Commodities & Metals

Goldman Sachs Picks US Steel Industry's Winners and Losers

Published:

The U.S. steel industry is getting a push from more sources than just the recently proposed infrastructure bill proposed by President Joe Biden. According to a new research report on the industry from Goldman Sachs analysts Emily Chieng and Abigail Chernila, the highly cyclical steel industry is “currently enjoying the benefits of metal prices at all-time highs, underpinned by strong pent-up demand, lagging supply, and a low starting point for inventories.”

The Goldman analysts are initiating coverage on seven steel-related firms with three of the companies rated as Buy, three at Neutral and one at Sell. While steel prices are expected to moderate in the second half of this year, they could establish a “new normal” mark above their historical levels.

[in-text-ad]

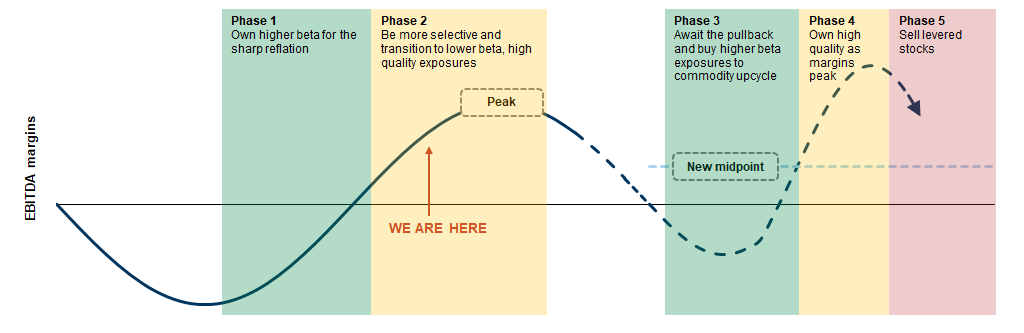

The analysts also believe that the industry will reach “peak EBITDA margins in coming quarters” and recommend that “investors stay selective and look for quality and those names that can drive margin expansion.” The Goldman Sachs report includes the following graphic that illustrates the industry’s EBITDA margins as a percentage of sales.

Chieng and Chernila base their evaluations of the seven companies on four key points:

The first three companies here meet all four of those key points.

Besides being the country’s largest steelmaker, Nucor Corp. (NYSE: NUE) is a recycler with a capacity of 27 million tons and 25 scrap-based steel mills. Nucor expects to continue its diversification, shifting its product mix more heavily into value-added goods. Over the past 12 months, the share price has increased by about 120% with most of the gain coming since late January.

Goldman rates Nucor a Buy and puts a 12-month price target of $86 on the stock, working out to upside potential of 8% based on Wednesday’s closing price. Nucor’s dividend yield is 2.1%, the highest of any of these stocks and its enterprise value-to-EBITDA ratio (EV/EBITDA) is 5.0 times for 2021, 8.4 times for 2022 and 8.2 times for 2023.

Goldman’s analysts believe the key issues for Nucor include “(1) delivery of projects to drive margin expansion, (2) increasing share in the automotive segment, and (3) building and maintaining the financial strength to drive further growth and capital returns.”

The stock closed at $79.81 on Thursday and traded up fractionally to $80.04 midday Friday. The stock’s 52-week range is $34.72 to $82.76, and the consensus price target is $65.60.

With 13 million tons of steelmaking and coating capacity, Steel Dynamics Inc. (NASDAQ: STLD) is among the nation’s largest steel producers and metal recyclers. The company is focused on increasing its value-added product offerings, a plan designed to help insulate the firm from commodity price swings. Over the past 12 months, Steel Dynamics stock has added 130%.

[in-text-ad]

Chieng and Chernila rate the stock a Buy with a price target of $57, implying upside of 11.6% to Wednesday’s closing price. Steel Dynamics’s dividend yield is 2.0%, and its EV/EBITDA ratio is 4.5 times for 2021, 7.8 times for 2022 and 7.0 times for 2023.

The analysts also note that the stock currently trades above its historical EV/EBITDA average, but “we do believe the premium is justified, reflecting near-term volume growth, balance sheet strength and continued opportunities for margin expansion as seen in the past (EBITDA margin up 590bps from 2013-2017).”

The stock traded up marginally at $50.98 on Friday. The 52-week range is $20.58 to $52.59, and the consensus price target is $50.30.

Schnitzer Steel Industries Inc. (NASDAQ: SCHN), a recycling firm for both ferrous and non-ferrous metals, is expected to benefit from rising demand for ferrous scrap metal from China, increased electric arc furnace (EAF) capacity and higher infrastructure spending. The Goldman Sachs analysts comment that Schnitzer “is well-positioned to benefit, given the company’s well-established auto-part recycling business and attractive logistics position on both the East and West Coasts of the United States, providing access to Europe, Africa, Middle East and Asia.”

The analysts rate the stock a Buy with a price target of $48, implying an upside of around 15%. Schnitzer’s dividend yield is 1.9% and its EV/EBITDA ratio is 4.8 times for 2021, 4.6 times in 2022 and 4.2 times in 2023. In the past 12 months, the stock is up about 200%.

Chieng and Chernila like the company’s “outlook for volume growth, improved US steel outlook and attractive positioning from a carbon emissions intensity/recycling perspective.”

