Commodities & Metals

After Aluminum Car Bodies Can Jet Engines Help Turn Alcoa Around?

Published:

Last Updated:

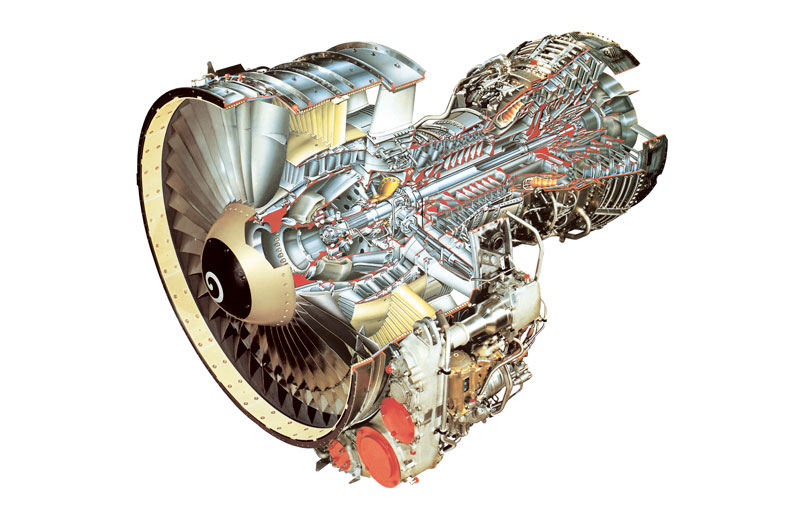

The company is investing $22 million in Hot Isostatic Pressing (HIP) technology at its facility in Whitehall, Michigan. Alcoa expects that this investment will allow it to capture growing demand for advanced titanium, nickel and 3D-printed parts for the world’s bestselling jet engines.

Ultimately this investment supports Alcoa’s strategy to build its value-add business for profitable growth and greater innovation in the aerospace market. Alcoa expects global aerospace sales growth in the range of 9% to 10% in 2015. At the same time this sales growth is expected to be driven by strong deliveries across the large commercial aircraft, regional jet and business jet segments. Separately, Alcoa Power and Propulsion is expected to generate $2.2 billion in revenues by 2016 as a result of its organic growth expansions.

Olivier Jarrault, Executive Vice President and Alcoa Group President, Engineered Products and Solutions, commented on the investment:

As aerospace growth soars, Alcoa continues to invest in the latest technologies, creating added capacity to capture fast-growing demand. Combined with our expansions in LaPorte, Indiana and Hampton, Virginia, and our growing 3D printing capabilities, this investment will give Alcoa the broadest capabilities to deliver high-quality titanium, nickel and 3D-printed parts for the world’s best-selling jet engines.

The city of Whitehall is further supporting Alcoa’s investment by approving a 12-year Industrial Facilities Tax Exemption valued at over $1 million.

This announcement comes at a good time for Alcoa, as shares are just above their 52-week lows and are in definite need of a boost. Year to date, Alcoa shares are down 21% at current prices.

However analysts might view this differently and potentially as a buy opportunity. The stock has a consensus analyst price target of $17.30 which implies an upside of 36.2% from current prices. The highest price target from analysts is $22.00.

Shares of Alcoa were up 2.2% at $12.70 on Tuesday afternoon, within a 52-week trading range of $12.29 to $17.75.

ALSO READ: The Most Expensive Wars in U.S. History

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.