Commodities & Metals

Commodities & Metals Articles

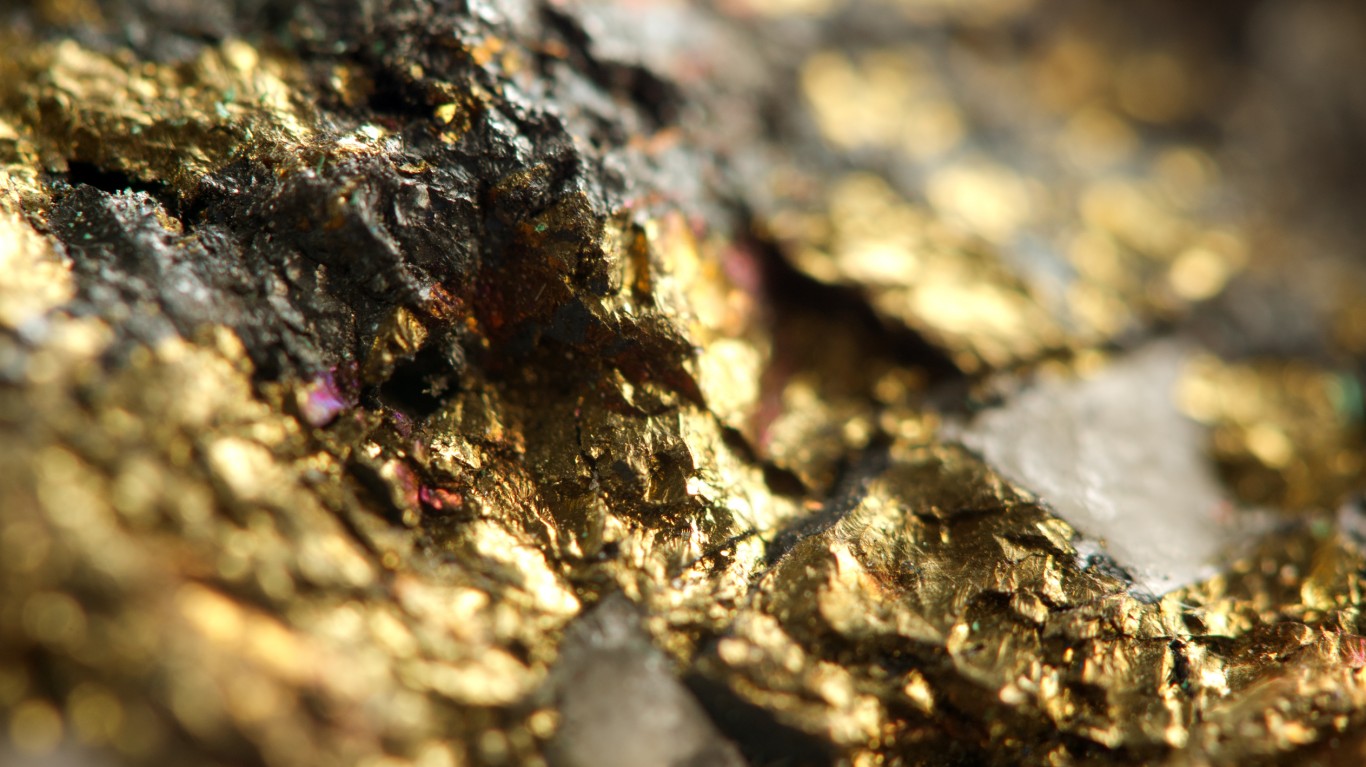

Short interest in gold-mining stocks and ETFs rose in the two-week reporting period ending July 15. But gold prices rose more sharply.

Published:

While many investors are hyper-focused on gold, the issue that may be overlooked by much of the investing public is what happens to the price of silver in the coming weeks.

Published:

Gold prices have been on a tear that began more than a year ago. One segment likely to see increased profits are the gold miners. Here a several that deserve another look.

Published:

Positive net inflows into exchange-traded funds continued for a seventh straight month in June. Two U.S. ETFs accounted for 67% of the total.

Published:

The gold bugs must be happy again. With gold trading just under $1,800 again, the gold bugs are going to be increasing their calls for gold to rise to $2,000. Some have even been publishing reports...

Published:

Proper asset allocation should always include a single-digit percentage holding of precious metals like gold and silver. These six stocks look like solid choices for investors.

Published:

Gold is making a great case for itself this year, and gold bugs have to be happy about that. The strategists at JPMorgan have a bullish view on gold.

Published:

According to the World Gold Council, May marked another month of positive fund flows into gold-backed ETFs.

