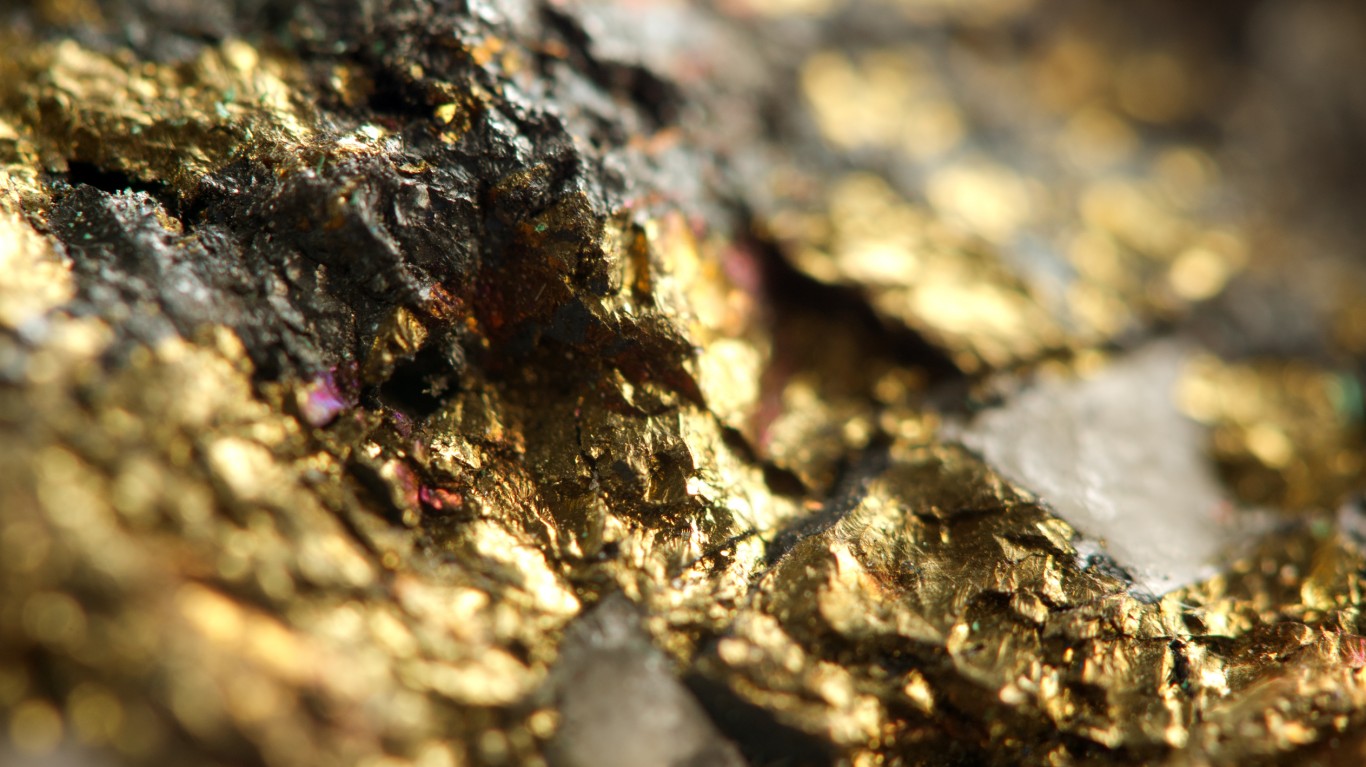

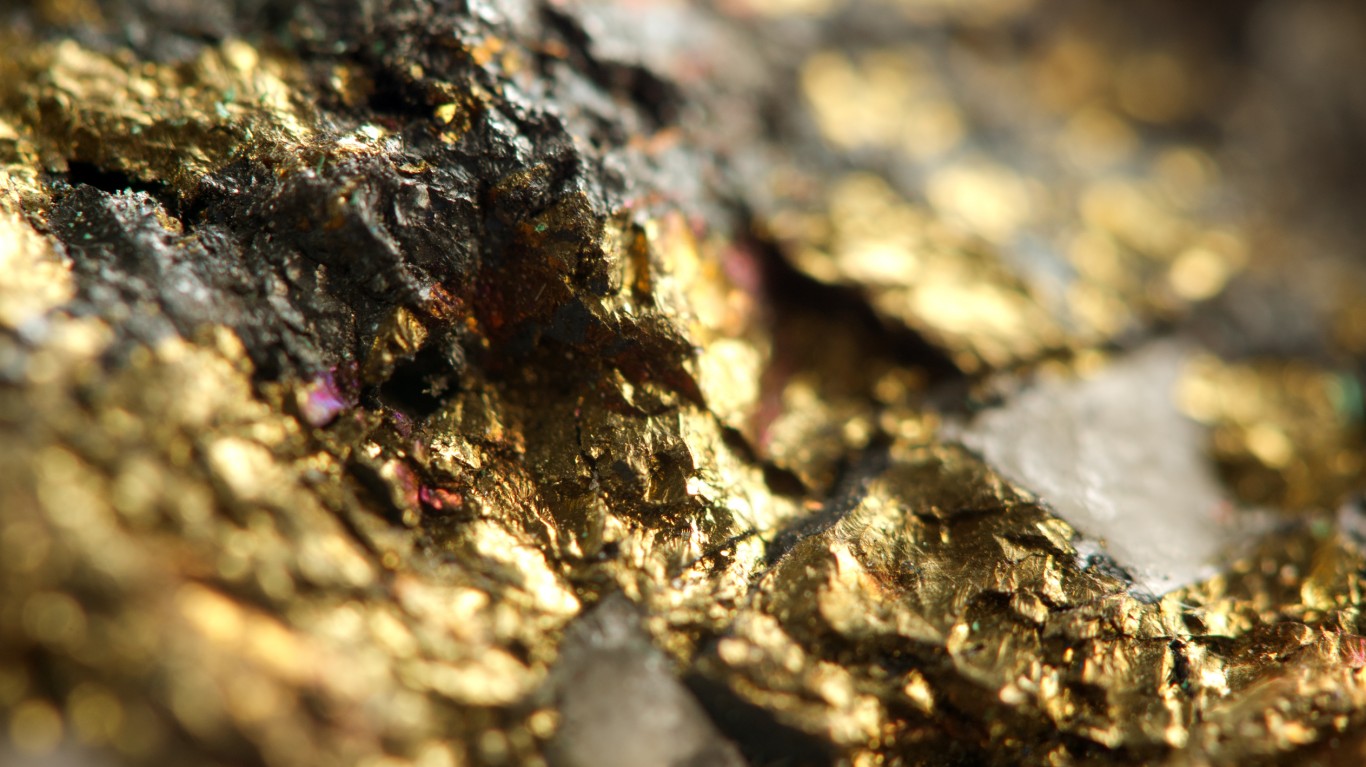

Commodities & Metals

5 Gold-Mining Stocks Still Expected to Surge Higher and Outperform in 2020

Published:

Last Updated:

Gold has enjoyed a stellar 2019. After starting the year close to $1,290 per ounce, gold peaked above $1,555 per ounce by the start of September. While its peak 2019 price was up 20.5% for the year, gold’s current price near $1,475 per ounce is still a gain of more than 14% year to date. Many investors have moved into gold-backed exchange-traded funds (ETFs) in recent years, but sometimes, rather than investing in gold itself, they choose individual gold-mining stocks or the gold-mining ETF to get more diversity.

24/7 Wall St. has been looking for data to see how gold might actually be setting up for 2020. Central bank buying is expected to continue, and even if the China-U.S. trade pact is signed, there are no assurances that the full phase-two deal will come. There is also a U.S. election cycle in 2020 that is expected to be both exhausting and brutal, and interest rates are expected to remain low, with the U.S. Federal Reserve more or less on hold and with negative interest rates remaining in much of Europe and in Japan. There is also ongoing geopolitical risk to consider, as well as global strife between labor and employers that could lead to other large strikes that shut down or curtail production.

