Commodities & Metals

Gold and Precious Metals Moving Toward Lows of the Year

Published:

Last Updated:

Gold has had a rough 2018. Despite some of the international trade worries and international suspense, the reality is that most investors are just not looking for the “ultimate safety trade” that is often the reason for gold’s rally. Much of this weakness in gold has spilled over into other precious metals as the U.S. dollar strength and the promise of higher interest rates ahead are keeping gold buyers on the sidelines.

The move for higher interest rates is one of the major factors that is driving this truck for weak precious metals pricing. After all, gold pays no dividend and comes with no coupon, and the Treasury yield curve is very flat, with short-term rates just above 2% and the 10-year and 30-year just under 3.0% at this time.

It now turns out that latest weakness is taking the basket of precious metals to 2018 lows and even toward the 52-week lows. This is turning into a story in which the technical traders looking at charts may have more weighting than in recent in months.

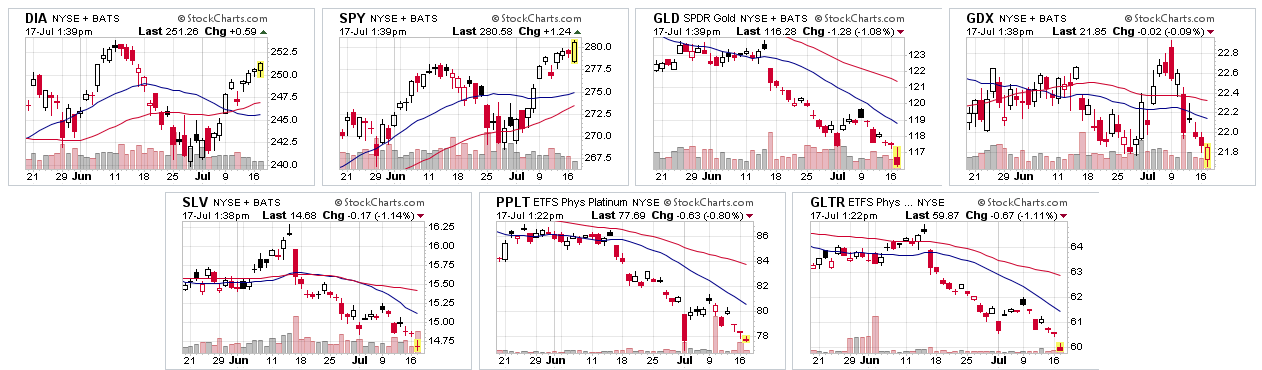

Gold itself was down 5% for 2018 on last look, as measured by the SPDR Gold Shares (NYSEMKT: GLD). That is now down just over 10% from its 52-week high. The gold miners, measured by the VanEck Vectors Gold Miners ETF (NYSE: GDX), is down almost 6% year to date, but its chart looks less bad than gold’s key ETF. That said, the gold mining ETF is down over 14% from its 52-week high.

Silver has had a very hard time in 2018. The metal has even been living up to its name of the “devil’s metal” due to being more volatile than gold. The iShares Silver Trust (NYSE: SLV) was last seen down just over 7% so far in 2018, and it is down over 14% from its 52-week high. Last seen trading at $14.67, the iShares Silver Trust was above $16 very briefly as recently as mid-June.

ETFS Physical Platinum (NYSE: PPLT) has really had a rough 2018, and this platinum-tracking ETF was last seen down about 11.5% so far in 2018 and is down just over 20% from its 52-week high.

There is also a mixed precious and semiprecious metals basket called the ETFS Physical PM Basket (NYSE: GLTR). Its shares aim to reflect the price performance of physical gold, silver, platinum and palladium. This ETF was last seen down almost 7% so far in 2018 and down 12% from its 52-week high.

Charts from StockCharts.com have been provided below, with the first charts measuring the Dow and S&P 500.

The Average American Is Losing Momentum On Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4%1 today. Checking accounts are even worse.

But there is good news. To win qualified customers, some accounts are paying more than 7x the national average. That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn a $200 bonus and up to 7X the national average with qualifying deposits. Terms apply. Member, FDIC.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.