The country with the world’s largest identified deposits of lithium has just signed agreements with two state-controlled companies from Russia and China to develop those resources. These were the second and third development deals the government of Bolivia has concluded this year. The first came in January when Bolivia’s state-controlled Yacimientos de Litio Bolivianos (YLB) signed a deal with a consortium led by China-based battery behemoth Contemporary Amperex Technology (CATL), which holds a 66% stake, and two of its affiliates, China’s CMOC Group and Guangdong Brunp Recycling Technology, owners of the other third. YLB will own 51% of all projects in the country. (These countries are buying up the world’s gold.)

Bolivia is believed to be sitting on the world’s largest lithium deposits. According to the U.S. Geological Survey’s 2023 minerals yearbook, Bolivia’s identified lithium resource of 21 million tons tops Argentina’s estimated 20 tons and is nearly twice as large as Chilean deposits of 11 million tons. These three South American nations form what is known as the lithium triangle, accounting for nearly half the world’s 98 million tons of lithium resources. Identified U.S. resources total 12 million tons.

Note that identified resources are not the same as reserves. Reserves are resources that can be economically extracted and are typically much smaller than identified resources. There is no estimate for Bolivian reserves because there has been so little mining activity in the country. In Argentina and Chile, however, exploration has determined that 2.7 million tons and 9.3 million tons of the identified resources may be categorized as reserves.

Last week’s announced deals involved Russia’s Uranium One group (part of Rosatom) and China’s Citic Guoan. Both companies are state-controlled. The agreements call for a total investment of around $1.4 billion to mine and refine up to 50,000 metric tons of battery-grade lithium carbonate annually by 2025.

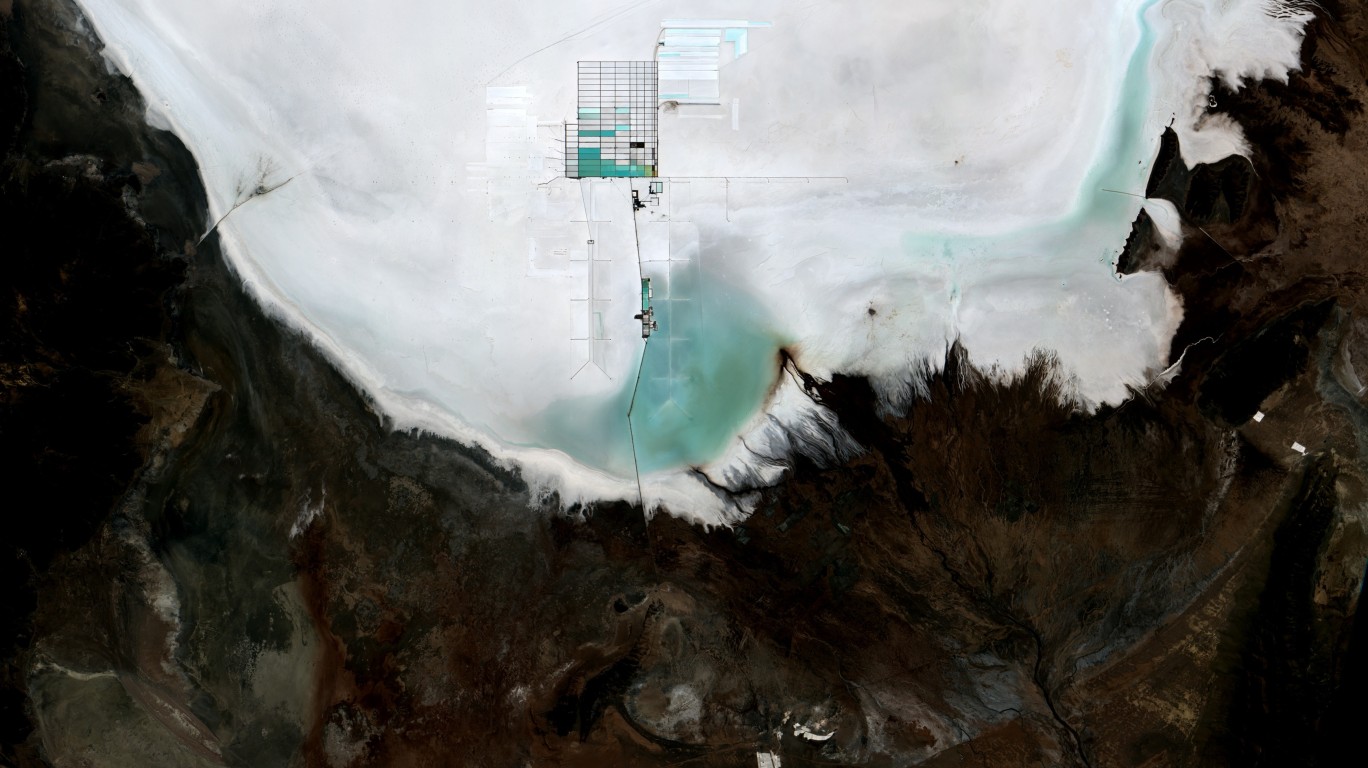

Bolivia’s lithium deposits are located in three salt flats: Uyuni, Coipasa and Pasto Grande. One direct lithium extraction plant will be built near Pasto Grande and Uyuni, each capable of processing 25,000 metric tons of lithium a year.

Uranium One plans to invest $600 million to build a plant at Pasto Grande capable of producing 25,000 metric tons of lithium carbonate. Citic Guoan said it will invest $875 million in the Uyuni facility.

Two privately held U.S. companies remain in the running for a chunk of Bolivia’s lithium riches. Lilac Solutions and Fusion Enertech employ different proprietary technologies to produce battery-grade lithium carbonate. There has been no announcement from either company regarding an agreement to develop Bolivia’s lithium.

Former Bolivian President Evo Morales talked about developing the country’s lithium resource after he first took office in 2006. The country’s current president, Luis Arce, took office in 2020 after Morales’ successor, Jeanine Áñez, was sentenced to 10 years in prison last year for illegally taking over the presidency from Morales.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.