While no one should expect all those risks to remain in place by the end of 2020, if you add up even a portion of them then some are likely to remain as factors toward the end of 2020. That should create a climate that is at least supportive for gold, even if it doesn’t create a runaway price surge that sends the gold bugs into a swarm. Economists have even moved out their recession fears into 2021, rather than anything imminent in 2020.

Another consideration for 2020 is that gold forecasters remain supportive. Goldman Sachs recently came out with a $1,600 per ounce forecast for 2020 that would imply another 10% or so for gold itself. That’s also massively higher than the forecasts from major gold players with their assumptions about their all-in sustaining costs and capital spending plans. Meanwhile, Merrill Lynch was positive on industrial metals but more cautious for gold and precious metals in its 2020 outlook. RBC has forecast of $1,500 per ounce for 2020 and $1,450 for 2021 and 2022, as gold was hitting new highs earlier in 2019. And SSGA, parent of the SPDR ETFs, has a 2020 forecast that talked up the positives of gold’s historic low-correlation to stocks and bonds to help boost returns during bouts of volatility.

What does this all mean for the gold-mining and production stocks? 24/7 Wall St. screened out the U.S. and international gold-focused companies with a $2 billion market cap and U.S.-listed shares. That left 15 companies that are focused on gold more than any other commodity or mineral. We compared the current price to the consensus analyst target price from Refinitiv, and we included dividend data (if applicable) and trading history. Additional color was provided on each company.

Investors should consider that most new or reiterated Buy and Outperform analyst ratings tend to come with 8% to 10% implied total return forecasts to their price targets at this stage in the bull market. We used that as a baseline for “undervalued” when it comes to above-market upside, since the average 2020 S&P 500 forecast now implies upside of only about 6%.

Here are five of the top gold-mining and gold-producing stocks that still screen as being undervalued despite gold’s performance in 2019. These have been listed in order by market capitalization for simplicity, and investors should keep in mind that the top two post-merger gold mining giants are now worth the same as the next 18 gold miners and producers combined.

Barrick Gold Corp. (NYSE: GOLD) recently traded at $17.35, with a $31 billion market cap. Its consensus target price is $20.39, implying 17.5% upside, before accounting for its 1.15% dividend yield. Toronto-based Barrick has a 52-week trading range of $11.52 to $20.07. Independent research outfit Argus recently assigned an even more aggressive $22 target price on the stock. Barrick’s recently closed acquisition of Randgold made it the second-largest pure-play gold stock traded in the United States on major exchanges. Its shares were last seen up about 28% year to date, and in recent days Barrick agreed to sell its 90% stake in the Massawa gold asset to Teranga Gold for up to $430 million.

Agnico Eagle Mines Ltd. (NYSE: AEM) has closer to a $14 billion market cap, and the $59.70 recent share price and the $69.72 consensus target price imply upside of 16.9%, before taking its 1.1% dividend into consideration. Toronto-based Agnico Eagle Mines has a 52-week trading range of $38.17 to $64.88. The shares were last seen up over 45% year to date.

AngloGold Ashanti Ltd. (NYSE: AU) still has an $8.1 billion market cap, and the recent share price of $19.50 and the consensus target price of $24.11 imply upside of 23.6%. AngloGold Ashanti is from South Africa and has a 52-week trading range of $11.29 to $23.85. That’s not bad, considering it was up more than 50% so far in 2019.

Kinross Gold Corp. (NYSE: KGC) was trading at $4.25, with a $5.3 billion market cap. The stock has pulled back handily since its summer high of close to $5.50 (but still managed well over a 40% gain in 2019), and Wall Street (despite many low analyst ratings) still somehow has a $5.69 consensus price target. This represents nearly 34% upside, and it just secured up to $300 million with the IFC and others in loans for its Tasiast operation in Mauritania. The Toronto-based gold player has a 52-week range of $2.85 to $5.47.

Investors should keep in mind that it was just about four months ago that calls for $2,000 gold were coming back into mind. That’s obviously widely more aggressive than the consensus expectations. There are many things to add up in the case for gold, and we did not even address the dollar and bitcoin for reference here.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.