Platinum is generally supposed to be worth more than gold per ounce. After all, it is more rare, considered more precious and harder to work with. That basic assumption changes through time, and sometimes the price of platinum and gold can invert. October of 2014 is bringing up an interesting case in which gold prices are almost identical to the price of platinum. On Wednesday, gold prices were trading at $1,245 per ounce while platinum prices were closer to $1,270.

24/7 Wall St. wants to examine they why this is happening. For starters, gold and platinum inverting is not something that never happens. It is just rare, less than 10% of the time over the past two decades. Much of that inversion was during the time that the gold bugs were buying gold like it was going to be the replacement currency, when the quantitative easing and money printing fears were in overdrive.

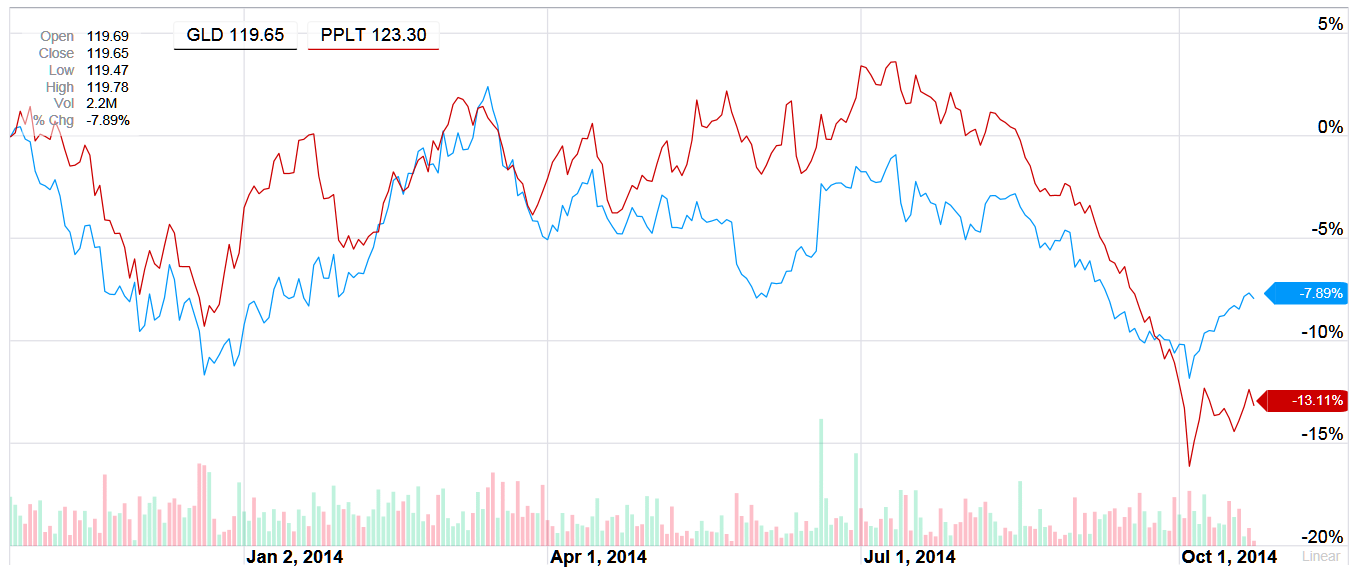

What is taking place now is that emerging markets are soft and Europe is teetering on a deflationary recession cycle. The move for this potential test of gold and platinum inverting is not due to any gold rally — platinum has cratered since July. Gold may have sold off during much of that time, but platinum fell from $1,500 in July to around the $1,250 mark.

The issue is of course complicated, but gold can be a bit of a schizophrenic metal when it comes to why nations and individuals buy it. Platinum is used by industry, so it has a more direct move in direction of anticipated industry trends — particularly expectations around auto sales trends due to catalytic converter demand.

ALSO READ: The 10 Safest High-Yield Dividends

Again, the reasons that people, nations and industry buy gold are numerous. It is not just as a currency alternative or inflation protection, or because central banks need to bolster their reserves. What is scary here is not what is happening to the price of gold. The scarier notion is what this drop in platinum says about expected world growth more than anything that the moves in gold say.

24/7 Wall St. has also compared the SPDR Gold Shares (NYSEMKT: GLD) and ETFS Physical Platinum (NYSEMKT: PPLT) in charts from Yahoo! Finance. The drop from July is shown to be much more severe in the platinum ETF in percentage terms. We have then used charts from GoldMoney.com to show exactly how much in raw dollars per ounce the drop has been in platinum versus the whipping trade pattern in gold.

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.