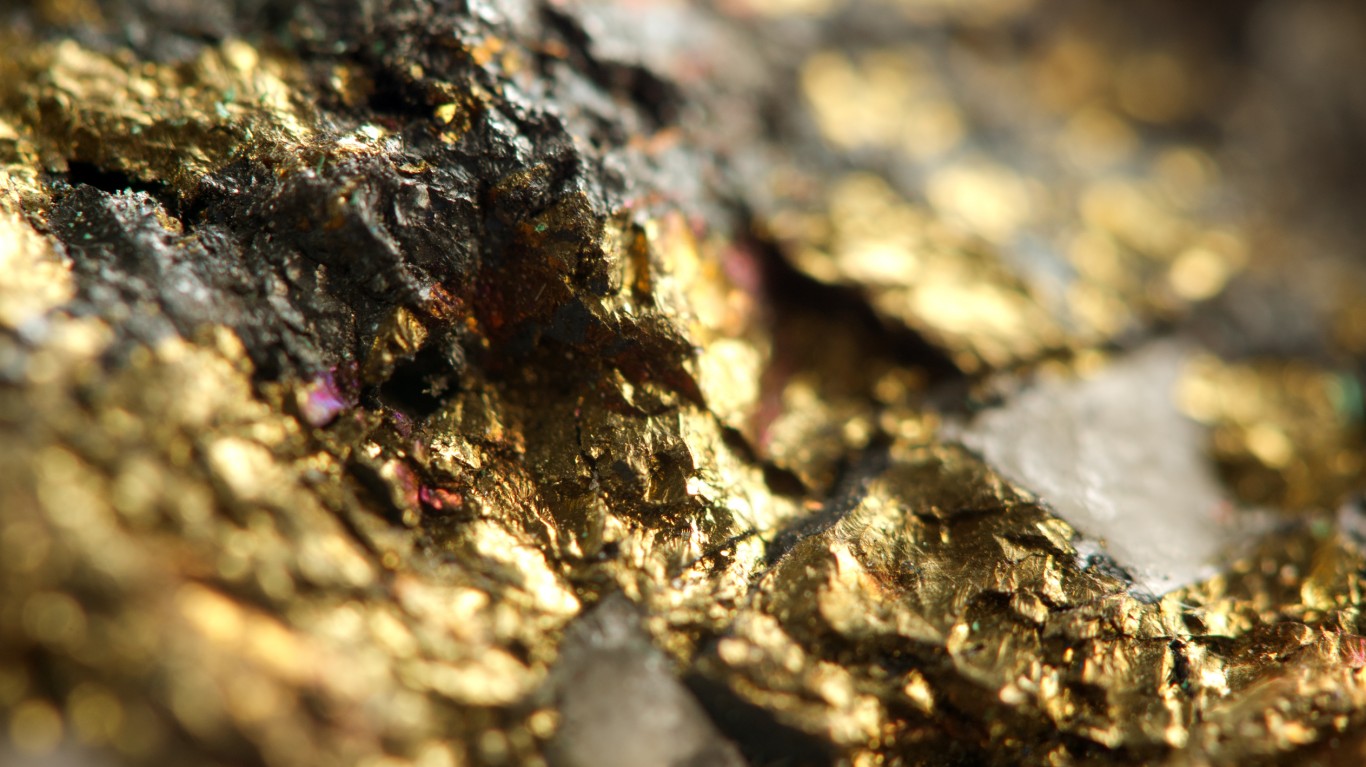

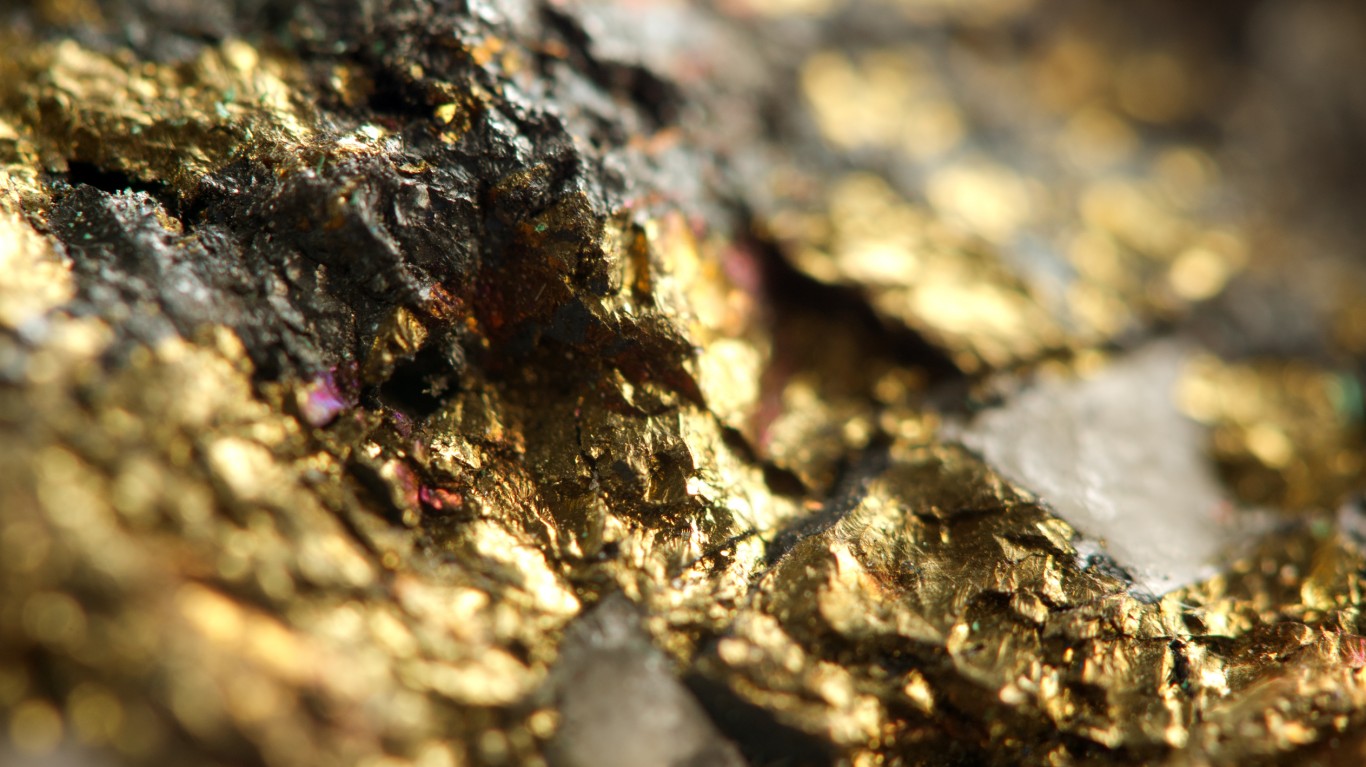

Commodities & Metals

Gold Could Shatter Records If the Coronavirus Threat Turns Into a Pandemic

Published:

Last Updated:

Many people will argue, and rightfully so, that the coronavirus situation is just another in a long litany of the “world is doomed” health scares, and with good reason. They said the same thing about the West Nile virus in 2002, SARS in 2004, bird flu in 2005, swine flu in 2009, Ebola in 2014 and Zika in 2016.

A pandemic is the worldwide spread of a new disease. An influenza pandemic occurs when a new influenza virus emerges and spreads around the world, and most people do not have immunity. Viruses that have caused past pandemics typically originated from animal influenza viruses.

However, there is always the chance that the current coronavirus outbreaks are a pandemic, and if so, one asset class could explode much higher if it is. While gold traded to seven-year highs recently, the top could get blown off if things get serious. In fact, some on Wall Street feel the precious metal could soar to as high as $2,100 an ounce near term, or even to $2,600 an ounce if the worst-case scenarios come into play.

Gold dropped a stunning 5% last Friday, the biggest drop in seven years despite continued massive demand. Top Wall Street traders and analysts attributed the plunge to forced selling aimed at offsetting losses elsewhere and also to covering margin calls. The sell-off also provides a much better entry point for nervous investors who have been looking to add gold but have waited after big price moves already posted over the past year.

