Companies and Brands

The GoPro IPO Filing Has Arrived -- Risk and Reward Alike

Published:

Last Updated:

When 24/7 Wall St. identified and highlighted what we expected to be the top 10 initial public offerings for 2014, one of those was GoPro. And now GoPro has filed for public documents for its initial public offering.

The filing shows that the company plans to sell up to $100 million in common stock, but this number can change and should be used solely for filing purposes. We originally wrote that GoPro was seeking to raise about $400 million in the offering, with a total market value that could be in excess of $2 billion.

A large underwriting group has been selected: J.P. Morgan, Citigroup, and Barclays were listed as the lead underwriters; and co-managers are listed as Allen & Company, Stifel, Baird, MCS Capital Markets, Piper Jaffray, and Raymond James. It will list under the GPRO stock ticker, and it chose the NASDAQ over the New York Stock Exchange.

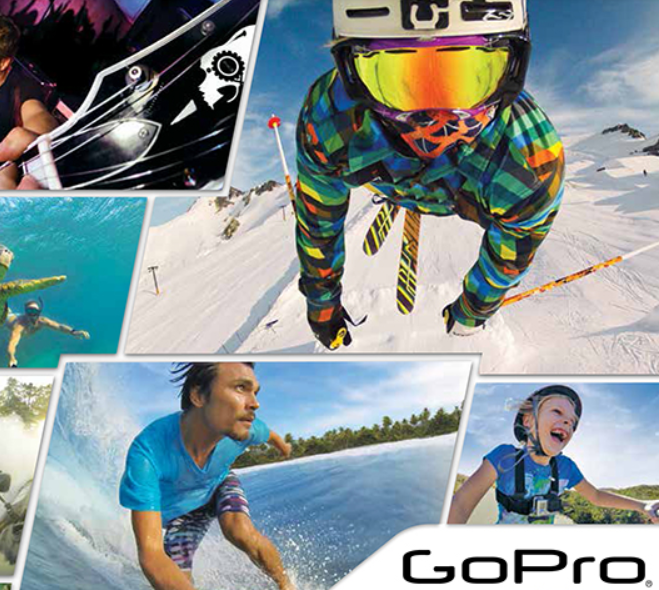

GoPro taken over video efforts of active sports enthusiasts and video fans alike. Skydivers, rock climbers, cyclists and many others are attaching GoPro cameras to their helmets to film their adventures.

ALSO READ: 12 Analyst Stocks Trading Under $10 With Huge Upside

In an interview last year with Forbes, founder Nick Woodman said the company sold 2.3 million cameras in 2012 for a total of around $521 million. Revenue has also doubled every year since its 2004 founding. The open S-1 SEC filing showed that revenue was $985.7 million, with net income of $60.6 million. Revenue in the March 2014 quarter was $235.7 million, with net income coming in at about $11 million.

Our warning in early 2014: “This is a hot product, but investors should remember that one-product companies, with just a few related products, often go through severe swings in their business cycle — and that some of those swings could be very unpleasant.” The hope now is that GoPro won’t just be a one-product company. It could easily migrate into a GoPro media network.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.