Zekelman Industries has filed an S-1 form with the U.S. Securities and Exchange Commission (SEC) regarding its initial public offering (IPO). No pricing details were given in the filing, although the offering is valued up to $100 million, but this number is usually just a placeholder. The company intends to list its shares the New York Stock Exchange under the symbol ZEK.

The underwriters for the offering are Goldman Sachs, Merill Lynch, BMO Capital Markets, Credit Suisse, GMP Securities, KeyBanc Capital Markets, William Blair, Stifel, BTIG and PNC Capital Markets.

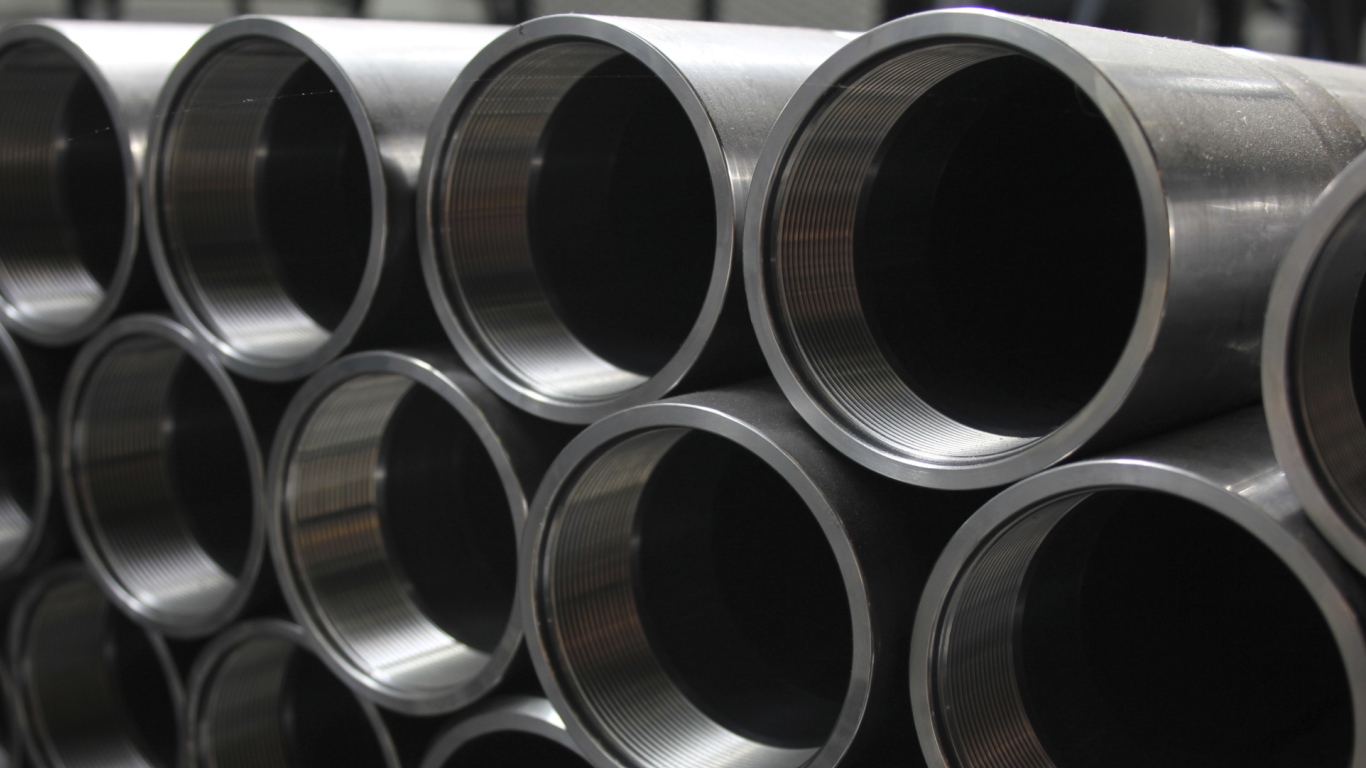

This a leading North American manufacturer of industrial steel pipe and tube products with over 100 years of operating experience. Management believes it is the largest producer by volume of hollow structural sections and electrical conduit products in the United States and Canada on a combined basis, and the largest producer by volume of standard pipe products in the United States.

The company is headquartered in Chicago, Illinois, and has 13 pipe and tube production facilities in seven states and one Canadian province, with total production of roughly 2.1 million tons from its continuing operations for the past 12 months. It offers a broad array of products marketed under a family of respected brands. such as Atlas, Wheatland, Sharon Tube, Western Tube & Conduit, Picoma and Z Modular. In the past 52 weeks, the firm sold over 10,000 distinct pipe and tube products to over 2,000 customers.

Zekelman generates revenue primarily in the United States, which accounted for about 86% of its net sales in the past 52 weeks, with the remainder generated primarily in Canada. For the past 12 months, it generated $2.6 billion of net sales, $249.2 million of income from continuing operations and $492.5 million of adjusted EBITDA.

The company intends to use the net proceeds from this offering to repay its indebtedness, as well as for working capital and general corporate purposes.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.