In addition, other issues are in play that could help support gold prices in a big way, and in a recent Deutsche Bank report noted this:

We expect gold prices to derive more enduring support from accommodative monetary policy worldwide, a shrinking pool of risk-free assets, and lower beta of traditional risk-off currencies, than from the coronavirus epidemic given a still-low probability of the most disruptive scenario. While the upside for gold may appear nearly unlimited given its historical relationship to CPI, PPI and other asset prices, scenarios suggest the disruption to global growth and financial markets will have to be extreme indeed in order for gold prices to reach new highs in asset-price ratios. USD – $2600 per ounce.

Given the massive volatility, and stock market massacre last week, it probably still makes sense for worried investors to add some gold to their portfolios. One way to hedge a continued sell-off would be to buy gold, and while the SPDR Gold Shares (NYSE: GLD) is an outstanding vehicle, as you literally buy physical gold, investors may want to invest in some of the top miners and royalty companies. We screened the Merrill Lynch precious minerals universe looking for companies rated Buy and found five solid choices for investors.

This is one of Wall Street’s most preferred North American gold producers. Agnico Eagle Mines Ltd. (NYSE: AEM) is a senior Canadian gold mining company that has produced precious metals since 1957. Its eight mines are located in Canada, Finland and Mexico, with exploration and development activities in each of these regions, as well as in the United States and Sweden.

