Commodities & Metals

Yamana Gold Cuts Dividend, but Stock Price Holds Up

Published:

Last Updated:

We have noted before that the gold miners would be taking substantial hits due to the falling price of gold when they calculated the value of their proved reserves. Yamana used a figure of $1,375 per ounce in its 2013 calculation and lowered that to $1,300 an ounce for 2014.

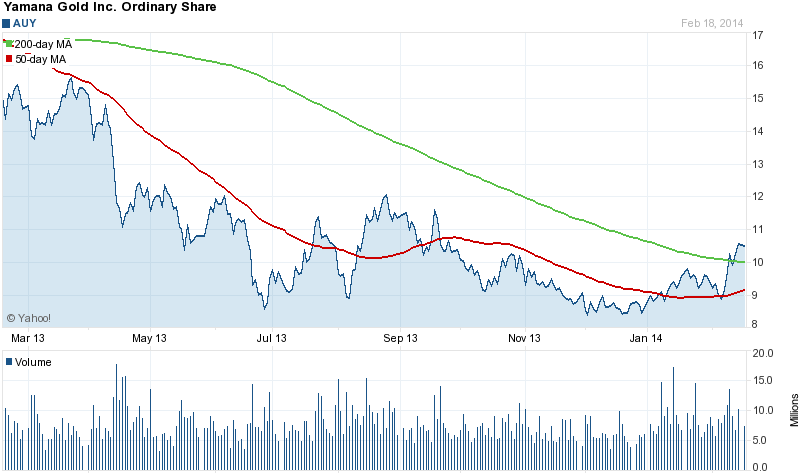

Yamana’s results and write-downs reflect what is happening to the gold miners in general, but gold bugs are not convinced. Yamana’s forward price-to-earnings (P/E) ratio is highest of any of the big gold miners at 27.71, and only Barrick Gold Corp. (NYSE: ABX) has a multiple below 23. (We have also got a look at some other gold miners that shows that enthusiasm for Yamana is not unique.) The following chart on the 50-day and 200-day moving averages for Yamana indicates what investors believe is the start of a rise in the company’s share price.

Yamana shares were down only 0.8% in the first few minutes of trading Wednesday, at $10.45 in a 52-week range of $8.31 to $15.66.

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.