Commodities & Metals

Commodities & Metals Articles

There is more pain coming for the steel industry. At least that is the take from Deutsche Bank.

Published:

This exchange-traded fund could find itself right in the middle of the trade war if China decides to halt or limit its exports of rare earth metals and minerals.

Published:

In the Peoples Daily, a medium controlled by the Chinese government, editors warned that the export of "rare earth elements" could be interrupted due to the trade war between China and the United...

Published:

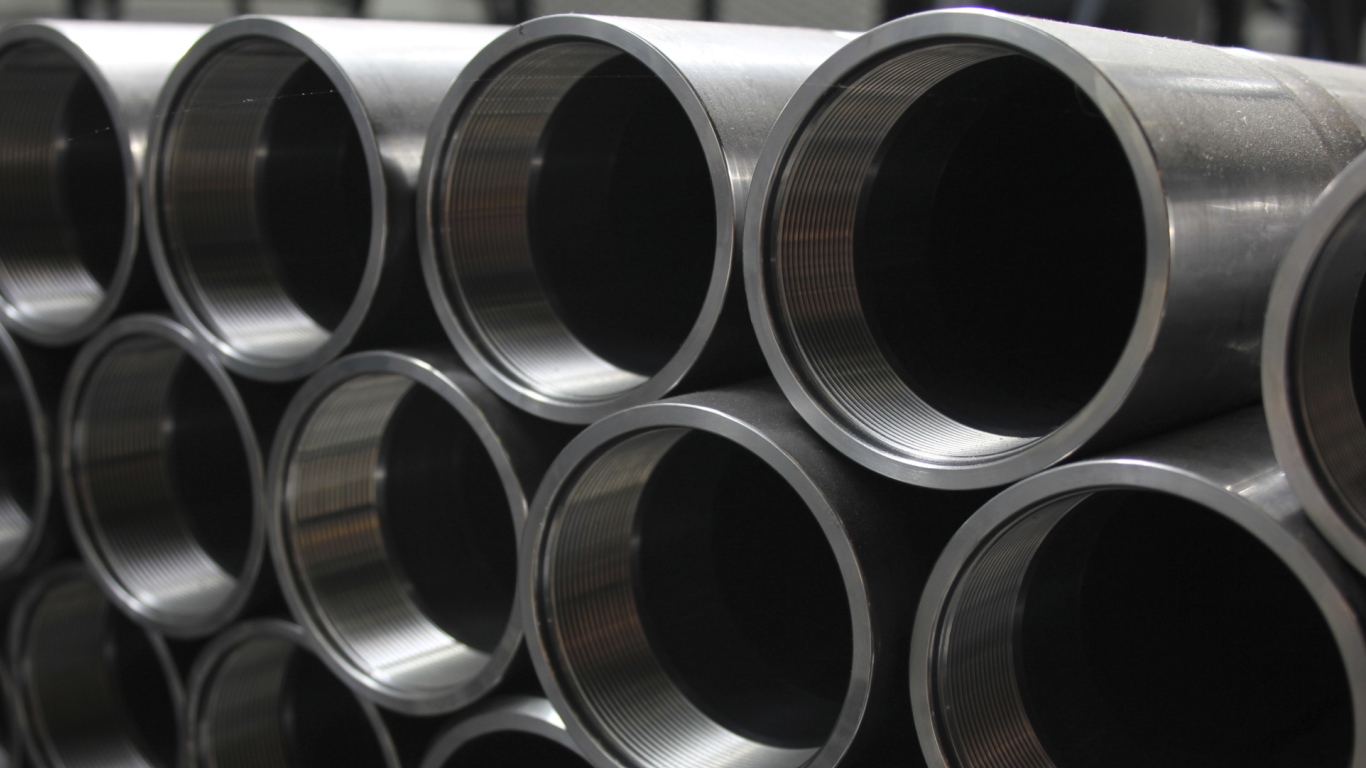

Credit Suisse sees some serious concerns brewing in the steel industry. The firm downgraded some of its top names, citing lower prices for hot-rolled coil steel.

Published:

Canada and Mexico have reached a deal with the United States to remove tariffs on steel and aluminum. The top steel picks at Jefferies make sense for growth accounts looking to play not only the...

Published:

A report from Bloomberg on Thursday had indicated that Iamgold was exploring a sale of the company, garnering at least some interest from speculators who chase buyout rumors.

Published:

If one thing has proven true over the years and works in favor of the gold bugs, it is that the price of gold thrives on geopolitical uncertainty.

Published:

The question to ask after U.S. Steel's revenues and earnings beat their consensus analyst estimates is if a rerating on Wall Street is ready to take place.

Published:

The World Gold Council reports that central banks are buying gold at levels not surpassed since 2013, and they bought more than 140 tons of the precious metal in the first quarter.

Published:

It may seem hard for the gold bugs to celebrate that gold was last seen down about 3% in dollar terms so far in 2019, but against the backdrop of what is happening in the global markets, gold...

Published:

With steel pricing potentially firming, and export potential and demand at home still strong, these four stocks make sense for growth investors, especially after stock price pullbacks from last...

Published:

Shareholders of gold miner Newmont have approved the company's $10 billion acquisition of Goldcorp. Barring any regulatory hitches, the deal is expected to close this quarter.

Published:

Shares of U.S. Steel were hit hard on Tuesday after Credit Suisse downgraded and slashed its price target.

Published:

When an industry sees falling commodity prices, consumers usually expect this to translate to lower prices for the goods they pay for. But lower commodity costs often fail to ever result in lower...

Published:

The sell-off last Friday showed just how nervous investors are, so 24/7 Wall St. screened the Merrill Lynch research database looking for gold stocks rated Buy and found three outstanding values.

Published:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.