The company and its shareholders have full exposure to gold prices due to its long-standing policy of no forward gold sales. Agnico Eagle has declared a cash dividend every year since 1983.

The company’s Meadowbank complex in Nunavutis is expected to achieve commercial production very soon, and the Amaruq project was expected to ramp up to full production by late last year. Amaruq’s gold output is forecast to rise from 130,000 ounces in 2019 to 351,000 ounces in 2021, and it could account for 17% of Agnico Eagle’s total output.

Shareholders receive just a 0.86% dividend. The Merrill Lynch price target on the shares is $62, and the Wall Street consensus target is in line at $62.04. Agnico Eagle Mines stock closed Friday’s trading at $47.53, down almost 4% on the day.

This is another top miner, and it is offering a very solid entry point. Barrick Gold Corp. (NYSE: GOLD) and Randgold Resources completed their merger on January 1, 2019, which created the world’s largest gold company in terms of production, reserves and market capitalization.

Last year, Barrick and Newmont created the Nevada Gold Mines joint venture, on a 61.5% to 38.5% basis, with Barrick as operator. The venture is targeting $450 million to $500 million in annual operational and other synergies over the next five years.

Barrick Gold recently reported adjusted earnings per share that were above Merrill Lynch and consensus expectations, in part due to lower interest expenses. For 2020, the company is forecasting for gold output of 4.8 million to 5.2 million ounces at total cash cost, and all-in sustaining costs of $650 to $700 and $920 to $970 per ounce, which was basically in line. The company lowered net debt by $0.9 billion quarter over quarter and hiked its quarterly dividend by 40% to $0.07 per share.

Merrill Lynch has a $22 price target, while the consensus target is $21.35. Barrick Gold stock closed Friday at $19.04 a share, down close to 4% on the day.

This off-the-radar play offers numerous ways for investors to make money. Franco-Nevada Inc. (NYSE: FNV) is a resource sector royalty and investment company that was formed to acquire an established portfolio of mining, oil and natural gas royalties and certain equity interests. The royalty assets were spun out of Newmont Mining.

The royalty portfolio represents over two decades of acquisitions by Newmont and the old Franco-Nevada, which Newmont acquired in 2002. Franco-Nevada intends to grow through the advancement of existing properties and through acquisitions and investments.

The Merrill Lynch team remains very positive on the shares for 2020, noting that the company is very well positioned financially to pursue new royalty and stream acquisitions that are focused on precious metals.

Investors receive a 1.00% dividend. Merrill Lynch has set a $127 price target. Oddly, the consensus target is just $81.27, but Franco-Nevada stock was last seen at $107.50, even after slipping 4.5% on Friday.

This is one of the largest mining companies and a solid buy for more conservative accounts. Newmont Corp. (NYSE: NEM) is a leading gold and copper producer. It employs approximately 29,000 employees and contractors, with the majority working at managed operations in the United States, Australia, Ghana, Peru, Indonesia and Suriname. Newmont is the only gold producer listed in the S&P 500 index.

In recent years, the company announced that “first gold” has been poured at its new mine, called the Merian gold mine, in Suriname in South America. It reported Merian contains gold reserves of 5.1 million ounces and that annual production is expected to average between 400,000 and 500,000 ounces of gold at competitive costs during the first five full years of production.

The analysts noted this about recent very positive news:

In keeping with its capital return objectives, Newmont announced a 79% hike in its quarterly dividend to $0.25, effective the second quarter of 2020. The company has repurchased 12.4 million shares for $506 million, halfway to achieving its $1 billion share repurchase program. Approaching its centenary, the company has rebranded itself from Newmont Goldcorp to Newmont Corporation.

Shareholders receive a 1.25% dividend. The $54 Merrill Lynch price objective compares with the $50.86 consensus figure and the most recent close at $44.63. Shares retreated 4% on Friday.

This precious metals royalty stock makes good sense for more conservative accounts looking to have exposure to the sector. Wheaton Precious Metals Corp. (NYSE: WPM) is a Canadian precious metals streaming company with approximately 60% of its revenues from the sale of silver and 40% from gold.

Under the terms of long-term contracts, the company purchases silver and gold from a variety of mines, including Goldcorp’s Penasquito mine in Mexico, Vale’s Salobo mine in Brazil, the Lundin Mining Zinkgruvan mine in Sweden, and Glencore’s Antamina and Yauliyacu mines in Peru, then sells the silver and gold into the open market.

Shareholders receive a 1.16% dividend. The Merrill Lynch price target is $38. The consensus target is $35.86, and Wheaton Precious Metals stock pulled back almost 8% to close at $28.50 on Friday.

Proper asset allocation should always include a single-digit percentage holding of precious metals like gold and silver. Not only do they hedge inflation over the long term, but they can really help when the market does go into correction or bear market mode, as they tend to trade inverse to the markets.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.