Shares traded up more than 3% on Friday, at $39.96 in a 52-week range of $12.93 to $46.86. The consensus price target on the stock is $34.00.

Reliance Steel & Aluminum Co. (NYSE: RS) is the largest steel service center in North America and serves more than 125,000 customers. It acquires primary products, including carbon steel, aluminum and stainless steel, from metals producers and provides value-added processing before distributing metals products to manufacturers and other end-users. The company offers a real contrast in risk-reward, according to Goldman Sachs:

Reliance executes a just-in-time inventory management system that translates to higher margins. Additionally, with an average order size below $2,000, the company can quickly adjust to changes in demand. While we believe this scale and business model will contribute to margins consistency, we expect both limited risk and limited growth as Reliance does not have direct exposure to rising steel prices. Importantly, we acknowledge that Reliance’s business model is less volatile and cyclical than commodity exposed peers.

That translates to a Neutral rating on the stock and a price target of $153, implying a 1% downside. The dividend yield is 1.8%, and the EV/EBITDA ratio is 6.6 times for 2021, 7.1 times in 2022, and 7.0 times in 2023. In the past 12 months, the stock is up about 85%.

Chieng and Chernila hold a “cautiously optimistic near-term outlook” for Reliance’s largest market, nonresidential construction, “where [Reliance] sees healthy quoting activity for infrastructure projects, schools, utilities, water and power, strip malls and data and distribution centers.”

The stock traded at $154.62 on Friday, in a 52-week range of $80.06 to $159.02. The consensus price target on the stock is $143.40.

The nation’s second-largest steel producer, United States Steel Corp. (NYSE: X), has more than 26 million tons of raw steel production capacity following the acquisition of Big River Steel that was completed in January of this year. That acquisition marks a transition from U.S. Steel’s traditional role as an integrated steel producer to a mixed role as an EAF mini-mill producer of advanced high-strength steel products. Big River is a LEED-certified facility in northeastern Arkansas. The analysts like the increased production of higher-margin EAF products, but are concerned with U.S. Steel’s leverage, which is the highest among its peers.

[in-text-ad]

Chieng and Chernila rate the shares Neutral with a price target of $25, implying upside of 6% to Wednesday’s closing price. The company’s dividend yield is 0.2%, and its EV/EBITDA ratio is 3.5 times for 2021, 7.8 times for 2022 and 7.7 times in 2023. Over the past 12 months, U.S. Steel’s shares have added more than 250%.

The analysts see potential upside to their earnings estimates if U.S. demand for steel continues to rise and if the Big River acquisition continues to perform above expectations. The downside risks are lower demand for steel and an industry restart of currently idled capacity that could drive prices lower.

U.S. Steel stock traded down about 0.8% Friday morning, at $22.53 in a 52-week range of $6.30 to $27.40. The consensus price target is $18.43.

In 2020, Cleveland-Cliffs Inc. (NYSE: CLF) invested billions to transform the company from a supplier of iron ore to an integrated producer of flat-rolled steel. The acquisitions of AK Steel and ArcelorMittal USA give the company the largest flat-rolled steel-producing footprint in the United States. Goldman’s analysts describe the company’s approach to steelmaking this way:

[Cleveland-Cliffs’] view is centered around the expectation that prime scrap prices should increase relative to historical levels, on new EAF capacity addition in the United States (of which EAFs already comprise ~70% of total steel production) and increasing demand from China as the country seeks to double its EAF capacity.

Chieng and Chernila have given Cleveland-Cliffs a Neutral rating and a 12-month price target of $20, implying a 10% upside to Wednesday’s closing price. The company does not pay a dividend, and its EV/EBITDA ratio is 3.7 times for 2021, 4.6 times for 2022 and 4.9 times in 2023. Over the past 12 months, the company’s stock price has soared by more than 340%.

In addition to downside risks from falling demand and returning excess capacity, Cleveland-Cliffs is also exposed to the auto industry and, the analysts note, “Extended auto OEM downtime due to the global semiconductor shortage could drive downside risk to shipments given the end market weighting.”

The stock traded up by about 1% at $18.28 on Friday, in a 52-week range of $3.30 to $20.87. The consensus price target is $20.18.

Commercial Metals Co. (NYSE: CMC) is a steel recycler, long-steel (bars, rods, rails, and so on) producer and steel and metal fabricator with operations in the United States and Poland. The company operates more than 40 recycling facilities in North America and nine steel mills in the United States with annual capacity of 5.4 million tons of long steel products. Downstream fabrication plants “act as demand pull” for the company’s own mills.

Goldman’s analysts rate the stock a Sell with a price target of $29, implying a downside of 7% to the company’s closing price on Wednesday. Commercial’s dividend yield is 1.6%, and its EV/EBITDA ratio for 2021 is 6.7 times, falling to 6.5 times in both 2022 and 2023. The stock has appreciated by 95% over the past 12 months.

The just-announced U.S. infrastructure plan could boost demand for the company’s rebar products and Commercial should benefit from a general strengthening of metal margins. Should either of these effects materialize, Goldman Sachs’s view of the company could become “more positive.”

The stock traded down about 2.7% Friday to $29.60, after closing Thursday at $30.43. The 52-week range is $13.72 to $32.43, and the consensus price target is $27.10.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.