cash.

But at $100 a barrel, 500 million barrels of oil is worth $50 billion, not $10 billion. What about the other $40 billion? Hedging just a part of a risk that size moved Brent into backwardation, pushing spot prices higher than futures prices, and Vitol and Glencore will have to continue that massive hedging for a long time, which will keep Brent prices high for a long time.

Counting physical barrels and matching supply of oil to demand for it is relatively easy. But pricing those barrels depends much more on the vagaries of trading those barrels. There is nothing to stop Rosneft from buying back some of the barrels it has pre-sold and gaining more pricing power in the market, which it would almost certainly like to do. Vitol and Glencore are probably concerned, and the rest of us should be as well.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.