The Federal Reserve’s Federal Open Market Committee (FOMC) has four more meetings on its calendar for 2023, one each in July, September, October/November and December. That is four more chances for the Fed to lift interest rates after declining to do so at the FOMC’s June meeting. The European and U.K. central banks did not pause their interest rate hikes at their most recent meetings.

Gold analysts and investors will be watching economic and market movements carefully for signs that gold prices may rise or fall. An expanding U.S. economy in the first half of this year sent the S&P 500 index to a gain of 15.9%. The MSCI EAFE (Europe, Australasia and Far East) index rose 9.7% in the first six months of 2023, and gold prices increased by 5.4%.

On the currency markets, the dollar index (DXY) dropped by 0.6%, while oil fell by 12.0% and commodities dropped by 10.0%. U.S. Treasury bonds added 2.1%.

The World Gold Council (WGC), in its latest outlook published Thursday, said that global markets appear to favor the view that the U.S. economy will suffer a “mild contraction” late this year accompanied by slow growth in other developed markets. But a hard landing for the global economy is still possible due to the lag between the time when monetary policy is implemented and when it achieves its effect on economic performance. (These are the countries buying up the world’s gold.)

A softish landing or much more restrictive monetary policy would be bad for gold. Conversely, a deteriorating economy offers a historically brighter outlook for gold prices. As things now stand, the WGC currently expects gold “to remain supported on the back of rangebound bond yields and a weaker dollar.”

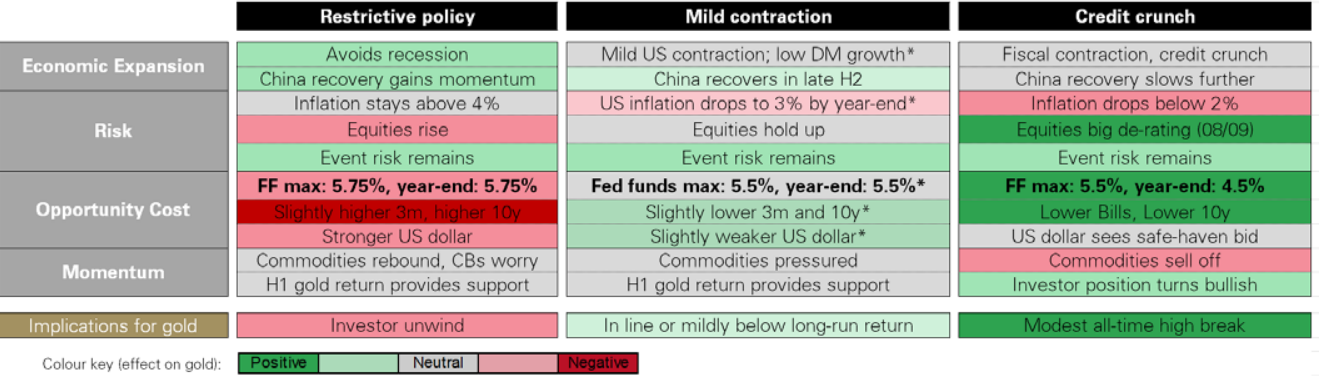

The following chart indicates by color (red=bad news for gold; green=good news; gray=neutral) the effect on gold of changes in four key economic drivers: expansion, risk, opportunity cost and momentum.

The middle column of the chart represents the WGC’s current expectations. FF refers to the upper bound of the federal funds target rate, and DM refers to developed markets.

The more red in a column, the worse gold will perform. Interestingly, whether commodities prices rise or face some downward pressure is neutral for gold prices. Only in the case of a commodities sell-off does gold take a hit.

What the WGC calls gold’s “asymmetrical” benefits are revealed in a chart that tracks those benefits using two hypothetical defensive strategies applied over the past 25 years. The first allocates 20% of an investor’s portfolio to defensive sectors (consumer staples, utilities, etc.) and the second splits the non-stock allocation in half, with 10% going to defensive stocks and 10% going into gold.

| Baseline strategy | Defensive strategy (a) | Defensive strategy (b) | |

|---|---|---|---|

| Defensive sectors | 20% | 10% | |

| Gold | 10% | ||

| Total | 100% | 100% | 100% |

| Annualized returns | 7.0% | 7.7% | 8.4% |

| Volatility | 15.5% | 15.0% | 14.6% |

| Reward to risk | 45.3% | 51.4% | 57.2% |

| Drawdown | −50.6% | −48.0% | −44.1% |

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.