Being in the metals industry is currently not an easy gig. Profitability and demand just are not cooperating. The good news is that AK Steel Holding Corporation (NYSE: AKS) has recovered handily after earnings. AK Steel also joined in with US Steel Corp. (NYSE: X) and with steel companies like Arcelor Mittal (NYSE: MT), Nucor Corp. (NYSE: NUE), and Steel Dynamics Inc.(NASDAQ: STLD) in filing antidumping and counter-vailing duty petitions against eight countries related to cold-rolled steel (Brazil, China, India, Japan, South Korea, Netherlands, Russia, and the United Kingdom) for causing material injury to AK Steel and the domestic steel industry.

24/7 Wall St. wants to see if this is the quarter that the longstanding turnaround can finally turn around. With how this stock has treated turnaround investors, it matters.

As far as AK Steel earnings, the report itself was mixed with beating estimates on earnings but with in-line revenues. Its second quarter loss was -$0.36 per share, but revenues were up 10.4% to $1.69 billion. The consensus estimates were -$0.39 EPS and $1.71 billion in revenue. Shipments in the second quarter were 1,811,700 tons versus 1,397,500 tons a year ago and versus 1,750,500 tons in the first quarter.

AK Steel said that it sees improved results for third quarter and second half of 2015 on higher shipments, improving carbon steel spot prices, higher production, lower operating costs, and lower raw materials costs. The strength is expected to remain in automotive as well, at a time when imports of carbon steel products are expected to continue declining after pending and anticipated steel industry trade cases.

Continued high levels of unfairly traded imports significantly impacted selling prices in the carbon steel spot market, which negatively impacted AK Steel’s results.

As far as why AK Steel’s turnaround is far from completion, this turnaround has been a stop and start turnaround for quite some time. One additional issue was that AK Steel was shown to have previously guided cautiously ahead.

The question is whether 2015 will really mark a bottom. Earnings (or losses) are expected to be -$0.92 per share in 2015 with a recovery to $0.13 in positive earnings per share in 2016. This would be on a 6.2% sales recovery in 2015 to $6.9 billion and a 5.4% sales recovery in 2016 to $7.3 billion.

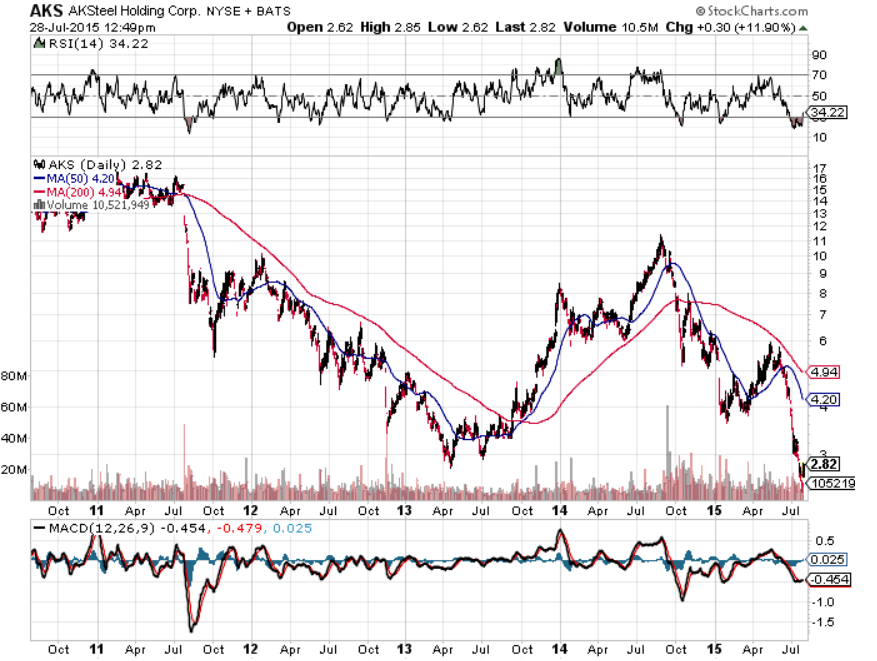

Here is what investors need to consider, and that is beyond whether this quarter marks a true bottom or not. AK Steel shares being up 12% at $2.80 sounds great on the surface. Still, this was a $5.00 stock in the first part of June and it was a $10.00 stock as recently as last September. AK Steel was a $15 and $20 stock in 2010 and 2011.

The long and short of the matter is that many turnaround investors have been bracing for a big AK Steel turnaround. Unfortunately, they have been burned on too many occasions. Merrill Lynch’s price objective was still last seen at $8.00 (and was even higher), which, at least as of now, just sounds too aggressive given a sub-$3 share price. The highest official analyst price target still appears to be up at $10.50, and the consensus price target is still $5.15.

ALSO READ: 7 Big Banks Trading at Discounts to Book Value

A 5-year chart from StockCharts.com has been provided below.

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.