Commodities & Metals

Why Lower Gold Prices Will Bring Buyers Back In, but Will It Support Gold Stocks?

Published:

Last Updated:

Gold has enjoyed one stellar 2016. At least until recently. The World Gold Council (WGC) has chimed in on the recent activity, and its view is that the fresh October drop of 3% will bring buyers back into gold.

This is an on-sale price argument, and it should be pointed out that the WGC is of course quite pro-gold. 24/7 Wall St. has selected five gold stocks as well in an effort to show just how much carnage has been in recent weeks despite serious gains year to date, and the call from the WGC did not seem to be helping the major gold stocks yet.

In an effort to explain the recent price drop, several issues are working simultaneously here. The WGC noted that the 3% price drop in October seems to have been driven by speculation that the European Central Bank will scale back on its endless asset purchase program. Another issue hitting gold was rising expectations that the U.S. Federal Reserve will raise interest rates in December.

Another issue cited is that the price drop was enough to trigger stop-losses, along with further tactical selling. The WGC even noted the national holiday in China being an issue for gold. The council’s interim report said:

Looking forward, we believe the price dip will offer a good buying opportunity for consumers and long-term investors. In addition, even though central banks may start to normalize monetary policies, such a prolonged period of extraordinary measures has led to a structural shift in asset allocation that will linger much longer. In this new normal of lower returns and higher uncertainty, gold has an important role to play in the portfolios of investors large and small.

We believe that a shift in monetary policy need not signal lower gold prices. The price dip will likely result in physical demand from consumers, long term investors and central banks. The broader market environment of ongoing low and negative interest rates, coupled with continuing political, economic and policy uncertainty remains unchanged, and are generally positive for gold.

On tactical selling, it is mainly pointing to a chart. The WGC pointed out that once the gold price went under $1,310.00 per ounce, which was gold’s 100-day moving average, technical selling increased sharply. The WGC feel this exacerbated the price drop, triggering stop-losses and further tactical selling.

One issue to consider here is that the WGC warns that higher interest rates might not actually generate lower gold prices. Three bullet points were offered:

- When real rates are negative, gold returns tend to be twice as high as the long-term average.

- Even if real rates are positive and as long as they are not significantly high (4% in our analysis), average gold returns remain positive.

- Falling rates are generally linked to higher gold prices; yet rising rates aren’t always linked to lower prices.

On why the lower gold prices will bring new buyers in, the WGC cited higher demand for jewelry and coins, exchange traded fund demand, and even from central banks. The council pointed out on central banks:

Meanwhile, a recent survey of 19 central bank reserve managers, conducted by the World Gold Council shows that nearly 90% of them will either increase or maintain their current gold reserve levels, indicating a strong floor of support for gold demand.

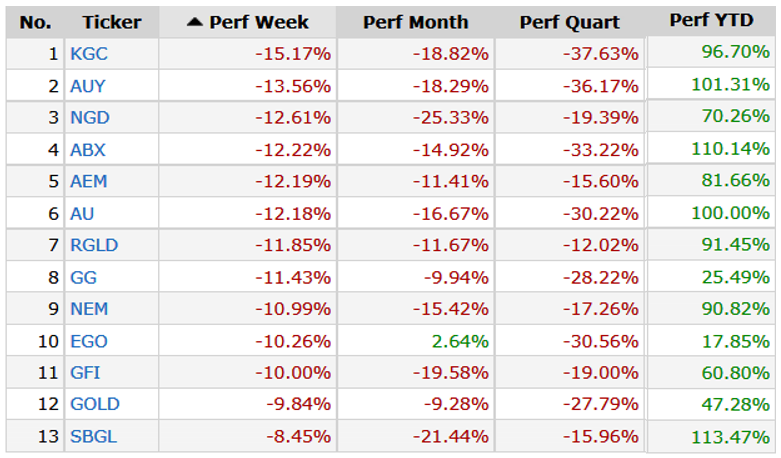

Here we see how the recent drops are affecting key gold stocks. The gains generally are still huge so far in 2016, but each one has pulled back massively over the past 90 days. A condensed chart from FINVIZ also has been included.

Shares of Barrick Gold Corp. (NYSE: ABX) recently closed at $15.98 and were trading at $15.76 after Thursday’s opening bell, with a consensus analyst price target of $23.21 and a 52-week trading range of $6.90 to $23.47. So far year to date, the stock is up by 110%, but over the past 90 days the stock is actually down by 33%.

Goldcorp Inc. (NYSE: GG) shares last closed at $14.45 but were lower at $14.34 shortly after Thursday’s open. The consensus price target is $21.09, and the 52-week range is $9.46 to $20.38. So far year to date, the stock is up by 25.5%, but over the past 90 days it is actually down 28%.

Shares of Newmont Mining Corp. (NYSE: NEM) recently closed at $34.59. They were down 2% more at $33.90 after Thursday’s open. The consensus price target is $47.05. The 52-week range is $16.05 to $46.07. So far this year, the stock is up 91%, but over the past 90 days it is down by 17%.

Gold Fields Ltd. (NYSE: GFI) closed at $4.48 on Wednesday, but it was trading down 4% at $4.29 on Thursday after the opening bell. The consensus price target is $6.05, and the 52-week range is $2.04 to $6.60. Year to date, the stock is up by 61%, but over the past 90 days it is down by 19%.

Shares of Kinross Gold Corp. (NYSE: KGC) closed at $3.63 on Wednesday, and they were trading down about 2% at $3.56 after Thursday’s opening bell. The consensus price target is $6.21, and the 52-week range is $1.31 to $5.82. So far year to date, the stock is up by 97%. Over the past 90 days it is down more than 37%.

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.