Published:

24/7 Wall St. screened the BofA Securities precious metals research universe and found five gold stocks rated Buy that look like solid plays for investors starting to worry about renewed volatility.

Published:

The initial reaction might seem like Newmont investors felt a bit let down by its earnings report. But it has a lot going for it, and high gold prices might be only one driver here.

Published:

Silver is supposed to track gold to a certain extent, but in 2020 that just is not the case. Silver is proving to live up to its nickname the "Devil's Metal."

Published:

Last Updated:

Proper asset allocation should always include a holding of precious metals. Not only does it have the potential to hedge inflation over the long term, but such a position can really help if the...

Published:

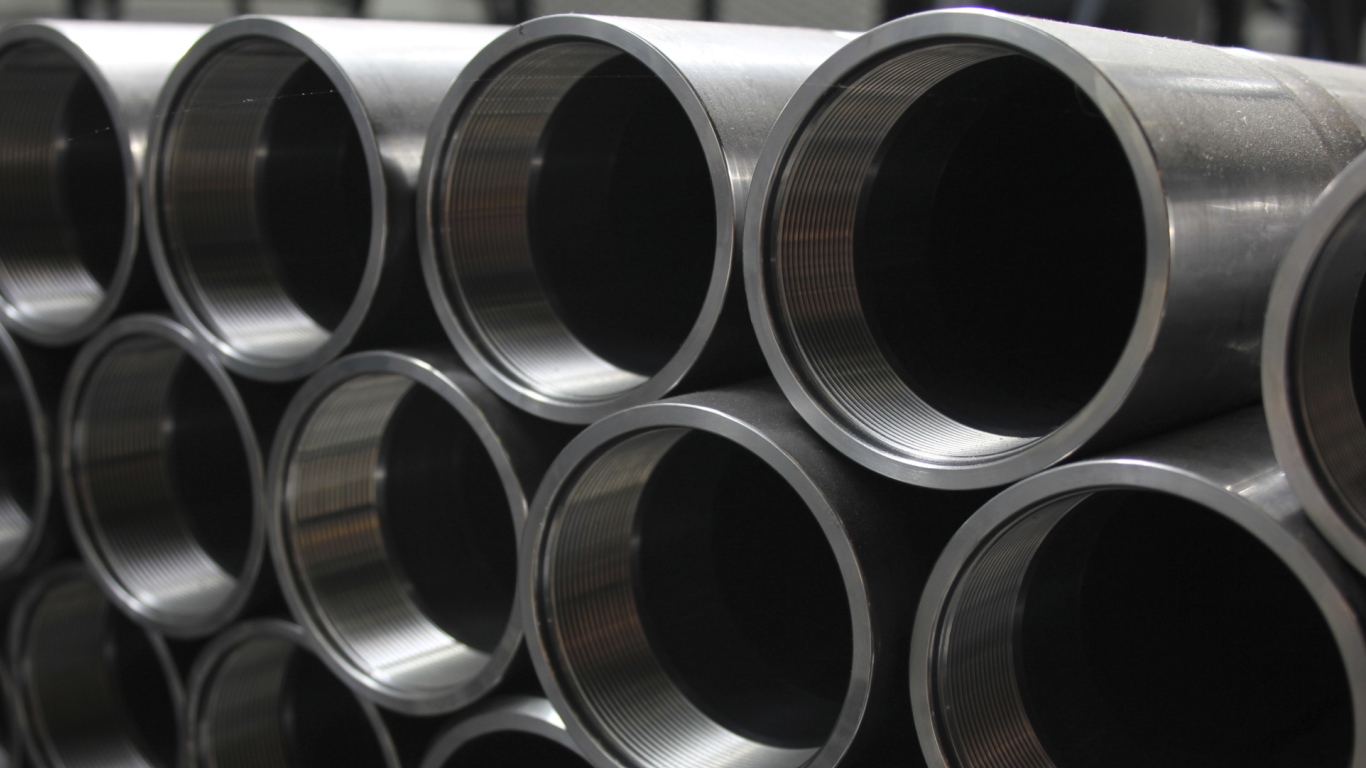

Recessions are generally brutal for the steel and specialty metals industry. A new Credit Suisse report outlines what it calls a perfect storm for steelmakers.

Published:

The World Gold Council announced on Wednesday that inflows into gold ETFs rose sharply in March. It was not just the United States driving gold.

Published:

In an effort to prioritize cash and liquidity, U.S. Steel wants to remain well prepared for when the global economy ultimately recovers.

Published:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.